Since the last time influential JPMorgan strategist Marko Kolanovic told investors to buy the dip, the S&P 500

SPX

fell by another 3%. That’s hardly a freezing cold take, but at the very least a bit early.

But he hasn’t changed his mind, saying the selloff in cyclicals and small-caps

RUT

in particular are overdone. “Many market metrics such as recent performance of high vs. low beta stocks and valuations of small-caps are already fully pricing in a recession — something we do not see materializing,” Kolanovic says in a note to clients. There’s also an attractive risk-reward in China and emerging-market equities

EEM.

“While jitters around a Fed hiking cycle are understandable, this has been magnified by technical factors that can change quickly — i.e., we could see a reversal of systematic outflows, pickup in buyback activity as we exit blackout windows, and magnification of flows by weak liquidity and short-gamma hedgers,” he says.

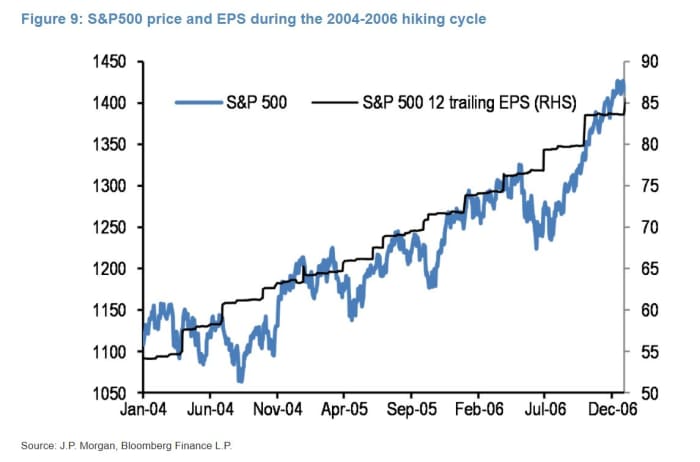

His bottom line is that the Federal Reserve tightening should not derail the current cycle. “Similar to the 2004-2006 Fed tightening cycle, the current cycle is taking place in a backdrop of above average nominal [gross domestic product] and [earnings per share] growth, which should allow the equity market to easily outperform cash and fixed income over the coming years, even if one assumes some gradual derating,” he says.

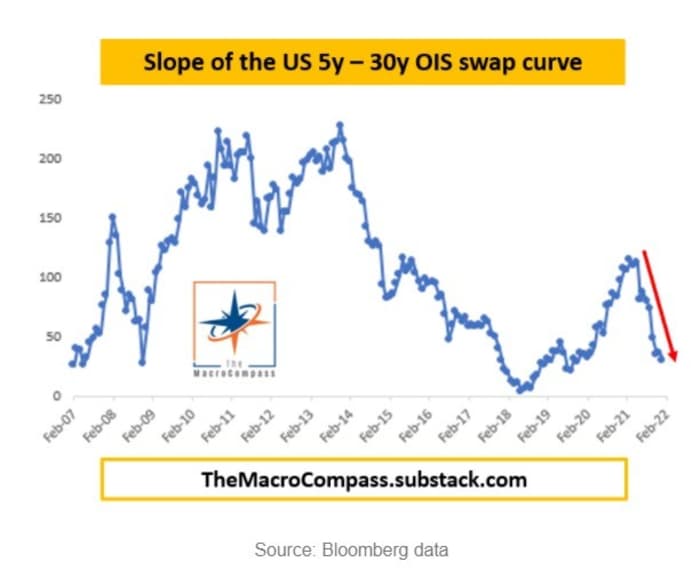

The flip side of this argument comes from Alfonso Peccatiello, a former head of a trading desk and now author of The Macro Compass blog, who notes the spread on overnight index swaps is dangerously close to inverting, at just 16 basis points on Monday. (The more widely followed Treasury curve isn’t as close to inversion, but is a less-pure metric in his opinion due to the credit spread.) This near-inversion is the byproduct of both a more hawkish Fed as well as deteriorating economic data.

Inverted yield curves, he argues, not only predict recessions but also contribute to them. After all, an indebted investor looking at higher short-term rates than long-term would naturally refinance. “A vicious circle therefore unfolds: restricted/more expensive access to credit in an already slowing and poor long-term growth environment leads the private sector to be more defensive, which compounds on the already ongoing cyclical slowdown,” he writes.

The chart

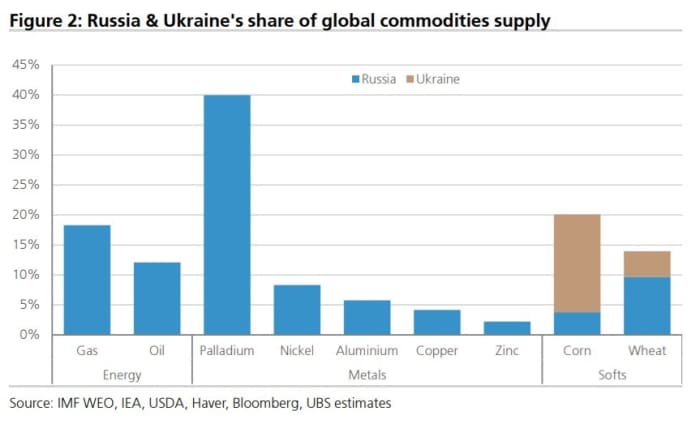

Everyone’s talking about Russian-Ukrainian tensions through the prism of its impact on energy. Less well known is the degree to which Russia supplies the palladium market, a vital commodity for catalytic converters, fuel cells, jewelry and dentistry, among its other users. Strategists at UBS note that when palladium prices have climbed in January, it was generally on days when Russian assets weren’t stressed. “Not much happened to international assets in 2014, and that’s the template the market seems to be using today,” say strategists led by Bhanu Baweja. “But there is a clear risk that the current situation is more serious.”

The buzz

There’s a crowded slate of economic data, including the Institute for Supply Management’s manufacturing index for January and job openings for December.

The earnings calendar includes Exxon Mobil

XOM,

and after the close, Alphabet

GOOGL,

General Motors

GM

and Starbucks

SBUX.

UPS

UPS

shares jumped after the parcel delivery service beat earnings expectations.

AT&T

T

announced it would spin off its stake in WarnerMedia after closing its deal with Discovery

DISCA.

UBS

UBS

rallied in Swiss trade after the bank said it would buy back up to $5 billion in stock following a stronger-than-forecast fourth-quarter profit.

The market

After the monster rally on Monday following some key broker upgrades and end of the month rebalancing, U.S. stock futures

ES00

NQ00

were languishing. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 1.75%.

The U.K. natural-gas contract

GWM00

tumbled 11% on news Russia was boosting gas supplies to Europe via Ukraine.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

The buzz

Fans of the viral puzzle game Wordle took to social media to lament its acquisition by New York Times Co.

NYT

The teen who has annoyed Tesla CEO Elon Musk by tracking his private flights is looking to expand his venture to track other billionaires.

Members of the U.S. Space Force are finding difficulty in getting military discounts — because employees often don’t think the service is real.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.