TCV Bookings of $15.1 million year to date

Increases guidance for 2021 TCV Bookings from $15 million to $15.8 million at the midpoint

Industry benchmarks confirm superior performance of IonQ computers compared to competitors; technology reaches key scaling milestone with industry-first error correction demonstration

Cloud partnerships and integrations ensure IonQ available on all major U.S. clouds, with support for all major quantum software tools

Commercial and ecosystem partnerships with Fidelity Center for Applied Technology, Goldman Sachs, the University of Maryland, and GE Research

COLLEGE PARK, Md., November 15, 2021–(BUSINESS WIRE)–IonQ, Inc. (“IonQ” or the “Company”) (NYSE: IONQ), a leader in quantum computing, today announced financial results and a business update for the third quarter ended September 30, 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211115006227/en/

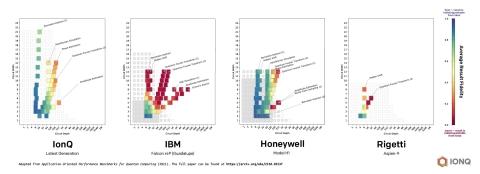

Side-by-side comparison of quantum computers tested from each of four providers included in the paper. IonQ’s latest system outperformed all others evaluated by having higher average result fidelity across a wide set of algorithms with a greater circuit width/depth than any other system. (Photo: Business Wire)

“IonQ delivered a number of significant milestones this quarter, delivering upon our technology roadmap and accelerating the commercialization of our quantum computers,” said Peter Chapman, President and CEO of IonQ.

This quarter, the publication of a benchmarking study of all currently available quantum computers by the Quantum Economic Development Consortium (QED-C), a third-party industry group, validated the Company’s belief that its computers are best-in-class along key dimensions, such as in their accuracy while running algorithms with high circuit width and high circuit depth. IonQ’s computer outpaced entries from IBM, Honeywell and Rigetti.

In the third quarter, IonQ announced a new chip for the Company’s quantum processing unit, or QPU, that is designed to allow the Company to increase the number of qubits in its system while maintaining stability. IonQ believes this could allow it to scale to hundreds of qubits on a single chip, up from the dozens the Company has on chips today.

In early October, researchers from IonQ and The University of Maryland published results in Nature, a prominent peer-reviewed journal, that documented cutting-edge error correction technology. This joint study with Duke University, the University of Maryland, and the Georgia Institute of Technology was the first, and so far the only one, on any quantum computing system, to show fault-tolerant error-correction working in practice and with very little overhead. Solving error correction is critical to creating quantum computers large enough to deal with the complex problems that governments, businesses, and societies face today.

IonQ’s bookings results demonstrate the Company’s leadership and growing demand for IonQ’s industry-leading trapped-ion hardware. IonQ is the only maker of quantum hardware that is available through every major cloud provider in the United States, which includes Amazon Web Services, Microsoft Azure, and Google Cloud. This gives public and private sectors unprecedented access to the Company’s technology. IonQ’s next generation system was released to select customers in private beta via IonQ’s dedicated cloud.

“We look forward to 2022 with confidence as we continue to build out IonQ’s ecosystem, demonstrate our superior scalability and efficiency, and solve useful problems for our worldwide customer base,” said Chapman.

Third Quarter Financial Highlights

-

Revenue of $223 thousand, for a total of $451 thousand year to date.

-

Year-to-date total contract value (TCV) bookings of $15.1 million.

-

Cash and cash equivalents of $587 million as of September 30, 2021.

-

Net loss of $14.8 million.

-

Adjusted EBITDA was a loss of $7.9 million.*

“The completion of our business combination with dMY Technology Group III gave us the capital to fuel additional momentum in our system development and commercialization efforts,” said Thomas Kramer, CFO of IonQ. “As part of our business combination, we are fortunate to now call Hyundai Motor Company and Kia Corporation, Silver Lake, MSD Partners, L.P., Breakthrough Energy Ventures, NEA, GV and Fidelity Management & Research Company LLC investors in IonQ.”

“We believe our strong balance sheet with cash and cash equivalents of $587 million on September 30, 2021 will allow us to accelerate scaling of all business functions and continue attracting the industry’s best and brightest. We are well-capitalized and, we believe, well-positioned to benefit from Capitol Hill’s interest in quantum as shown by the infrastructure bill.”

* Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Financial Measures,” and is reconciled to net loss, its closest comparable GAAP measure, at the end of this release.

Third Quarter and Recent Business Highlights

-

Industry benchmarking by the QED-C demonstrated the superior power of IonQ hardware compared to key competitors.

-

First team globally to show fault-tolerant error correction in practice in a peer-reviewed paper published in Nature, alongside researchers from Duke University, the University of Maryland and the Georgia Institute of Technology.

-

Debuted the industry’s first Reconfigurable Multicore Quantum Architecture, creating a path to scale quantum computers with potentially hundreds of qubits on one chip.

-

A partnership with The University of Maryland to create the National Quantum Lab at Maryland (Q-Lab), the nation’s first user facility that enables hands-on access to a commercial-grade quantum computer.

-

Announced partnerships and collaborations with leading organizations such as Accenture, Goldman Sachs, Fidelity Center for Applied Research, and GE Research.

-

Closed business combination with dMY Technology Group, Inc. III on September 30, 2021, to become the first pure-play publicly traded quantum computing company in the world.

-

Continued our hiring of world-class talent with key positions filled by Tom Jones as Chief People Officer (Blue Origin, Microsoft, Honeywell), Ariel Braunstein as Senior Vice President of Product Management (Google, Lytro, Cisco), and Dean Kassmann as Vice President of Research and Development (Blue Origin, Amazon).

Financial Outlook

-

Expected bookings of $600 thousand to $800 thousand for fourth quarter 2021, to end the year between $15.7 million and $15.9 million.

-

Expected revenue of $1.0 million to $1.2 million for fourth quarter 2021, to end the year between $1.5 million and $1.7 million.

Third Quarter 2021 Conference Call

IonQ will host a conference call today at 4:30 p.m. Eastern time to review the Company’s financial results for the third quarter ended September 30, 2021. The call will be accessible by telephone at 877-300-8521 (domestic) or 412-317-6026 (international) using passcode 10161621. The call will also be available live via webcast on the Company’s website here, or directly here. A telephone replay of the conference call will be available at 844-512-2921 or 412-317-6671 with access code 10161621 and will be available until 11:59 PM Eastern time, November 29, 2021. An archive of the webcast will also be available shortly after the call and will remain available for 90 days.

Non-GAAP Financial Measures

To supplement IonQ’s condensed financial statements presented in accordance with GAAP, we use non-GAAP measures of certain components of financial performance. Adjusted EBITDA is a financial measure that is not required by or presented in accordance with GAAP. Management believes that this measure provides investors an additional meaningful method to evaluate certain aspects of the company’s results period over period. Adjusted EBITDA is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other nonrecurring nonoperating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and the Company’s non-GAAP measures may be different from non-GAAP measures used by other companies. For IonQ’s investors to be better able to compare its current results with those of previous periods, the Company has shown a reconciliation of GAAP to non-GAAP financial measures at the end of this release.

About IonQ

IonQ, Inc. is a leader in quantum computing, with a proven track record of innovation and deployment. IonQ’s next-generation quantum computer is the world’s most powerful trapped-ion quantum computer, and IonQ has defined what it believes is the best path forward to scale. IonQ is the only company with its quantum systems available through the cloud on Amazon Braket, Microsoft Azure, and Google Cloud, as well as through direct API access. IonQ was founded in 2015 by Christopher Monroe and Jungsang Kim based on 25 years of pioneering research. To learn more, visit www.ionq.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions are intended to identify forward-looking statements. These statements include those related to the Company’s ability to further develop and advance its quantum computers and achieve scale; ability to attract personnel; market opportunity, anticipated growth, and future financial performance, including management’s outlook for the fourth quarter and fiscal year 2021. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: market adoption of quantum computing solutions and the Company’s products, services and solutions; the ability of the Company to protect its intellectual property; changes in the competitive industries in which the Company operates; changes in laws and regulations affecting the Company’s business; the Company’s ability to implement its business plans, forecasts and other expectations, and identify and realize additional partnerships and opportunities; and the risk of downturns in the market and the technology industry including, but not limited to, as a result of the COVID-19 pandemic. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-1 and other documents filed by the Company from time to time with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. The Company does not give any assurance that it will achieve its expectations.

