Of the dozens of central bank meetings crammed into this week, the Federal Reserve is seen stealing the show with a tapering start and possible early rate-hike hints.

After the “worst inflation call in history” and its credibility shattered, Chair Jerome Powell will need to take the reins hard, says Allianz’s chief adviser Mohamed El-Erian. So we’ll see if a potentially sterner Fed knocks the S&P 500, which glided to a new high on Friday despite nosebleed consumer prices, off the Santa rally path.

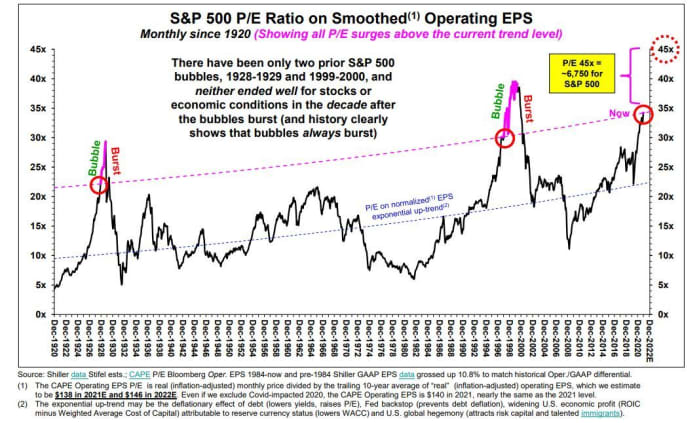

On to our call of the day from a team at Stifel, led by Barry Bannister, warning of another bubble for the ages, thanks to “poor monetary and fiscal decisions since COVID-19.”

And maybe enjoy any Santa rally while it lasts, as the team sees a near-term correction taking the S&P 500 toward the low 4,000s by the first quarter of next year. And then…

“Later in 2022-23E, we believe the ‘behind-the-curve’ Fed might create the third bubble in 100 years, by 2023 to 6,750 for the S&P 500 (Nasdaq [approximately] 25,000),” said the Stifel team.

“Populism (which the Fed and Treasury seemingly embrace) leads to poor choices and even worse outcomes. Rate repression may again create a bubble that bursts (always do), followed by a lost decade,” it said.

It said investors should look to history for proof this can happen. The S&P 500 dropped nearly 20% in the third quarter of 1998 before the dot-com bubble burst in 1999-2000. A “late arriving” Fed tightening from the second-half of 1999 to the first half of the next year couldn’t stop it, said Bannister and the team.

“The same happened in the Roaring ’20s, with a -10.7% mid_Dec-1928 drop as rates rose before the Oct.-1929 crash,” the strategists added.

The only way to prevent such a bubble would be for the Fed to heed its own financial stability report, where it warned over elevated risk appetite among retail investors and high equity and real estate valuations, and “tilt hawkish.”

“Still, policy may arrive too late, and if the market goes ‘risk-on’ with a falling Equity Risk Premium and if the 10Y Treasury Inflation Protected Security (TIPS) yield remains repressed at -1.0% due to global central banks, a P/E [price-earnings] convexity bubble in 2022-2023E may occur,” they said.

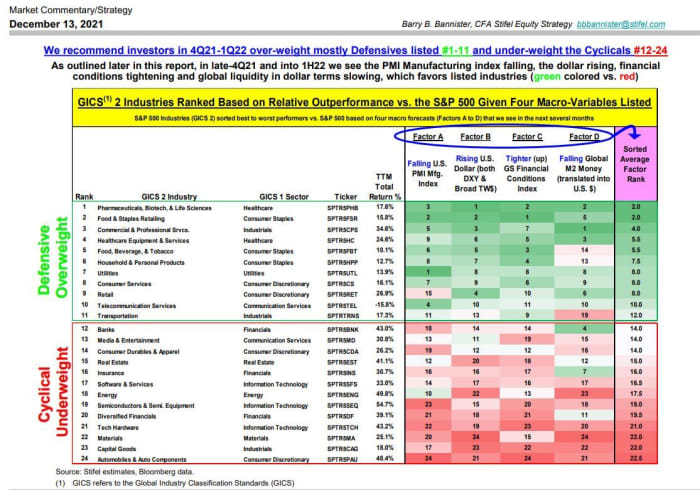

While the big one may be a way off, they offer a near-term survival guide. Bannister and his team said if both the S&P 500 and commodities weaken simultaneously — they expect that due to dollar strength, a China growth slowdown, Fed exit signals and tighter global liquidity —investors can take refuge in S&P 500 defensives. So healthcare, consumer staples, utilities and telecommunications are the safety spots of choice, for now.

The buzz

We’ve got Monday mergers and acquisitions. Pfizer

PFE

is buying Arena Pharma

ARNA

in a $6.7 billion deal. Software group SPX Flow

FLOW

has agreed to a $3.8 billion buyout from Lone Funds.

South African researchers say a two-shot course of Pfizer and BioNTech’s

BNTX

COVID-19 vaccine is about 23% effective against the omicron coronavirus variant, but may still prevent serious disease. Pfizer also got upgraded to buy at UBS, which sees $50 billion in COVID franchise sales next year.

Peloton

PTON

has fired back lightning fast at a plot twist in the “Sex and the City” reboot that was partly blamed for some stock selling, with a new ad featuring actor Chris Noth…back on his bike.

