Link: Apply now for the Capital One Venture X Rewards Credit Card (this is the best publicly available offer for the card, and we appreciate your support if you use our link)

We recently saw the launch of the new Capital One Venture X Rewards Credit Card, which is Capital One’s new premium credit card.

While the card has a $395 annual fee, there are so many reasons to get this card, from the welcome bonus of 100K miles, to ongoing perks like a $300 annual travel credit, 10K anniversary bonus miles, a Priority Pass membership, access to Capital One Lounges, and amazing authorized user perks. I applied for this card and was instantly approved, and I know many OMAAT readers are in the same boat.

In this post I wanted to focus on the single benefit that should most help offset the annual fee of the Capital One Venture X, which is the card’s $300 annual travel credit. Let’s get into all the details of how this works.

How does the Venture X $300 annual travel credit work?

The Capital One Venture X offers a $300 annual travel credit, which can be redeemed through Capital One Travel. Here’s what you need to know about that:

- The credit applies each cardmember year (or anniversary year, if you prefer), including the year in which you open the card; the credit timing isn’t based on the calendar year

- The credit can be used across one or multiple transactions, until the $300 limit is reached

- There’s no registration required to use the $300 annual travel credit

- Any purchase through Capital One Travel qualifies towards using this credit, so there’s all kinds of travel you can arrange this way

- The credit will generally appear in your account within one to seven business days of making an eligible purchase

- If the credited Capital One Travel purchase is canceled, the statement credit may be removed from your account, though can be reissued on any past or future Capital One Travel purchase of up to $300

What travel can you book through Capital One Travel?

Capital One Travel is Capital One’s travel portal, as you may have guessed based on the name. The portal is powered by Hopper, and Capital One is essentially acting as the travel agent here. You can use Capital One Travel to book everything from flights, to hotels, to car rentals.

In general I’m not a huge fan of using travel portals, though in my opinion Capital One Travel is the best travel portal of any of the major credit card companies. You can easily search flights, hotels, and car rentals.

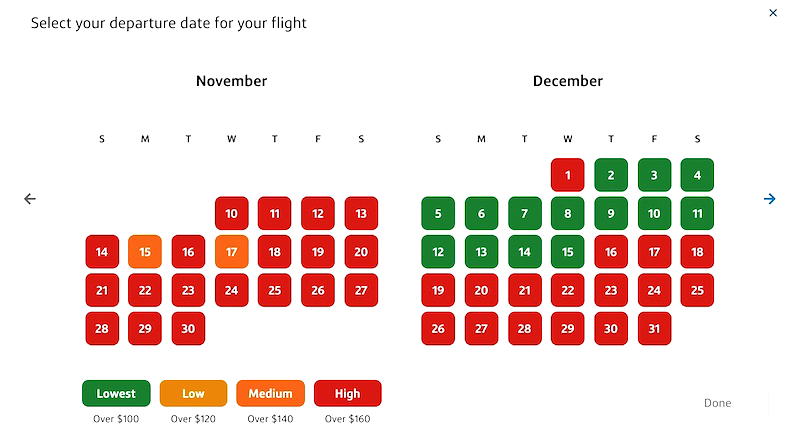

The portal has some nifty features. For example, when searching flights, there’s a calendar showing the dates with the best prices, which is something I wish we’d more consistently see from airlines.

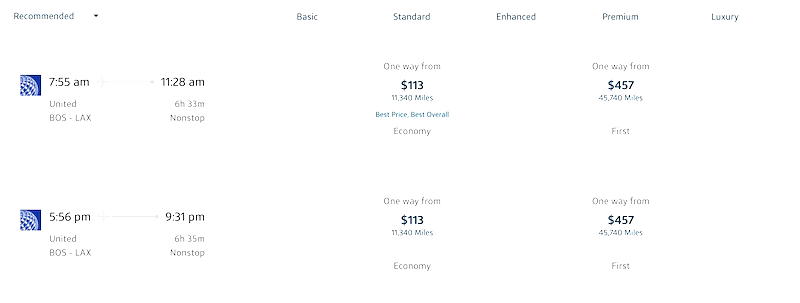

Similarly, the option to filter results is great, better than with any other portal out there, in my opinion.

If you wanted to apply your $300 annual travel credit towards a purchase (like a flight), you’d just want to make the purchase with your card, and then the statement credit will post automatically.

Keep in mind that the Venture X is also rewarding for purchases through Capital One Travel, so you can earn lots of miles for any spending on top of the credit amount. The card offers:

- 10x Venture miles on hotels and rental cars booked via Capital One Travel

- 5x Venture miles on flights booked via Capital One Travel

But isn’t booking through credit card travel portals annoying?

Some people are probably thinking “I don’t really want to book through a travel portal though.” I hear you. To be honest, I only rarely use travel portals. Even if a travel portal is great, there are downsides to using them:

- On the flight front, in the event of schedule changes or wanting to cancel, it can be easier to do so if you book direct, especially in an era where airlines largely allow free ticket changes

- On the hotel front, you don’t usually receive elite perks or earn points when booking through a third party

- On the car rental front, there are often discount codes available online that can’t be used if booking through a portal

That being said, I still value this credit at pretty close to face value, and will have no issues whatsoever using it. What’s my strategy? To keep things simple, I’ll probably book a single flight that costs $300+ through here at least once per year, and that will be reimbursed.

You still generally earn points and receive elite perks when booking flights through a portal, and the pricing is almost always identical. So the opportunity cost to booking this way is limited.

The way I see it, having to book through Capital One Travel is hardly a huge deal or anything that prevents this from being maximized, and I’ll have no issues maximizing this. Even as someone who is generally opposed to using portals, I don’t view this as being a big deal.

How does this compare to travel credits on other cards?

How does the Capital One Venture X $300 annual travel credit compare to the credits issued by other premium cards? Just to compare:

I’d argue that the Capital One travel credit isn’t as easy to use as the Chase travel credit, but is much easier to use than the American Express travel credit.

Now, that doesn’t tell the full story of the cards’ value propositions, though:

- The Venture X has by far the lowest annual fee of the three cards

- The $300 annual travel credit is only one of the annual perks the card offers — the card also offers 10,000 anniversary bonus miles, which can be redeemed for $100 worth of travel, or can be transfered to airline & hotel partners at a ratio of up to 1:1

- For savvy travelers, the $300 travel credit plus 10,000 bonus miles should be worth more than the card’s $395 annual fee, not even factoring in anything else

Bottom line

The new Capital One Venture X is incredibly lucrative. The card has a $395 annual fee, and one of the primary things that offsets that fee is the $300 annual travel credit, which can be applied towards virtually any purchase with Capital One Travel.

While there might be a slight hassle factor to some in using a portal, this really shouldn’t be that hard to maximize on a flight, hotel, or car rental. Personally I plan on just booking a $300+ flight every year through the portal, and that’ll get me the $300 statement credit.

To fellow Venture X cardmembers, what’s your plan for using the $300 annual travel credit?