ANKARA, Dec 21 (Reuters) – Turkey’s lira rocketed back from record lows in volatile trading on Tuesday after Turkish President Tayyip Erdogan proposed measures to protect local currency savings against such swings.

Erdogan introduced a series of steps late on Monday that he said will ease the burden of a weakened currency on Turks and encourage them to hold lira rather than dollars. read more

Under Erdogan’s plan, his government promised to guarantee deposits in lira, sending the currency soaring some 25%, its biggest intra-day rally on record, at one point on Monday.

Register now for FREE unlimited access to Reuters.com

Register

Analysts and bankers warned that if the lira’s rally fizzles and reverses, the government woudl be on the hook to cover future losses based on the exchange rate. It could also stoke already high inflation. read more

The Turkish currency, which has lost 44% of its value against the greenback this year, initially strengthened on Tuesday to a daily high of 11.0935 versus the dollar, later weakening to 14.3885 before swinging back to 13.1 at 1417 GMT.

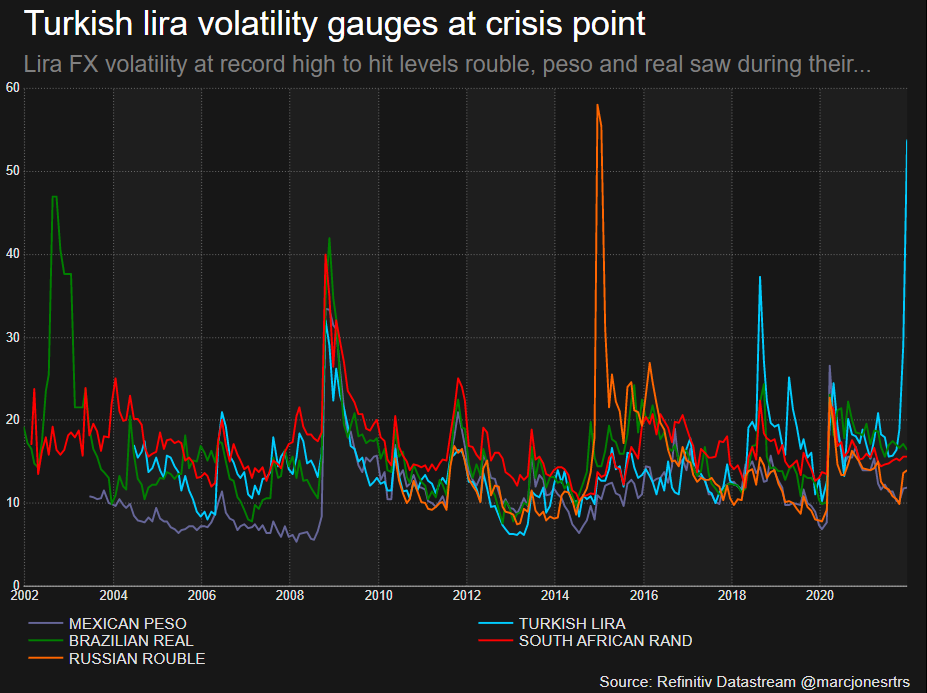

Implied volatility on the lira – or expected price swings – jumped to the highest on record, reflecting uncertainty about the scheme even as the Treasury provided some details.

The government has pledged to pay the difference between the yield on savings in lira and equivalent dollar deposits.

More than half of locals’ savings is in foreign currencies and gold, according to central bank data, due to a loss of confidence in the lira after years of depreciation.

The currency has plunged to record lows this year over fears of an inflationary spiral brought on by Erdogan’s push for monetary easing. At its low, it was down some 60% on the year.

A source with knowledge on the matter said the measures were decided after the exchange rate hit “problematic” levels, adding the government would manage the coming period carefully.

“The dollar and euro had risen up to the point of forming a bubble really. This needed to be intervened in. This situation was not sustainable,” the person said, requesting anonymity.

Turkey’s five-year credit default swaps , the cost of insuring against sovereign default, jumped to 613 bps, the highest since May 2020, according to IHS Markit.

Meanwhile, one month implied volatility in the Turkish lira jumped to 63%, its highest on record.

Finance Ministry said the new instrument will be available for lira savings by retail investors with maturities of three to 12 months, with the minimum central bank policy rate deposit yield. read more

Presidential adviser Cemil Ertem told Reuters the moves had removed the need for individual investors’ dollar demand, adding it was “a very important paradigm shift” for Turkey’s economy.

‘MOTHER OF ALL RALLIES’

While the government called the lira’s rebound on Monday a major win on policy, economists have said Erdogan’s economic programme based on low interest rates is reckless and expect inflation, currently above 21%, to blow through 30% next year.

Turkey’s EPDK energy regulator said, after the lira’s rally, it had halted planned price hikes for now. Turkey’s main BIST 100 stock index was down 7.66% on Tuesday, triggering indexwide circuit breakers that halt trading temporarily.

Under pressure from Erdogan, the central bank has cut rates by 500 basis points since September. The president has pledged to continue with his low-rates policy, including on Monday.

Some economists have said the new measures are effectively veiled rate hikes that may not ultimately stem the selling pressure on the lira, while putting a strain on the Treasury.

“It can have dangerous consequences,” said Refet Gurkaynak, head of Bilkent University’s economics department, in Ankara.

Jeffrey Halley, senior market analyst, Asia Pacific, OANDA, said it remained unclear how the government would carry out the new measures “especially in a short time”.

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Orhan Coskun in Ankara, Ebru Tuncay in Istanbul and Davide Barbuscia in Dubai; Editing by Jonathan Spicer, Sam Holmes, Ana Nicolaci da Costa and Alexander Smith

Our Standards: The Thomson Reuters Trust Principles.