|

IonQ, Inc. |

||||||

|

Condensed Consolidated Balance Sheets |

||||||

|

(unaudited) |

||||||

|

(in thousands) |

||||||

|

September 30, |

December 31, |

|||||

|

2021 |

2020 |

|||||

|

Assets |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

$ |

587,294 |

$ |

36,120 |

||

|

Accounts receivable |

4,082 |

390 |

||||

|

Prepaid expenses and other current assets |

6,478 |

2,069 |

||||

|

Total current assets |

597,854 |

38,579 |

||||

|

Property and equipment, net |

16,729 |

11,988 |

||||

|

Operating lease right-of-use assets |

4,098 |

4,296 |

||||

|

Intangible assets, net |

5,521 |

2,687 |

||||

|

Other noncurrent assets |

2,357 |

2,928 |

||||

|

Total Assets |

$ |

626,559 |

$ |

60,478 |

||

|

Liabilities and Stockholders’ Equity |

||||||

|

Current liabilities: |

||||||

|

Accounts payable |

$ |

1,967 |

$ |

538 |

||

|

Accrued expenses |

3,483 |

608 |

||||

|

Current portion of operating lease liabilities |

564 |

495 |

||||

|

Unearned revenue |

3,909 |

240 |

||||

|

Current portion of stock option early exercise liabilities |

1,153 |

– |

||||

|

Total current liabilities |

11,076 |

1,881 |

||||

|

Operating lease liabilities, net of current portion |

3,681 |

3,776 |

||||

|

Unearned revenue, net of current portion |

1,533 |

1,118 |

||||

|

Stock option early exercise liabilities, net of current portion |

2,252 |

– |

||||

|

Warrant liabilities |

50,350 |

– |

||||

|

Total liabilities |

$ |

68,892 |

$ |

6,775 |

||

|

Stockholders’ Equity: |

||||||

|

Common stock |

10 |

3 |

||||

|

Additional paid-in capital |

629,364 |

93,305 |

||||

|

Accumulated deficit |

(71,707 |

) |

(39,605 |

) |

||

|

Total stockholders’ equity |

557,667 |

53,703 |

||||

|

Total Liabilities and Stockholders’ Equity |

$ |

626,559 |

$ |

60,478 |

||

|

IonQ, Inc. |

|||||||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive Loss |

|||||||||||||

|

(unaudited) |

|||||||||||||

|

(in thousands, except share and per share data) |

|||||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||||

|

September 30, |

September 30, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||

|

Revenue |

$ |

233 |

$ |

– |

$ |

451 |

$ |

– |

|||||

|

Costs and expenses: |

|||||||||||||

|

Cost of revenue (excluding depreciation and amortization) |

234 |

57 |

742 |

57 |

|||||||||

|

Research and development |

6,180 |

2,339 |

15,311 |

7,643 |

|||||||||

|

Sales and marketing |

1,286 |

81 |

2,384 |

263 |

|||||||||

|

General and administrative |

2,461 |

727 |

8,321 |

1,840 |

|||||||||

|

Depreciation and amortization |

596 |

372 |

1,543 |

995 |

|||||||||

|

Total operating costs and expenses |

10,757 |

3,576 |

28,301 |

10,798 |

|||||||||

|

Loss from operations |

(10,524 |

) |

(3,576 |

) |

(27,850 |

) |

(10,798 |

) |

|||||

|

Offering costs associated with warrants |

(4,259 |

) |

– |

(4,259 |

) |

– |

|||||||

|

Other income |

2 |

11 |

7 |

305 |

|||||||||

|

Loss before benefit for income taxes |

(14,781 |

) |

(3,565 |

) |

(32,102 |

) |

(10,493 |

) |

|||||

|

Benefit for income taxes |

– |

– |

– |

– |

|||||||||

|

Net loss and comprehensive loss |

$ |

(14,781 |

) |

$ |

(3,565 |

) |

$ |

(32,102 |

) |

$ |

(10,493 |

) |

|

|

Net loss per share attributable to common stockholders |

|||||||||||||

|

Basic and diluted |

$ |

(0.12 |

) |

$ |

(0.03 |

) |

$ |

(0.27 |

) |

$ |

(0.09 |

) |

|

|

Weighted average shares used in computing net loss per share attributable to common stockholders |

