On Friday, the Dow finished down 532 points, or 1.5%. It was its worst drop in three weeks. The S&P 500 closed down 1%. Both are still sitting on healthy gains for the year so far.

Two factors appeared to be driving Monday’s losses.

“A combination of increasing Omicron nerves, particularly in the UK and Europe, and the failure of President Biden’s spending plan… has seen Asian equities head directly south in sympathy with Wall Street’s Friday finish,” wrote Jeffrey Halley, senior market analyst, Asia Pacific, at Oanda.

Citing the “apparent demise” of Build Back Better, Goldman Sachs now expects US GDP to grow at an annualized pace of 2% in the first quarter, down from 3% previously.

Adding to the gathering gloom is the threat that Omicron poses to business. The highly-transmissible variant had been identified in at least 45 US states as of Sunday, as well as Puerto Rico and Washington, DC. And with Delta still present, Covid-19 cases are rising in some areas. New York set a new record for single-day Covid-19 cases for a third consecutive day Sunday, according to Gov. Kathy Hochul’s office.

Omicron is also spreading fast in Europe, prompting governments across the region to introduce new measures restricting travel and social activity. The Netherlands introduced a strict lockdown on Sunday, while France said Friday it would ban large outdoor events and gatherings on New Year’s Eve. Denmark has closed cinemas and theaters, and limited the numbers of people in shops this week.

“Even if booster shots are effective at reducing the medical risks, a rapid spread of Omicron could still overburden health systems and force countries to follow the Netherlands and adopt more economically damaging restrictions,” Berenberg chief economist Holger Schmieding wrote in a research note on Monday.

UK Deputy Prime Minister Dominic Raab told Sky News on Monday that he could not rule out further Covid-19 restrictions being implemented before Christmas in England.

Davos delayed

The World Economic Forum announced Monday that it would delay its annual meeting in Davos, Switzerland — scheduled for January 17-21 — until early summer because of uncertainty over the Omicron outbreak.

“Current pandemic conditions make it extremely difficult to deliver a global in-person meeting,” the forum said in a statement, citing the impact of Omicron on travel.

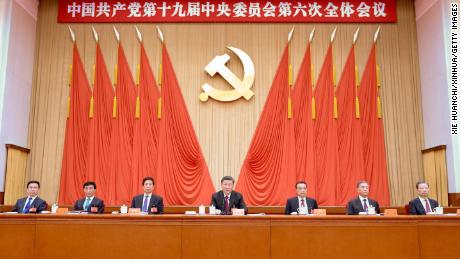

China is already experiencing a major economic slowdown, buffeted by a real estate crisis, a crackdown on private enterprise, outbreaks of Covid-19 that have disrupted manufacturing and shipping, and a power crunch. Analysts say the world’s second biggest economy could grow at its slowest pace since 1990 next year.

The People’s Bank of China trimmed its benchmark loan prime interest rate for the first time in 20 months on Monday, but stock market relief quickly evaporated.