The American Petroleum Institute (API) reported a small inventory build in crude oil that was just enough to keep the market from panicking over dwindling inventories.

This week, the API estimated the inventory build for crude oil to be 655,000 barrels.

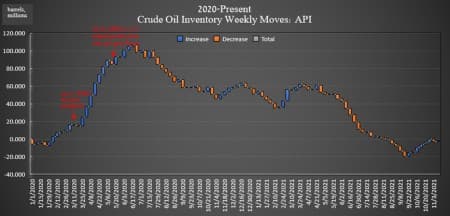

U.S. crude inventories are now 60 million barrels below where they were at the beginning of the year.

Analyst expectations for the week were for a build of 1.550-million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 2.485-million barrels, compared to the 1.90-million-barrel build that analysts had predicted.

Oil prices had been trading up just slightly on Tuesday in the runup to the data release, with WTI rising to $81 and Brent trading at $82.58 per barrel. WTI was down $3 week on week at 1:44 p.m. EST, while Brent was down $2 per barrel on the week.

U.S. oil production for the week ending November 5—the last week for which the Energy Information Administration has provided data—stayed the same at 11.5 million bpd, a figure that is still 1.6 million bpd below the all-time pre-pandemic high of 13.1 million bpd.

The API reported a draw in gasoline inventories of 2.792 million barrels for the week ending November 12—on top of the previous week’s 552,000-barrel draw, as high gasoline prices in the United States continues to draw attention.

Distillate stocks saw an increase in inventories of 107,000 barrels for the week, on top of last week’s 573,000-barrel increase.

Inventories at the largest U.S. oil hub, Cushing, continued to draw this week. The API estimated the draw at cushing to be 0.491 million barrels.

WTI was sliding at 4:39 p.m., and trading at $80.75 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com: