Long-lasting customer relationships are vital to growing any business. For SaaS businesses, where customers subscribe to a service for a monthly or annual fee, retaining customers takes more than just timely payment reminders and closing support tickets. It needs continual and meaningful engagement with the customers.

That’s why customer success is a crucial function in SaaS. And the best way to make decisions to keep your customers happy is to trust the data.

This article will cover some critical SaaS customer success metrics, the ways to calculate them, and help you understand how you can use the derived insights to make data-driven decisions to improve customer experience and satisfaction.

What are customer success metrics?

Customer success metrics are a set of metrics or key performance indicators (KPIs) used to measure how effective your strategies are, how satisfied your customers are, and how likely you are to retain them over a long time. Customer success metrics are critical to getting insights about employee onboarding, churn, and retention.

Knowing these insights and acting on them enables you to turn your customers into your advocates. It also helps you maximize your revenue by extending the customer lifetime value (CLV).

Why are customer success metrics important?

It’s more cost-effective to retain an existing customer than to acquire a new one. That doesn’t mean you shouldn’t be acquiring new customers – you absolutely should. But it’s equally important to retain existing customers, as it has a significant impact on your business growth.

Moreover, in the subscription business model, customers have an option to pause or even cancel anytime. That means you have to win customers over with every billing cycle. Focused retention strategies to improve customer experience are all the more relevant to SaaS businesses.

Keeping a close eye on the customer success metrics will help you ensure you’re on the right track and correct your course by devising specific strategies if you aren’t. For example, metrics help you understand your churn and what you can do to proactively prevent it. You can also identify revenue expansion opportunities to upsell and cross-sell.

10 customer success metrics for SaaS

You can measure various customer success metrics, but deciding what you measure is important to avoid analysis paralysis. Here are 10 customer success metrics every SaaS business should be tracking to get a complete picture of how effectively and efficiently they’re retaining their customers.

1. Net Promoter Score (NPS)

Net Promoter Score (NPS) is a measure of how likely a customer is to recommend your product or service on a scale of 1 to 10. Depending on their scores through a customer survey, you can segregate the customers into three buckets: the detractors (<6), the passives (7-8), and the promoters (9-10).

While NPS in itself isn’t enough to get a complete picture of your customer satisfaction, it’s a great way to quantify loyalty.

How to calculate NPS

NPS is expressed in the range -100 to 100.

NPS = % promoters – % detractors

If a business has more detractors than promoters, their NPS score is negative. For SaaS businesses, the average NPS sits at 41 out of 100. Suppose your NPS is lower than the industry average. In that case, you need to dig deep into why customers gave you this score and devise strategies to increase the number of promoters and advocates.

2. Customer lifetime value (CLV)

Customer lifetime value (CLV) is the average revenue generated by a customer over their lifetime with your business, i.e., before they churn. For example, if a customer signed up for your product and stayed with you for two years, the amount they pay you would become the CLV of that customer.

In conjunction with CAC (customer acquisition cost), CLV gives you a clearer picture of how much you’re spending on acquisition vs. how much revenue the customer is generating. It also provides more profound insight into customer behavior. You can segment customers using customer lifetime values and use that data to analyze churn.

How to calculate CLV

Customer lifetime value is calculated as:

CLV = ARPU x gross margin x average duration of contracts

or

CLV = ARPU / %churn

ARPU → average revenue per user

A profitable SaaS business should maintain LTV > 3 x CAC. To improve your CLV, use training programs to ensure that your customers realize your product’s actual value, provide superior customer support, and consider upselling or cross-selling.

3. Net retention rate (NRR)

Net retention rate (NRR) is a metric that tells you how good your business is at retaining and renewing existing customers and how well you are at generating new revenue from these existing customers. It is also known as Net Dollar Retention (NDR).

NRR is an excellent measure of how sustainable your business is. It gives you a picture of how your business would grow solely with your existing customers if you don’t acquire any new customers.

How to calculate NRR

NRR is calculated using the following four factors:

- MRR (Monthly Recurring Revenue) of last month (A)

- Expansion revenue, which generated through upsells and cross-sells (B)

- Contraction MRR lost to downgrades and cancellations (C)

- Revenue churn (D)

NRR = (A – C – D + B) 100 / A

For SaaS businesses, NRR of 100%+ is considered excellent. Some of the most successful SaaS businesses have enjoyed NRRs as high as 158% and 155%, respectively.

