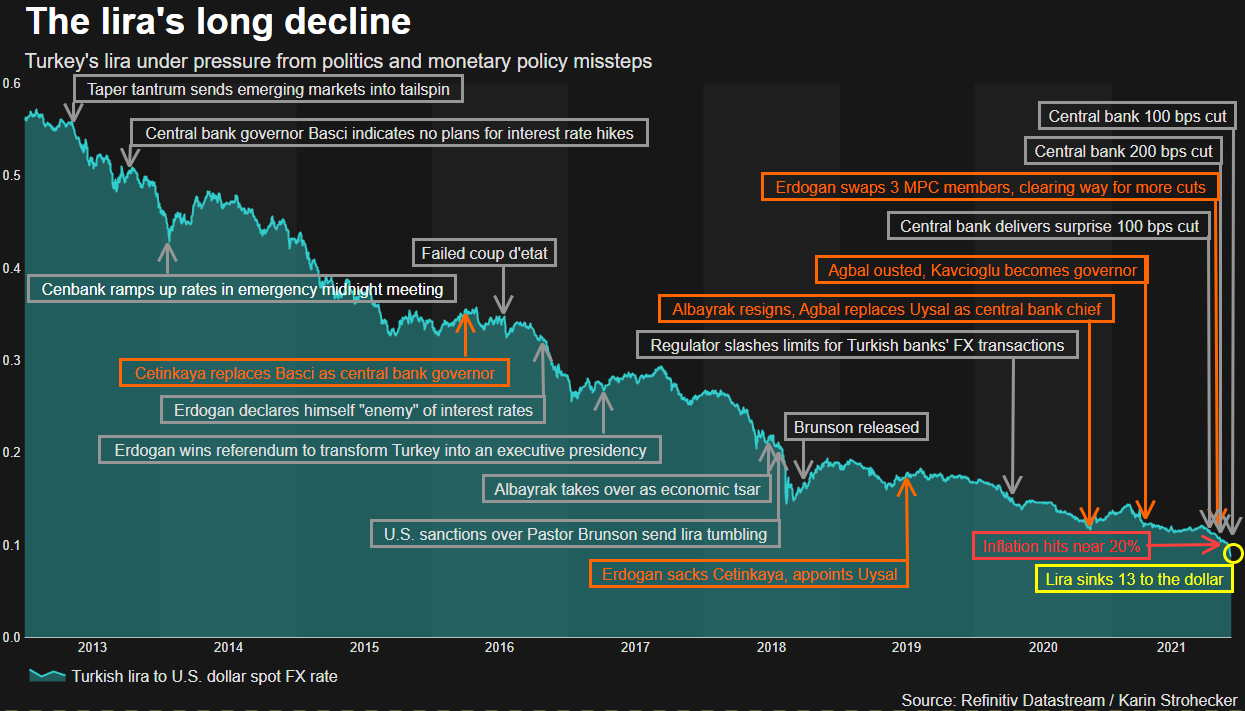

ISTANBUL, Nov 23 (Reuters) – Turkey’s lira nosedived 15% on Tuesday in its second-worst day ever after President Tayyip Erdogan defended recent sharp rate cuts, and vowed to win his “economic war of independence” despite widespread criticism and pleas to reverse course.

The lira tumbled as far as 13.45 to the dollar, plumbing record troughs for an 11th straight session, before paring some losses. It has shed 45% of its value this year, including a near 26% decline since the beginning of last week.

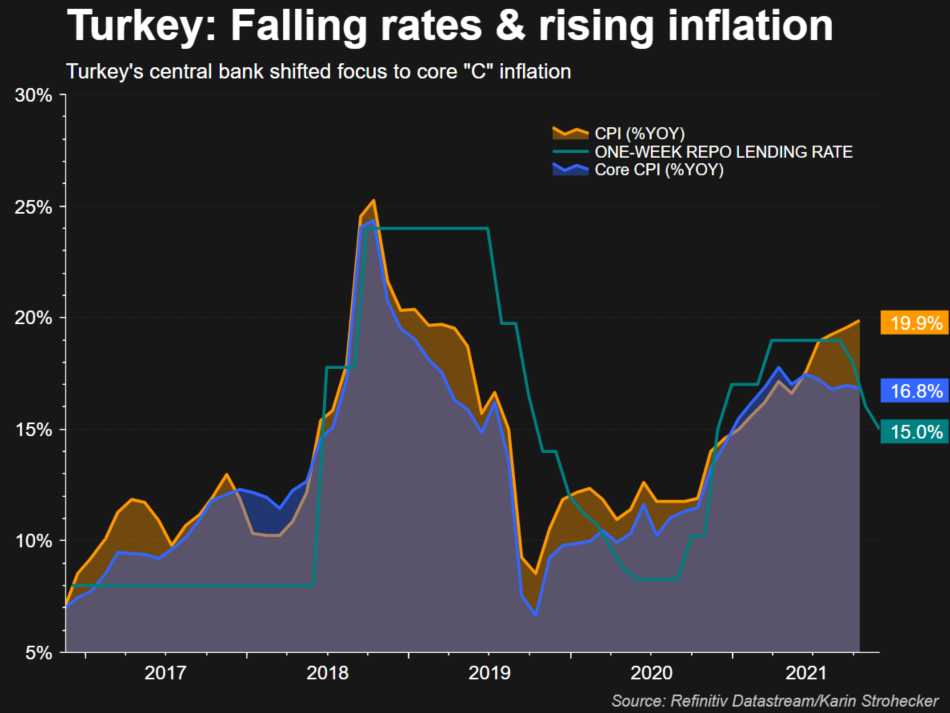

Erdogan has applied pressure on the central bank to pivot to an aggressive easing cycle that aims, he says, to boost exports, investment and jobs – even as inflation soars to near 20% and the currency depreciation accelerates, eating deeply into Turks’ earnings. read more

