The prices at a gas station in Los Angeles last week.

Photo: David Crane/MediaNews Group/Los Angeles Daily News via Getty Images

Economic warfare is expensive. For weeks now, the West has been trying to thwart Russia’s war of conquest in Ukraine by debasing its currency and banning its exports. This is having its intended effect on the Russian economy. But American consumers of wheat, industrial metals, Matryoshka Dolls, and, above all, energy, have ended up as collateral damage.

In recent years, Russia has produced about 10 percent of the world’s oil, and 3 percent of America’s. Now, Russian crude is banned from our nation’s shores, and purchasing it has become more logistically difficult and reputationally fraught for traders everywhere. Even before the war’s onset, the global economy’s swift rebound from the COVID recession — combined with years of underproduction in the fossil-fuel sector — were driving up energy prices. The last thing energy markets needed was a sudden contraction in the global oil supply. Now, we’ve got one. As a result, the price of oil has shot up by more than 40 percent since the start of this year

That poses a threat to both the U.S. economy and Joe Biden’s presidency. If energy prices continue to climb, America’s high-inflation, high-growth recovery could devolve into a stagflationary recession. Meanwhile, few economic indicators are more predictive of a president’s political fortunes than the price of gasoline. And for a Democratic president, high fossil-fuel prices are an especially vexing liability.

The present surge in oil prices has nothing to do with the Biden administration’s climate policies. But Republicans are doing their best to convince voters otherwise. As the White House mulls lifting sanctions on Venezuela and Iran to ease oil-supply shortages, the GOP has assailed the administration for begging “every bad actor around the world to ramp up their own fossil-fuel production” while waging a “holy war against our own American energy production here at home.”

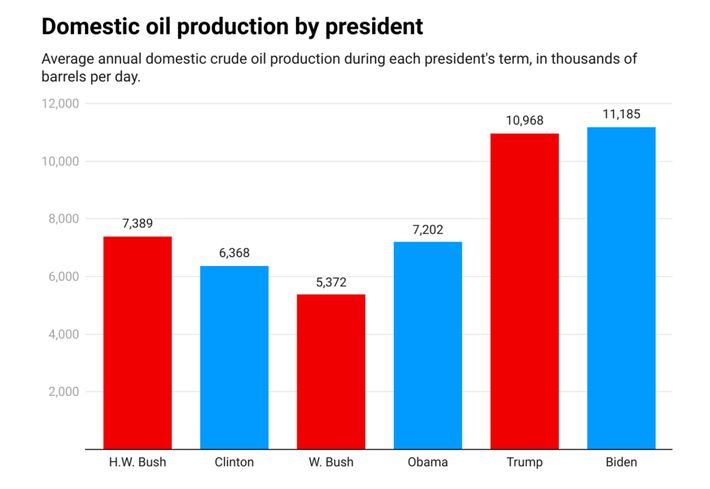

If Biden is fighting a crusade against fossil-fuel extraction, he’s losing it. As Matt Yglesias notes, the United States has produced more barrels of oil a day under Biden’s leadership than it did under Trump’s.

Graphic: Slow Boring

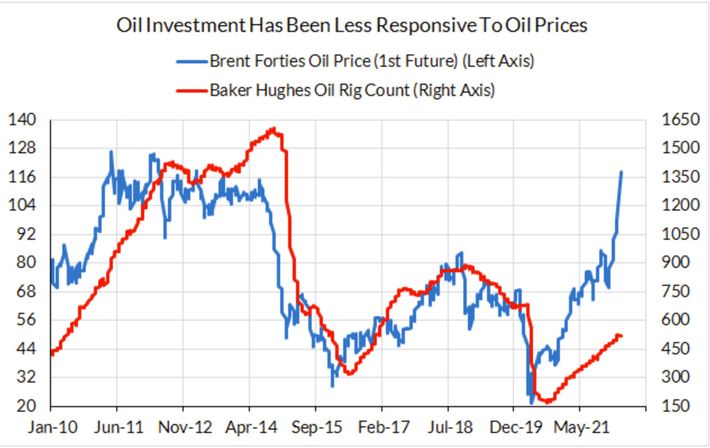

Nevertheless, it’s undeniably true that, even before the war in Ukraine, U.S. energy production was failing to keep pace with rising demand. In the recent past, when oil prices rose, the number of active oil rigs climbed at nearly the same pace. During the current recovery, however, rig growth has lagged far behind energy inflation:

Graphic: Employ America

But that’s a consequence of fossil-fuel investors’ caution, not Biden’s policies. The basic problem is that American shale drillers lost a lot of money during the oil-price collapse of 2014. During the recovery from the 2008 financial crisis, robust Chinese growth spurred high oil prices. At the same time, advances in horizontal drilling technology radically expanded opportunities for oil and gas extraction in the U.S. The shale boom ensued.

But for frackers, price signals are a cruel master. Getting a new drilling operation off the ground is a time-consuming process. And demand for energy can dissipate rapidly. Investment decisions that made perfect sense when oil was trading at $100 a barrel become disastrous if it crashes below $30. Which is what happened between the middle of 2014 and early 2016. American energy investors suffered heavy losses as a result.

Now, as boom times return to the U.S. energy sector, those investors want to be made whole. Thus, they’ve forced firms to prioritize shareholder dividends over expanded production. After all, the war in Russia could end tomorrow and they could lose money on expanding drilling all over again.