Monday is quiet on the data front, but the rest of the week is busy enough with retail sales and some manufacturing gauges. The Fed’s two-day meeting kicks off Tuesday. Here’s a preview.

Time Magazine has named Tesla

TSLA

CEO Elon Musk person of the year.

Iron-ore prices have been rising on speculation China will provide fiscal stimulus in early 2022, after the country’s top officials said at a weekend meeting that they want to stabilize the economy.

Celebrity chefs such as José Andrés are among those providing aid to Kentucky, which bore the brunt of a series of deadly and devastating tornadoes that hit multiple states this weekend.

The chart

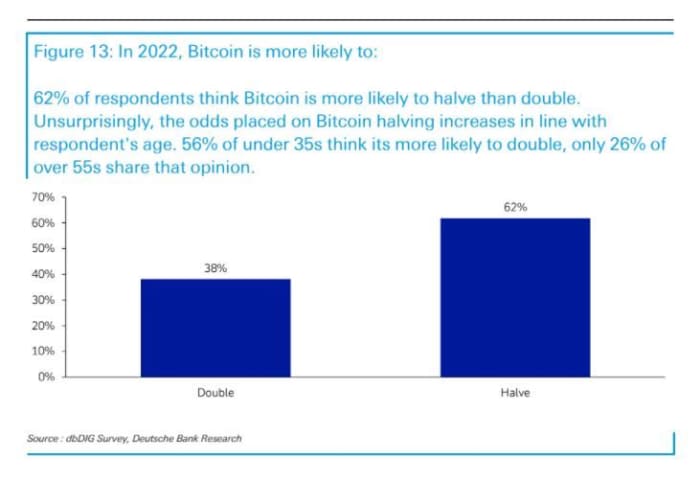

Betting on bitcoin? A survey conducted by Jim Reid and other strategists at Deutsche Bank finds that the older crowd is less optimistic about more gains than the younger crowd.

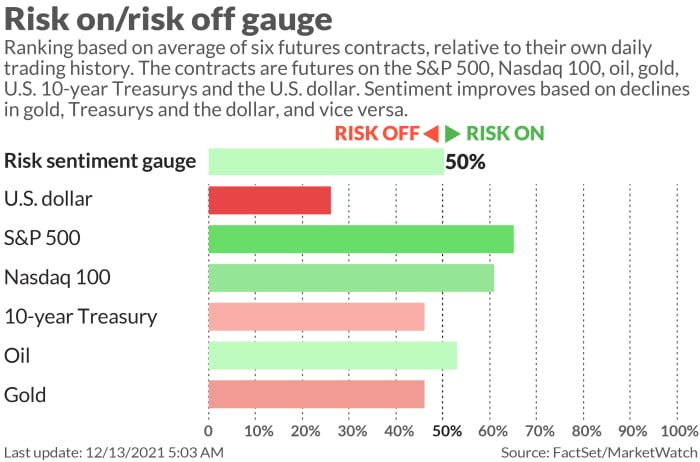

The markets

Stocks

DJIA

COMP

have slipped in early trading, and oil

CL00

is lower. It was a mixed day for Asian stocks, but Europe

XX:SXXP

is perking up, while bitcoin

BTCUSD

and other cryptocurrencies are softer. The beaten-down Turkish lira

USDTRY

was getting crushed again after Standard & Poor’s warned of a downgrade. Then the central bank intervened.

Top tickers

Here are the most active tickers on MarketWatch, as of 6 a.m. Eastern.

Random reads

An Oregon elementary school called the cops on a friendly, but foul-mouthed, snack-stealing crow.

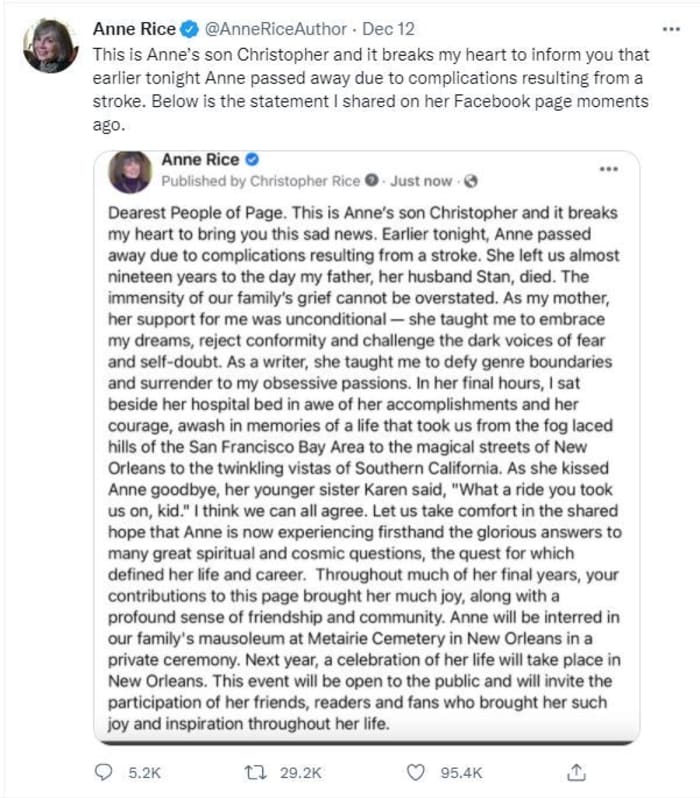

Fans mourn “Interview with the Vampire” author Anne Rice, who has died at 80. Here’s her son’s farewell:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.