4. Customer retention cost (CRC)

As the name suggests, this metric measures the cost of retaining a customer. It includes all expenses incurred by a business in retaining its existing customers. While customer acquisition cost (CAC) is a one-time cost, retention costs span a customer’s lifetime.

Measuring CRC will give you an estimate of the amount of money you’re pumping in retention efforts until the end of the customer’s tenure. With this information, you can make calculated decisions on future investments for retention and acquisition activities. It is also essential to look at retention costs in the context of the CAC payback period to know how long it takes for your business to recover the money invested in acquisitions.

How to calculate customer retention cost

Customer retention cost includes all expenses associated with retention efforts. CRC is calculated as:

Customer retention cost = Cost of (staffing + tools/software used + customer marketing + training + customer loyalty programs) / number of active customers

High retention costs result in lower margins. If you want to reduce retention costs, focus on reducing costs of people, increase efficiency by automating redundant tasks, get rid of inefficient processes, do an audit of tools used for retention, and eliminate the ones you can afford to do away with.

5. Customer churn rate

One of the most important metrics that need to be tracked in the SaaS world, customer churn rate, is the rate at which customers leave you. Churn is a limiting factor to the growth of the business and affects both profitability and business evaluations in the long run. The churn rate is a critical metric to assess the long-term viability of a SaaS business.

Calculating and analyzing customer churn can be helpful in proactively preventing churn and leakage of revenue. Out of the two types of churn (voluntary and involuntary), the latter is easier to mitigate with dunning mechanisms as it occurs due to payment failures and expired credit cards.

Churn analysis also helps you better understand customer behavior by analyzing the specifics of the churn, such as the length of tenure, industry, revenue segment, and so on.

How to calculate churn rate

You can calculate churn rate for a particular period as:

Churn rate = Canceled customers x 100 / active customers

An annual churn rate of about 5-7% is considered acceptable for SaaS businesses. That translates to a monthly churn of about 0.42 – 0.58%. There are several ways to reduce churn, starting from improving customer experience and onboarding to providing support at every touchpoint. It also helps segregate your high-value customers and go the extra mile to keep them happy.

6. Customer satisfaction score (CSAT)

Customer satisfaction score (CSAT) is one of the most straightforward ways to gauge customer satisfaction. It is often collected as a survey response on a scale of 1 to 5 or 1 to 10. Simplicity is a big plus for this metric, and you can take a CSAT survey for customers at different stages of their journey, such as onboarding and support.

Knowing CSAT at different touchpoints helps you identify and reduce friction or bottlenecks at that stage and help you improve customer satisfaction. Although CSAT and NPS surveys sound similar, NPS is an indicator of long-term loyalty while CSAT of short-term customer satisfaction.

How to calculate customer satisfaction score

CSAT is super simple to calculate.

CSAT = Total positive responses x 100 / total survey responses

CSAT scores are intuitive and simple to use. Tracking CSAT helps improve customer experience in the short term. However, CSAT is not an accurate and complete picture of customer satisfaction for various reasons.

There are no wide-ranging benchmarks available for you to judge where you stand. CSAT is best used in conjunction with other retention metrics to understand customer satisfaction and loyalty fully.

7. First contact resolution (FCR) rate

The first contact resolution (FCR) rate measures the effectiveness of the support you provide to your customers. A percentage of customer requests is resolved during their first interaction with the support team, eliminating the need for a second contact or follow-up.

As we all know, quick support is a critical contributor to customer satisfaction. High FCR rates often indicate high customer satisfaction and efficient support. FCR rate is also an essential factor to consider when deciding the size of your support team and automating processes.

How to calculate FCR

You can calculate the FCR as:

FCR = Tickets resolved at first contact x 100 / total no. of tickets

To improve FCR, create a knowledge base or FAQs for common issues and questions. It improves the efficiency of the support staff in resolving common issues without added assistance. You can also consider automating a part of the support process by implementing self-serve ticket portals for easily solvable problems.