This investor caution derives primarily from the inherent instability of oil prices, not fear of impending green policies. And it is Big Oil’s risk aversion — not Big Government’s regulations — that have held back U.S. production. While Republicans caterwaul about Biden’s failure to open up more federal lands for drilling, U.S. companies already own drilling rights on “so much federal acreage that they have enough to drill for years without needing to apply for more permits,” according to Barron’s.

All this said, it is true that the Democratic Party wants to reduce carbon emissions, and that it has blocked the construction of some new fossil-fuel infrastructure in recent years. Further, some prominent Democratic factions condemn oil extraction as inherently bad, and high gas prices as a positive good (since they discourage fossil-fuel consumption and therefore carbon emissions). These realities make it easier for Republicans to pin the current energy price spike on Biden. And they also make it harder for the president to address the private sector’s underinvestment in energy production through new federal policies.

For example, the government could theoretically overcome investors’ caution by extending loan guarantees or other federal subsidies to fossil-fuel companies. While such a policy might mitigate the short-term problem of an acute energy shortage, however, it might also undermine the Democrats’ long-term goals on decarbonization.

What Biden needs is some energy policy that threads the needle between these two challenges, easing gas prices today without encouraging higher fossil-fuel consumption tomorrow. Ideally, this policy would also be enforceable through creative interpretations of existing law, since Biden can hardly trust our fractious Congress to move quickly.

Happily, this ideal policy may actually exist.

In a new report, the progressive think tank Employ America offers Biden a plan for ratcheting up energy production in the near term while reducing fossil-fuel demand in the long run.

Their proposal’s fundamental aim is to reduce oil-price volatility. Wild swings in the price of crude don’t just inhibit production by promoting investor caution. They also hurt consumers and climate hawks alike. When oil prices boom, Americans’ living standards suddenly fall; when such prices collapse, they render renewables (temporarily) less competitive, thereby undermining the growth of the green-energy sector, while also sapping political will for public investment in mass transit and other forms of low-carbon infrastructure.

Fortunately, the U.S. government has tools that it can use to narrow the range in which oil prices fluctuate. The first (and most important) is the Strategic Petroleum Reserve, which currently holds about 714 million barrels of oil. The administration has already tried dampening prices by releasing oil from the SPR. But the effect of such an action is inevitably temporary. To leverage the SPR for more durable price reductions, Uncle Sam shouldn’t just liquidate the reserves, but also pledge to fill it at a future date.

It often takes shale drillers about two years to extract all available fossil fuels from a new well. Right now, frackers are sitting on their hands out of fear that, between now and 2024, the price of oil will fall below their break-even point. If the federal government committed to refilling the SPR two years from now — and pledged to do so by purchasing oil at a price above frackers’ cost of production (approximately $60 a barrel) — then investors’ fears would be allayed. A market for their wares would be guaranteed. And as production ramped up, prices would durably moderate.

To further reassure anxious shale shareholders, Employ America’s proposal advises the government to use the Treasury Department’s Exchange Stabilization Fund to reduce shale drillers’ borrowing costs. Under existing law, the ESF has the authority to purchase “instruments of credit and securities the Secretary considers necessary.” In this case, it could purchase credit and securities tied to the drilling of new oil wells. To prevent this fossil-fuel subsidy from setting back the green transition, the program would have a two-year sunset.

One fortuitous feature of shale drilling is its rapid decline rate: Unlike many other forms of fossil-fuel infrastructure, new shale wells rarely yield oil and gas for much longer than two years. So encouraging the drilling of such wells should mitigate contemporary energy inflation without facilitating carbon-intensive energy use far into the future. Further, the ESF program could also subsidize borrowing to projects that reduce demand for fossil fuels, such as expansions of mass transit.

Meanwhile, to prevent oil prices from ever collapsing far below the cost of production — and undermining the green transition in the process — the government could use SPR purchases and Energy Department rule-making to put a floor beneath the price of crude. For example, when weak demand sends the price of oil below $40 a barrel, Uncle Sam could go on a reserve-filling spree.

Finally, Employ America’s proposal recommends bringing the Defense Production Act to bear on the energy crisis. The DPA gives the government the authority to prohibit the hoarding or price-gouging of certain materials key to national security, and to force businesses to prioritize contracts critical to national defense. In this case, the government could use the DPA to resolve supply-chain bottlenecks in the shale sector (to reduce energy prices today), and help automakers secure the semiconductors necessary for electric-vehicle production (to reduce fossil-fuel consumption tomorrow).

Employ America’s plan might disconcert some climate hawks. And not without reason. The Biden administration could sunset its subsides for shale drillers. But once the precedent for such programs has been set, the next Republican administration is all-but certain to restart the subsidies on its first day in office, even if there is no energy crisis that would justify it.

Nevertheless, America’s present reliance on fossil fuels cannot be wished away. Economically, $100-plus a barrel oil threatens to shred many vulnerable Americans’ finances and induce a recession that will put others out of work. Politically, sky-high gas prices increase the probability that climate denialists will retake the reins of the EPA in 2024. By using executive authority to induce higher oil production in the immediate term, Biden can address his constituents’ top concern while also establishing a precedent for more expansive public management of the energy sector. The risk that such measures will prolong our economy’s dependence on carbon energy can be dramatically mitigated by the passage of the Build Back Better Act’s green-energy tax credits, which all 50 Democratic senators ostensibly support.

With prudent policy, there will soon be a time when reducing energy prices and slashing carbon emissions will cease to be conflicting imperatives. But right now is a time to drill.