The November jobs report gave a muddled picture of an improving economy.

Overall job growth fell far short of expectations, with the U.S. adding just 210,000 of the roughly 500,000 jobs that analysts projected the economy to gain last month. Even so, the unemployment rate sunk from 4.6 percent to 4.2 percent, landing less than 1 percentage point above the pre-pandemic jobless rate.

Here are five things to know about the November jobs report.

A confusing report on a confusing economy

The November jobs report defied expectations across the board. The divergence between the top-line jobs gain and other gauges of labor market strength left economists baffled, but generally optimistic.

“It’s a mixed picture being painted by today’s report, and it’s not obviously clear which picture is correct,” said Daniel Zhao, senior economist at Glassdoor, told The Hill.

“Ultimately, I think the picture is still a healthy job market recovery. But there’s a lot of uncertainty because of how today’s report muddies the picture,” he continued.

The top-line jobs number, compiled through a survey of businesses, fell far short of what many analysts expected after several months of booming consumer spending. Employment in leisure and hospitality rose by just 23,000 jobs, and retailers added just 28,000 jobs despite the impending rush of holiday shopping.

Even so, Americans fared far better in the labor market, according to the survey of households used to compile the report. Labor force participation rose to 61.8 percent, the highest level since the onset of the pandemic, and the full-time employment rate for prime-age workers rose above 70 percent.

Revisions could change the outlook

The COVID-19 pandemic has made it difficult for the Bureau of Labor Statistics to gauge the strength of the economy at a particularly critical time.

Zhao, along with many analysts, attributed the unusual split between the establishment and household surveys to a remarkably low response rate. He added that businesses responding to the survey late has been one of several factors forcing the bureau to make substantial revisions to previous reports.

“Anytime there’s a significant disruption to the economy, it’s very hard to get reliable real time data,” Zhao said.

Several economists also suggested that seasonal adjustments based on pre-pandemic hiring patterns could also be skewing the picture.

The top-line jobs gain would have been 778,000 without seasonal adjustments, noted Julia Pollak, chief economist at ZipRecruiter, and the household survey showed a 1.1 million increase in the number of employed Americans.

“Today’s miss shouldn’t cause too much concern,” she wrote.

Women are coming back to the workforce

The November jobs report showed encouraging signs of workers sidelined by the pandemic, particularly women, coming back to the job market.

Women’s labor force participation rose 0.2 percentage points to 56.2 percent, returning to August levels after falling during the delta outbreak. Women, particularly Black and Hispanic women, suffered a greater proportion of job losses and left the workforce in greater numbers than men did at the onset of the pandemic.

The uptick in women’s labor force participation is an early but promising sign as businesses still face intense pressure to hire more workers.

“This is the highest reading since March 2020 and the largest monthly gain since last April. Unfortunately, it is too soon to determine whether the November increase is the start of a new trend,” wrote Joe LaVorgna, chief economist for the Americas at investment bank Natixis and a former Trump White House economic adviser, in a Friday analysis.

“If it is, then there is more labor slack than economists estimate, and the longer-term inflation outlook becomes less troublesome. The participation rate may be the single most important variable for the economic and financial outlook.”

Wage growth may be cooling

After surging through the year thanks to high labor demand, wage growth has started to settle down slightly.

Average hourly earnings rose 0.3 percent last month and wages on the whole rose 4.8 percent in the 12 months leading into November, unchanged from October’s annual rate. While higher wage growth is welcome news after years of sluggish gains for low-paid workers, unchecked wage growth could also lead to persistently higher pressure on inflation.

“Wage gains remain the fastest at the bottom of the pay scale where workers have become scarce and companies struggle to hire,” explained Lydia Boussour of Oxford Economics in a Friday analysis.

“With the rebound in labor supply likely to be sustained and limited room for pricing power to rise further, we don’t foresee an upward wage-price spiral,” she continued.

A tough sell for Biden and Democrats

Though the report has ample signs of strength for the labor market, the November jobs haul could be hard to pitch for the president and his party as they attempt to cement their economic agenda.

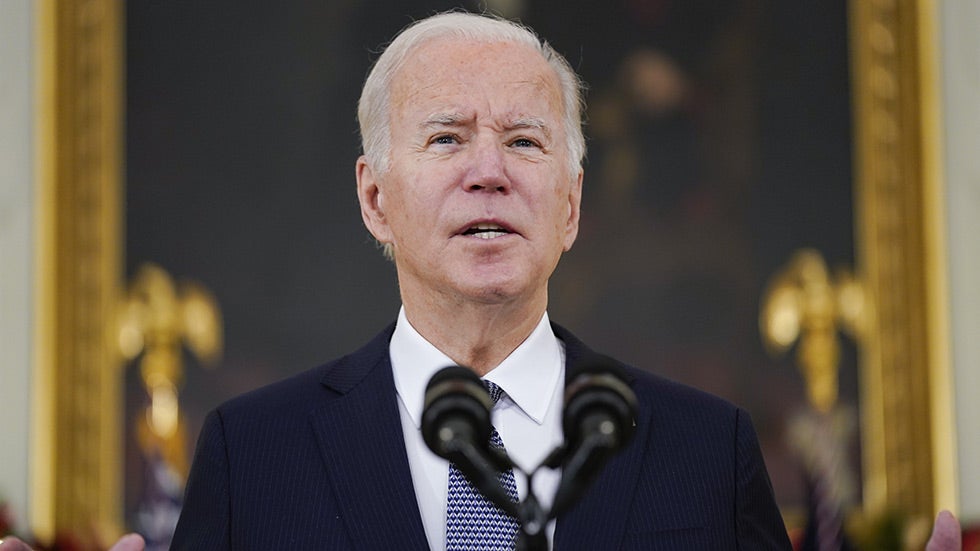

Biden sought to emphasize the bright spots of the report, including the rapid plunge in the jobless rate coupled with a growing labor market. Despite COVID-19-related obstacles, Biden noted, the U.S. economy has grown faster than any other nation hit hard by the pandemic.

“Because of the extraordinary strides we’ve made, we look forward to a brighter, happier new year ahead, in my view,” Biden said during remarks at the White House on Friday.

However, next year will most likely see another onslaught of criticism from Republicans, who are seeking to use voters’ concerns with the economy to recapture the House and Senate in the midterm elections.

“This is a miserable jobs report, there’s no spinning it any other way,” said Rep. Kevin Brady Kevin Patrick BradyEconomic growth rate slows to 2 percent as delta derails recovery Democratic retirements could make a tough midterm year even worse Yellen confident of minimum global corporate tax passage in Congress MORE (Texas), ranking Republican on the House Ways and Means Committee, in a Friday statement.

Kevin Patrick BradyEconomic growth rate slows to 2 percent as delta derails recovery Democratic retirements could make a tough midterm year even worse Yellen confident of minimum global corporate tax passage in Congress MORE (Texas), ranking Republican on the House Ways and Means Committee, in a Friday statement.