aprott/iStock via Getty Images

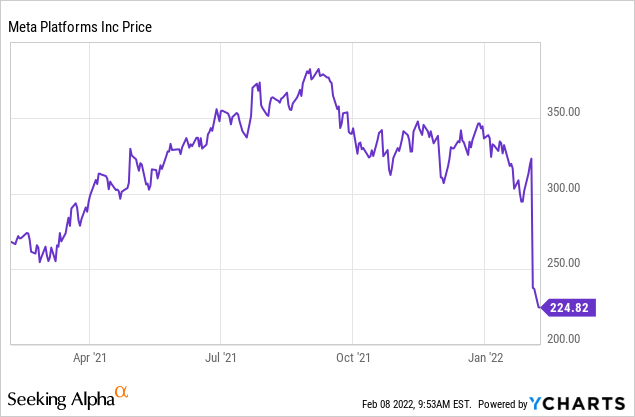

By now, every investor has read about Meta Platforms’ (FB) post-earnings wipeout, the largest single recorded loss of value in one day by any public company. The parent company of Facebook has not had an easy year, tangling with regulatory scrutiny while dealing with operating system changes that have dampened the profitability of its core advertising business.

And while I agree that Facebook stock had gotten frothy and complement about future risks at its 2021 peaks, it’s also difficult to not see this swift fall from peaks as a buying opportunity. Now a week out from that dreadful earnings release, Meta is sitting at 30% down from its pre-earnings prices and 40% down from all-time highs above $380.

I’ll cut to the chase here: I now view Meta to be quite the value play. While there is a lot of short-term noise around Meta at the moment (and I’ll certainly acknowledge there are fundamental risks on the horizon), we also shouldn’t let go of the long-term bullish drivers in Meta’s favor:

- Meta is the largest collection of social networks on the planet. While Facebook’s core site may be stagnating, “newer” platforms like Instagram are picking up the slack. While other social media companies have shown themselves to be more transitory in nature, Facebook’s self-branded “family of apps” has persisted for well over a decade and now act as a virtual platform of record for nearly half of the world’s population.

- One of the companies with the most advanced designs on the meta verse and augmented reality. Meta’s name change is a nod to the fact that the company views the next few decades to be dominated by the meta verse. While the concept has seen a lot of air time in both the news and in fiction, few companies outside of Meta have made any R&D headway into it.

- Immensely profitable. While Meta continues to build out the meta verse (which will be a multi-year endeavor), its social media businesses continue to mint profits and essentially subsidize these investments.

And yes, Meta is now trading at value-stock valuation multiples not yet seen in the company’s lifetime. At current share prices near $225, Facebook now trades at a P/E ratio of just 13.9x versus Wall Street’s $15.84 pro forma EPS expectations for FY23 (data from Yahoo Finance).

In short, I think there’s a lot to like about Meta/Facebook as it continues to digest losses from Q4 earnings. Above all, I think this is a stock market where value stocks shine – and believe it or not, Facebook has now joined that category. Despite the fundamental risks that Facebook’s Q4 earnings opened up, the massive drop in share prices since then more than makes up for that risk. Buy the dip here.

What’s plaguing Facebook?

Let’s do a quick rundown of the problems impacting Facebook at the moment. The first, as usual, is on user growth.

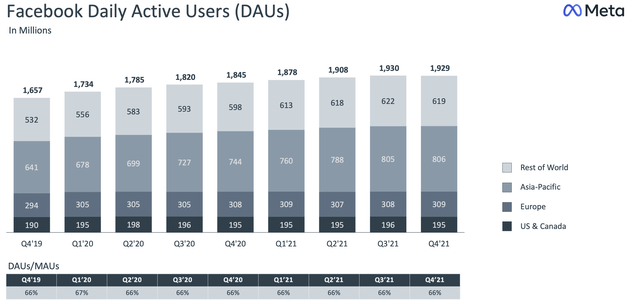

Facebook user trends (Meta Q4 earnings deck)

In Q4, as shown in the chart above, total daily users for Facebook (which account for about two-thirds of the company’s overall “family of apps” user base) declined to 1.929 billion, the first-ever sequential decline in the company’s history. Despite the juicy headline, this isn’t nearly as surprising as it sounds. Facebook proper has had a stagnating user base for several quarters, and we all know anecdotally that it’s falling out of favor with younger users.

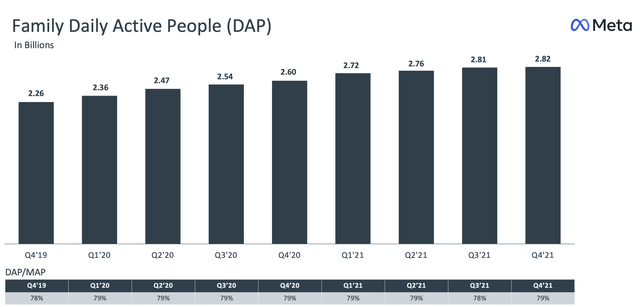

This being said, the mitigating factor here is that Facebook is no longer just a single app. The company’s ownership of Instagram has given it quite the buffer against the decline of Facebook. What we can see in the chart below is that while Facebook users are down, daily users across the “family” portfolio are up slightly to 2.82 billion.