Register now for FREE unlimited access to reuters.com

Register

Many economists called the rate cuts reckless while opposition politicians appealed for immediate elections. Turks told Reuters the dizzying currency collapse was upending their household budgets and plans for the future. read more

After a meeting between Erdogan and central bank Governor Sahap Kavcioglu, the bank issued a statement saying the selloff was “unrealistic and completely detached” from economic fundamentals.

There was no hint at an intervention to stem the meltdown. The central bank said it could only do so under certain conditions in “excessive volatility”.

Former bank deputy governor Semih Tumen, who was dismissed last month in the latest round of Erdogan’s rapid leadership overhaul, called for an immediate return to policies which protect the lira’s value.

“This irrational experiment which has no chance of success must be abandoned immediately and we must return to quality policies which protect the Turkish lira’s value and the prosperity of the Turkish people,” he said on Twitter.

Tuesday’s slide was the lira’s worst since the height of a currency crisis in 2018 that led to a sharp recession, and brought on three years of sub-par economic growth and double-digit inflation.

Though the lira recovered a bit to 12.86 by 1635 GMT, the last 11 days have been its worst run since 1999. Over just three hours of volatile trading on Tuesday, its value bounced to 13 from 12 to the dollar.

The central bank has slashed rates by a total of 400 points since September, leaving real yields deeply negative as virtually all other central banks have begun tightening against rising inflation, or are preparing to do so.

SLIDING POLLS

The lira has been by far the worst performer globally this year due mostly to what some analysts have called a premature economic “experiment” by Erdogan, who has ruled Turkey for nearly two decades.

Erdogan’s AK Party is sliding in opinion polls ahead of elections scheduled for no later than mid-2023, reflecting sharply higher costs of living.

“Prices are rising too fast. I don’t want to buy certain products because they’ve got too expensive,” said Kaan Acar, 28, a hotel executive in southern Turkey’s Kalkan resort, adding he was thinking of cancelling a trip abroad due to the rising cost.

People change money at a currency exchange office in Istanbul, Turkey November 23, 2021. REUTERS/Dilara Senkaya

Read More

“The fault lies with President Erdogan, the AKP government, and those who for years turned a blind eye and supported them.”

Investors appeared to flee as volatility gauges spiked to the highest levels since March, when Erdogan abruptly sacked hawkish central bank chiefNaci Agbal and installed Kavcioglu, who like the president is a critic of high rates.

Against the euro, the lira weakened to a fresh record low beyond 15 on Tuesday as Turks snapped up hard assets.

The 10-year benchmark bond yield rose above 21% for the first time since the start of 2019. Sovereign dollar bonds suffered sharp falls with many longer-dated issues down 2 cents, Tradeweb data showed.

As the lira plunged, Turkey’s main share index (.XU100) rose more than 1% due to suddenly cheap valuations, though bank stocks dropped.

EMERGENCY HIKES

The central bank cut its policy rate last Thursday by 100 basis points to 15%, and signalled another cut in December.

Erdogan received support on Tuesday from his parliamentary ally, nationalist MHP leader Devlet Bahceli, who said that high interest rates limit production and there was no alternative to a policy focused on investments.

“Turkey needs to rid itself of the hunchback of interest rates,” Bahceli said.

Erdogan defended the policy late on Monday and said high rates would not lower inflation, an unorthodox view he has repeated for years. read more

“I reject policies that will contract our country, weaken it, condemn our people to unemployment, hunger and poverty,” he said after a cabinet meeting, prompting a late-day slide in the lira.

Analysts said Turkey would need emergency rate hikes soon, while speculation about a cabinet overhaul involving the more orthodox finance minister, Lutfi Elvan, has also weighed.

Societe Generale predicted an “emergency” hike as soon as next month, with the policy rate rising to about 19% by the end of the first quarter of 2022.

Ilan Solot, global market strategist at Brown Brothers Harriman, said Erdogan would likely wait until a “breaking point” before reversing course.

“Right now locals seem content to keep their dollars in the local system. If they start to move money elsewhere, to Germany, to Austria, it’s another story…Then we will have a conversation about a real currency crisis.”

Register now for FREE unlimited access to reuters.com

Register

Additional reporting by Ali Kucukgocmen in Istanbul, Ece Toksabay in Ankara and Karin Strohecker, Marc Jones and Tommy Wilkes in London; Writing by Jonathan Spicer; Editing by Gareth Jones, Susan Fenton and Mark Heinrich

Our Standards: The Thomson Reuters Trust Principles.