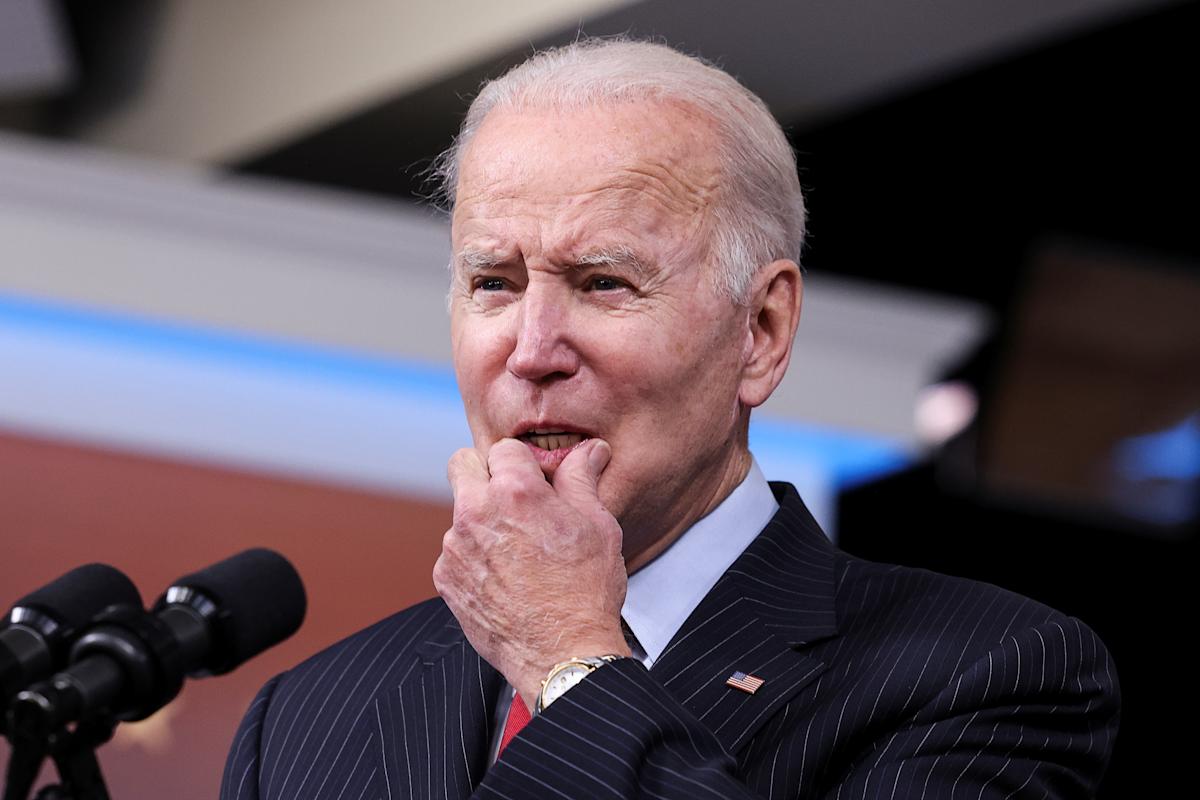

If President Biden has nightmares, he probably wakes up in the middle of the night terrified of gasoline prices.

Rising gas prices — up 50% during the last year to around $3.50 per gallon — compelled Biden to announce the release of 50 million barrels of oil from the U.S. national stockpile on Nov. 23. Before the announcement, crude oil futures traded at around $76 a barrel. After the Biden announcement, crude futures spiked to about $78 a barrel. Whoops.

Prices went up rather than down for a couple of reasons. The Biden move had been rumored beforehand and some traders guessed the release might be more like 100 million barrels, double what Biden announced. So markets had prepared for more new supply than the Biden move will provide. The additional supply could also lead the oil-producing nations of the OPEC+ cartel to curtail production, since most of those nations prefer higher oil prices, not lower prices.

Then Biden seemingly caught a break, when a post-Thanksgiving sell-off brought down the price of oil and most other globally traded assets. But that’s not the kind of price drop Biden wants. Markets are selling off on fears of the new COVID strain in South Africa and concern this could cause new lockdowns and stall the global recovery if it spreads. Yet another COVID-related slowdown would probably be worse news for Biden — and many other leaders — than high gas prices.

[Click here to get Rick Newman’s stories by email.]

If markets recover from the South Africa scare, it’s likely that oil prices will head back up. That could leave Biden with a worse conundrum than if he did nothing, because it will look like his effort to lower oil and gas prices backfired. Voters are already losing confidence in Biden on account of pandemic shortages, inflation, and lingering COVID concerns. If it looks like Biden is actually making a key problem worse, it could hobble Biden for the rest of his presidency.

It’s no surprise that Republicans are exploiting higher gas prices to ding Biden and claiming that his green energy policies are causing pain at the pump. That’s not really true. Gas prices in the United States are rising in line with oil prices, which are set by global supply and demand. A strong worldwide recovery, coupled with tight supplies, has been the main cause of higher prices. For Biden, however, it doesn’t really matter. Voters are uncomfortable and they’ll place the blame on whoever’s in charge. That’s him.

Most analysts think the new oil Biden plans to release will have little to no impact on global prices or American gasoline costs. It just isn’t enough oil. The world consumes 98 million barrels of oil per day. The Biden release is barely half a day’s worth of consumption. Other nations including the UK, India, China, South Korea, and Japan will also release some oil, but it will probably amount to less than the U.S. contribution.

What Biden has done, however, is take an action that will seem like a causal trigger, whichever direction oil and gas prices go. Offsetting the risk of a backfire is the possibility that prices could fall in 2022 for reasons having nothing to do with Biden. The U.S. Energy Information Administration, for instance, is forecasting a decline in oil prices of about 12% in 2022, as supply catches up with demand. That would let Biden claim credit for a development benefiting consumers, even if other factors were the cause.

Presidents catch blame when they don’t deserve it, but they also claim credit when things go right.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. You can also send confidential tips.

Read more:

Get the latest financial and business news from Yahoo Finance