8. Monthly recurring revenue (MRR)

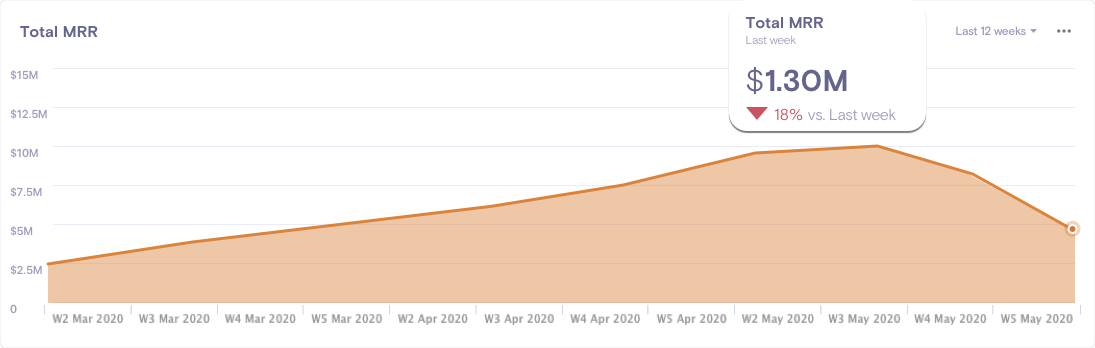

Recurring revenue is the holy grail of SaaS businesses. And therefore, monthly recurring revenue (MRR) is one of the most critical metrics that every SaaS business should measure. MRR is the recurring revenue earned from subscriptions in a month. While it includes recurring add-ons and coupons, it doesn’t include one-time charges such as set-up fees and non-recurring add-ons.

MRR is trusted by businesses and investors alike as one of the best indicators of a business’ viability. MRR can help you identify historical trends and also forecast future revenue. MRR is affected by upgrades, downgrades, and churn. A fall in MRR indicates a change in your customer behavior. You should invest in efforts to mitigate churn proactively.

How to calculate MRR

You can calculate MRR in two ways:

Total MRR = sum (monthly subscription charges of all paying customers)

or

Total MRR = ARPU x number of paid customers

High MRR is great, but having high MRR with high churn rates is bad news for the business. MRR should be looked at along with other metrics such as churn and CLV to get a complete picture of the health of your SaaS. To improve MRR, you can upsell and cross-sell by offering recurring add-ons, additional features, priority support, and more.

9. Annual recurring revenue (ARR)

Annual recurring revenue (ARR) is the recurring revenue generated by the number of subscriptions in a year. ARR gives you a snapshot of how your SaaS has performed year over year. Much like MRR, ARR indicates predictability and repeatability in cash flow and can be used in forecasting future growth.

You shouldn’t include subscriptions with terms shorter than one year in ARR calculation; they are more suited for MRR calculation. ARR can be used to keep tabs on revenue growth from new contracts, revenue expansion or contraction from existing customers, and estimate future revenue.

How to calculate ARR

Two factors influence ARR: revenue gained and revenue lost. Non-recurring add-ons and set up fees are not included in the ARR calculation.

ARR = Amount of revenue generated by yearly subscriptions + expansion revenue – revenue lost to churn

or

ARR = MRR x 12

Tracking ARR enables you to make decisions that’ll increase the growth momentum of your SaaS. ARR can also help identify key customer accounts and how they impact your business in the long term.

10. Qualitative customer feedback

One of the best ways to track your customer success’ performance is via the good old customer feedback. Customer feedback records everything from what they like or dislike about the product, what they think of your processes, and their overall experience.

Above all, customers want to be heard. Offering them a chance to provide feedback and learning from it is the first step in building meaningful and long-lasting customer relationships.

You can collect qualitative customer feedback via surveys or even calls. As the name suggests, the feedback cannot be “measured,” but it’s a gold mine of insights on what you’re doing well and what you need to improve.

Improve customer experience by measuring customer success

Customer success is critical to the success of any organization. Keeping an eye on these critical metrics will keep you on the course of growth by doubling down on what is going well and improving on the rest. A stellar experience will help convert subscribers into advocates.

It’s also advised to use a dashboard to track these metrics in a single view so that you can analyze them separately and understand how they affect each other and work with each other.

Metrics are only the first step in delivering a superior customer experience. Regularly tracking metrics opens doors to areas where more in-depth research is needed. From there, you can take the help of your single source of truth – your customers – and use those insights to make your customer success function more efficient.

In summary, a deeper insight into customer success metrics can help you:

- Get a better understanding of customer behavior

- Control churn proactively

- Understand what makes customers happy and, more importantly, what doesn’t (so you can improve accordingly)

- Identify revenue expansion opportunities, such as upsells to higher plans and cross-sells along with the core product

Tracking customer success helps you retain customers by improving the customer experience. But how do you make sure you’re using the right CX strategy? Read more about customer experience to find the best CX strategies that’ll work for you and your customers.