Family of Apps user trends (Meta Q4 earnings deck)

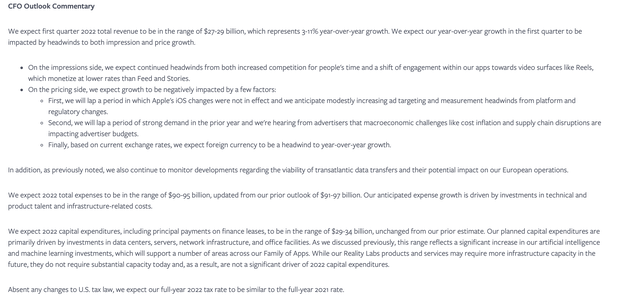

The second major force dragging Facebook downward is its outlook for FY22. The lackluster growth expectations shocked investors – the company is forecasting just 3-11% y/y revenue growth in Q1, representing a huge pace of deceleration versus Q4’s 20% y/y growth rate:

Meta FY22 guidance (Meta Q4 earnings release)

Here are the specific drivers that Meta is calling out that have significant short-term impacts on the company’s monetization. Per CEO Mark Zuckerberg’s prepared remarks on the Q4 earnings call:

But there are two things that I want to call out that are having an impact on our business.

The first is competition. People have a lot of choices for how they want to spend their time and apps like TikTok are growing very quickly. And this is why our focus on Reels is so important over the long-term, as is our work to make sure that our apps are the best services out there for young adults, which I spoke about on our last call.

The second area, and related to this, is that we’re in the middle of a transition on our own services towards short-form video like Reels. So as more activity shifts towards this medium, we’re replacing some time in News Feed and other higher monetizing services. So as a result of both competition and the shift to short-form video as well as our focus on serving young adults over optimizing overall engagement, we’re going to continue to see some pressure on impression growth in the near-term.

Now I’m confident that leaning harder into these trends is the right short-term tradeoff to make in order to get long-term gains. We’ve made these types of transitions before with mobile feed and Stories, where we took on headwinds in the near-term to align with important trends over the long-term.”

The good news is that Meta believes over the long run, it can build up short-form video like Reels (the direct TikTok competitor) to monetize at rates more in line with News Feed, and higher than other longer-form video offerings like Facebook Watch.

In addition, note that Meta’s outlook now calls for more moderate FY22 operating expenses of $90-$95 billion, down from a prior view of $91-$97 billion.

Don’t forget the good news

And though investors were focused on the sea of red ink that splashed across the stock after earnings, we can’t forget that several green shoots appeared for Facebook as well. In particular, these are the positive highlights I find worth calling out:

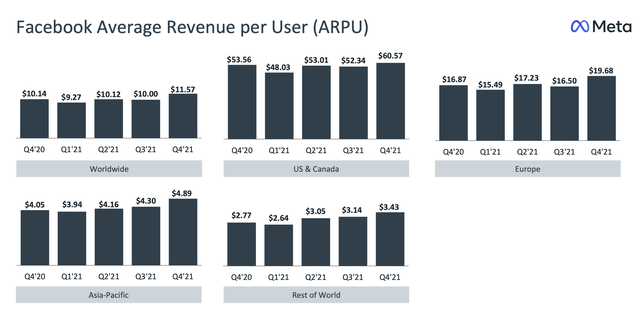

The first is ARPU growth. In spite of slowing user growth, Facebook is still growing its ARPU:

Facebook ARPU trends (Meta Q4 earnings deck)

As shown in the chart above, ARPU grew by 14% y/y globally. In particular, I find it encouraging that ARPU in Asia-Pacific, which is Meta’s fastest-growing region, grew 21% y/y to $4.89. Rest of World ARPU also grew 24% y/y to $3.43. While there’s still a large gap to close against the U.S. and Canada, these show growth is trending in the right direction.

Secondly, note that while Meta’s investments in the metaverse are still nascent and that this business unit (now being reported separately as its own segment) is still running large losses, Meta has managed to build up a base of early-adopters on the hardware side that position it well to be the future dominant force in the metaverse.

Here’s some additional commentary from Zuckerberg that fleshes out the company’s traction to date, including $1 billion in cumulative Quest sales:

Now the last investment priority here is the metaverse. We’re focused on the foundational hardware and software required to build an immersive, embodied internet that enables better digital social experiences than anything that exists today. On the hardware front, we’re seeing real traction with Quest 2. People have spent more than $1 billion on Quest store content, helping virtual reality developers grow and sustain their business. We had a strong holiday season and Oculus reached the top of the App Store for the first time on Christmas Day in the U.S.

We’re working towards a release of a high-end virtual reality headset later this year and we continue to make progress developing Project Nazare, which is our first fully-augmented reality glasses. As for software, Horizon is core to our metaverse vision. This is our social VR world-building experience that we recently opened to people in the U.S. and Canada. And we’ve seen a number of talented creators build worlds like a recording studio where producers collaborate or a relaxing space to meditate. And this year, we plan to launch a version of Horizon on mobile too, that will bring early metaverse experiences to more surfaces beyond VR.”

Lastly – Meta still remains massively profitable. In FY21, the company generated $38.44 billion of free cash flow, up 67% y/y and representing a rich 33% FCF margin. Note as well that the company generated $13.77 in pro forma EPS for the year, up 36% y/y.

Key takeaways

While the risks of growth deceleration stemming from changes in ad-targeting and the format switch of content consumption from news feeds to video are having meaningful impacts on Meta’s growth trajectory, I still view the company as an earnings powerhouse trading at an attractive valuation multiple, and with strong drivers for future growth driven by its investments in the metaverse. Don’t count Meta out just yet.