Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) traded in negative territory at press time as the global cryptocurrency market cap rose 2.2% to $2.25 trillion.

What Happened: The apex coin was down 1.6% at $48,132.60 over 24 hours. For the week, BTC has fallen 2%.

ETH, the second-largest cryptocurrency by market cap, traded 2.6% lower at $3,922.80 over 24 hours. Over a seven-day trailing period, it has declined 3%.

Dogecoin (CRYPTO: DOGE) was up 0.9% at $0.17 over 24 hours. The meme coin has lost 5.6% of its value over the week.

Self-described DOGE-killer Shiba Inu (SHIB) traded 5.7% higher at $0.00003. For the week, it is up 1.25%.

The top three gainers over 24 hours were NEAR Protocol (NEAR), Cosmos (ATOM), and ICON (ICX), according to CoinMarketCap data.

NEAR soared 29.9% to $11.95, ATOM was up 18.3% to $27.83 and ICX shot up 15.3% to $1.48 in the period.

See Also: How To Buy Ethereum (ETH)

Why It Matters: Bitcoin moved along with the comeback stock market rallies seen globally on Wednesday but continued to trade under the $50,000 level.

Cryptocurrency trader Michaël van de Poppe said on Twitter Wednesday that while there was talk of the apex coin touching the $150,000 mark at the end of the year, what we got instead were much more modest levels.

They said we get parabolic run with #Bitcoin to $150K.

Instead we got #Bitcoin at $50K.

— Michaël van de Poppe (@CryptoMichNL) December 22, 2021

“Bitcoin continues to face a wall at the $50,000 level and until that level is breached, speculators may remain on the sidelines,” wrote Edward Moya, a senior analyst with OANDA.

“Bitcoin and Ethereum have both entered holiday mode and continue to consolidate around key technical levels. The headlines have not been inspiring to suggest a breakout could be imminent,” wrote Moya, in a note seen by Benzinga.

Meanwhile, miners are holding on to their stores as unspent miner supply touches all-time highs.

BTC Miner Unspent Supply — Courtesy Glassnode Via GlobalBlock

“On-chain metrics continue to be bullish as the unspent miner supply closes in on all-time-highs,” wrote Marcus Sotiriou, an analyst with United Kingdom-based digital asset broker GlobalBlock.

“This shows the sentiment of miners and, by holding their mined Bitcoin, this suggests that they anticipate significant price rise in the short to mid-term,” according to Sotiriou.

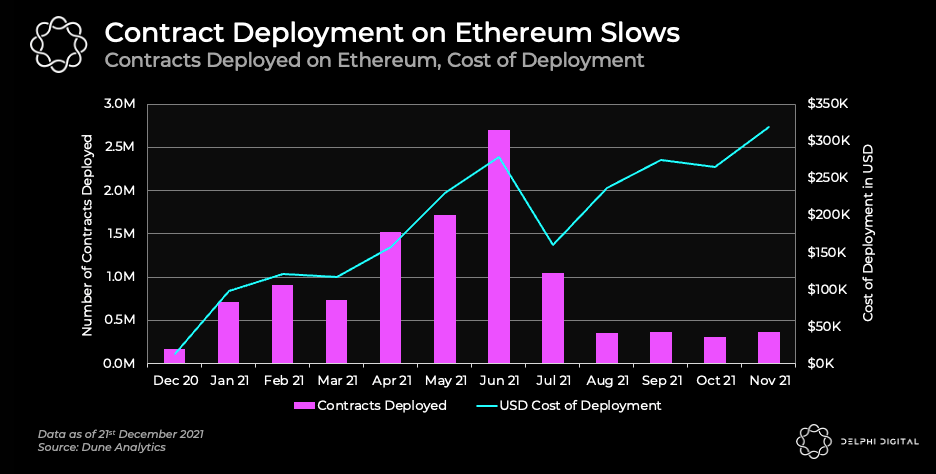

On the Ethereum side, smart contracts deployed on the network have been declining with rising costs of deployment being the likely precipitating factor, as per a Delphi Digital note.

Smart Contract Deployment On ETH Blockchain — Courtesy Delphi Digital

Smart Contract Deployment On ETH Blockchain — Courtesy Delphi Digital

“Smart contracts deployed on Ethereum took a hit in Jun. 2021, and while there are still over 250K contracts deployed each month, this number is far from where it was in H1 2021,” wrote the independent research firm.

Read Next: Why Jack Dorsey Says Bitcoin Will Replace The Dollar, Ethereum Is No Good