|||||||||||||

|

Basic and diluted |

120,605,457 |

115,369,517 |

119,535,167 |

114,597,135 |

|||||||||

|

IonQ, Inc. |

||||||

|

Condensed Consolidated Statements of Cash Flows |

||||||

|

(unaudited) |

||||||

|

(in thousands) |

||||||

|

Nine Months Ended September 30, |

||||||

|

2021 |

2020 |

|||||

|

Cash flows from operating activities: |

||||||

|

Net loss |

$ |

(32,102 |

) |

$ |

(10,493 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||

|

Depreciation and amortization |

1,543 |

995 |

||||

|

Non-cash research and development arrangements |

1,205 |

– |

||||

|

Amortization of warrant |

219 |

18 |

||||

|

Offering costs associated with warrants |

4,259 |

– |

||||

|

Stock-based compensation expense |

5,929 |

681 |

||||

|

Non-cash operating lease expense |

184 |

46 |

||||

|

Changes in operating assets and liabilities: |

||||||

|

Accounts receivable |

(3,691 |

) |

(293 |

) |

||

|

Prepaid expenses and other current assets |

(3,950 |

) |

(428 |

) |

||

|

Other noncurrent assets |

(39 |

) |

3 |

|||

|

Accounts payable |

(1,191 |

) |

178 |

|||

|

Accrued expenses |

1,714 |

214 |

||||

|

Operating lease liabilities |

(15 |

) |

14 |

|||

|

Unearned revenue |

4,084 |

743 |

||||

|

Net cash used in operating activities |

(21,851 |

) |

(8,322 |

) |

||

|

Cash flows from investing activities: |

||||||

|

Purchases of property and equipment |

(5,300 |

) |

(8,031 |

) |

||

|

Capitalized software development costs |

(1,205 |

) |

(775 |

) |

||

|

Intangible asset acquisition costs |

(414 |

) |

(286 |

) |

||

|

Proceeds from disposal of assets |

5 |

1 |

||||

|

Net cash used in investing activities |

(6,914 |

) |

(9,091 |

) |

||

|

Cash flows from financing activities: |

||||||

|

Proceeds from stock options exercised |

5,424 |

29 |

||||

|

Repurchase of early exercised stock options |

(968 |

) |

– |

|||

|

Proceeds from merger and PIPE transaction, net of transaction costs |

575,483 |

– |

||||

|

Net cash provided by financing activities |

579,939 |

29 |

||||

|

Net change in cash and cash equivalents |

551,174 |

(17,384 |

) |

|||

|

Cash and cash equivalents at the beginning of the period |

36,120 |

59,527 |

||||

|

Cash and cash equivalents at the end of the period |

$ |

587,294 |

$ |

42,143 |

||

|

IonQ, Inc. |

|||||||||||||

|

Reconciliation of Net Loss to Adjusted EBITDA |

|||||||||||||

|

(unaudited) |

|||||||||||||

|

(in thousands) |

|||||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||||

|

September 30, |

September 30, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||

|

Net loss |

$ |

(14,781 |

) |

$ |

(3,565 |

) |

$ |

(32,102 |

) |

$ |

(10,493 |

) |

|

|

Interest expense |

– |

– |

– |

– |

|||||||||

|

Benefit for income taxes |

– |

– |

– |

– |

|||||||||

|

Depreciation and amortization expense |

596 |

372 |

1,543 |

995 |

|||||||||

|

Stock-based compensation |

2,055 |

181 |

5,929 |

681 |

|||||||||

|

Change in fair value of assumed warrant liabilities |

– |

– |

– |

– |

|||||||||

|

Offering cost associated with warrants |

4,259 |

– |

4,259 |

– |

|||||||||

|

Adjusted EBITDA |

$ |

(7,871 |

) |

$ |

(3,012 |

) |

$ |

(20,371 |

) |

$ |

(8,817 |

) |

|

|

Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). Adjusted EBITDA should not be considered an alternative to net loss as determined by GAAP. Management believes that this measure provides investors an additional meaningful method to evaluate certain aspects of the Company’s results period over period. Adjusted EBITDA is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other nonrecurring nonoperating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted EBITDA may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations. |

|||||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20211115006227/en/

Contacts

Media:

ionq@missionnorth.com

Investor:

Ryan Gardella and Michael Bowen

IonQIR@icrinc.com