Well, Team Transitory took a punch in the nose after Wednesday’s inflation data came in well hotter than forecast, with the year-over-year change of 6.2% in October the highest in 31 years.

All that said, it isn’t the last word on whether inflation in 2022 will be sizzling. Bond yields did rise significantly, with the 10-year yield

TMUBMUSD10Y,

1.553%

jumping 11 basis points, but to a hardly staggering 1.56%, a sign that the fixed-income market is still of the belief that inflation will cool off.

Making that case is Dhaval Joshi, chief strategist of BCA Research’s Counterpoint. He’s forecasting a big demand slowdown next year and doesn’t see sustained inflation.

Right now, demand is on trend, thanks to a surprising category — nondurable goods, such as clothing, food and drink at home, and games, toys and hobbies. Spending on services, by contrast, is 5% below where it should be, which also is more or less the case in the U.K. and France.

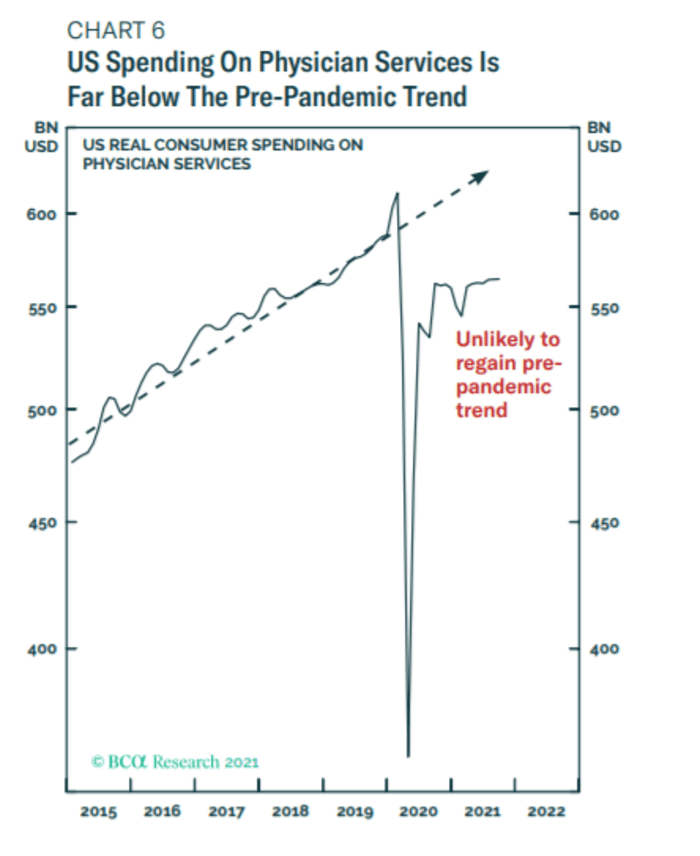

Won’t vaccinations and improving medical care for coronavirus disease increase services spending? Joshi isn’t so sure. The biggest component of underspending isn’t bars, restaurants and hotels, but healthcare. “A plausible explanation is that many doctor’s appointments have shifted to online, requiring much lower spending. The result is that healthcare consumption has slowed its convergence to the pre-pandemic trend, implying that a deficit could be persistent,” he said.

Other sources of underspending include recreation services, as consumers are now less likely to go to large-crowd events, and public transportation. “Worryingly, the recent spending on both recreation services and public transportation has stopped converging with the pre-pandemic trend. Admittedly, this might be a blip due to the delta wave of the pandemic, and spending could reaccelerate once this wave subsides. On the other hand, it would be prudent to assume that the delta wave was not the last wave of the pandemic and that further waves could arrive in 2022,” he said.

But, again, the current services shortfall has been overcome with goods spending. Joshi, however, doesn’t expect that to last. Durable-goods spending already has come back to Earth. And the biggest component of nondurable spending is clothes and shoes. “Clothes and shoes, though classified as nondurable, are in fact quite durable. Meaning that once the wardrobe transition is complete, we do not expect people to spend 20% more on clothes and shoes than they did before the pandemic,” he said. He also expects the overspending on eating and drinking at home to level out, given that the underspending on eating and drinking out has almost normalized.

The one area where he expects strength to continue is in games, toys, hobbies, and pets and pet products.

Putting it all together, he recommends being overweight 30-year Treasury bonds

TMUBMUSD30Y,

1.909%,

underweight reflation sectors including banks and basic resources, and overweight animal care and interactive entertainment such as videogames.

The buzz

A regulatory filing showed Tesla

TSLA,

+0.50%

CEO Elon Musk sold about $5 billion of shares this week as he exercised stock options. Musk had suggested he will sell about $10 billion in a Twitter

TWTR,

-0.26%

poll this weekend.

Walt Disney

DIS,

-7.67%

shares were due to retreat, after the entertainment giant posted a worse-than-forecast theme park operating profit and lower-than-forecast subscriber numbers for its Disney+ streaming service.

Opendoor Technologies

OPEN,

+18.72%

and Offerpad Solutions

OPAD,

+3.73%

shares surged as both real estate platforms reported better-than-expected revenue and outlook, in a segment Zillow

Z,

+0.23%

has exited.

Beyond Meat

BYND,

-15.95%

skidded as the meat-substitute maker reported a wider loss than forecast on worse revenue than estimated.

China Evergrande

3333,

+6.75%

made a series of last-minute bond payments to avoid default, while The Wall Street Journal reported Chinese regulators may ease leverage rules to let developers sell assets.

The market

U.S. stock futures

ES00,

+0.16%

NQ00,

+0.58%

bounced back after Wednesday’s 240-point decline in the Dow industrials

DJIA,

-0.21%,

while gold

GC00,

+0.82%

extended gains.

The U.S. bond market was closed in observance of Veterans Day.

Random reads

A look at three of Tesla’s founders who didn’t get staggeringly rich.

Indonesian religious leaders say crypto is against the rules of Islam.

Wilson, the volleyball in the Tom Hanks movie “Cast Away,” was auctioned for $308,000.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.