The chief economic adviser for financial services firm Allianz warned that the new coronavirus variant Omicron could shake up the markets, exacerbate supply chain woes, amplify record-high inflation pressures — and possibly result in 1970s-style “stagflation.”

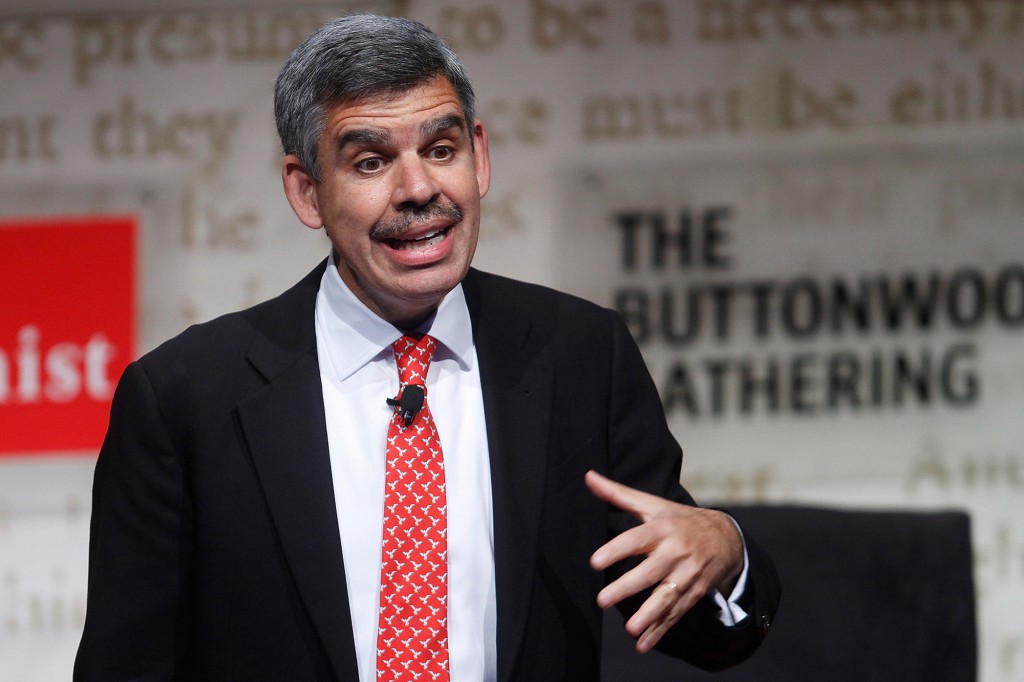

Economist Mohamed El-Erian was asked by “Fox News Sunday” host Trace Gallagher about the Dow tumbling 900 points on Friday over fears of the new variant and market uncertainty over the possibility of more lockdowns and travel bans.

“Yes. So – and it’s happening the world. The marketplace is worried about two things: one, that yet another variant of COVID is going to hit them hard. We travel less. We go out to restaurants less, and we may have additional restrictions that are imposed on us. That’s issue number one,” he said.

“And issue number two, the marketplace is worried also that this will cause more inflation, that the supply chain will be disrupted even more,” El-Erian said. “Those two things together: lower growth, high inflation are stagflation, and that’s what the market is worried about right now.”

Former President Jimmy Carter struggled to curb stagflation — caused by higher energy prices due to the Arab oil embargo, lower economic growth and rising unemployment — that eventually made him a one-term president.

El-Erian called on Jerome Powell, whom Biden said last week he would nominate to lead the Federal Reserve for a second term, to make reining in inflation a top priority.

“I think it’s time for a change in policy at the Fed, and I was of the view that this may be easier with someone who hasn’t repeated over and over again that inflation is transitory, don’t worry about it, it’s going away,” he said.

“Inflation is not transitory and it’s really important for the Fed to realize this, because the worst thing that can happen is that in addition to the supply disruption, which they can’t do anything about, in addition to labor shortages, they destabilize our expectations and we change behavior even faster,” he said.

“Companies increase prices faster, wage earners insist on higher wages, even more, and next thing you know, you got a cycle of inflation. That’s what we need to avoid,” he said.

El-Erian cautioned that if the supply chain issues continue, they could “contaminate” demand.

“I don’t think we have an issue with demand. I think incomes are strong, retail sales are strong. Companies have lots of money,” he said. ”The problem is the supply side. And unless we fix the supply side, it will contaminate the demand side. So, that’s why it’s really important to focus on two big issues that we have. Supply disruptions and inflation.”