Blame it on an obscure rule. For the first time in a decade, there will be no U.S. stock-market closure in observance of New Year’s Day which falls on a Saturday.

U.S. markets will be open on Friday Dec. 31, which is New Year’s Eve, and operators of the New York Stock Exchange are not designating Jan. 3, the first Monday in 2022, as a holiday in lieu of New Year’s Day either.

The last time this sort of calendar event transpired was on New Year’s Eve in 2010.

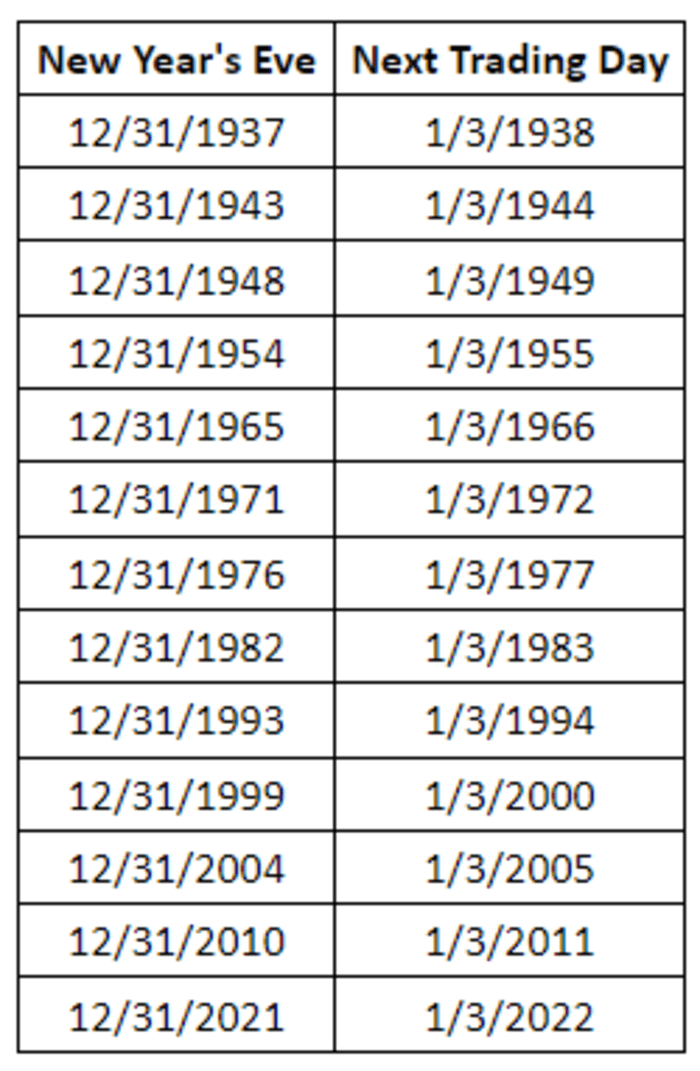

How rare is this calendar event? Assuming that it was applied since 1928, it would have occurred 13 times from 1928.

Dow Jones Market Data

The lack of a New Year’s Day respite for stock traders is the result of NYSE Rule 7.2, which stipulates that the exchange will be closed either Friday or the following Monday if the holiday falls on a weekend, unless “unusual business conditions exist, such as the ending of a monthly or yearly accounting period.”

In this case, the last day of December is a trifecta of accounting dates, including month-, quarter- and year-end dates, and comes as markets have experienced a year end rally.

Although U.S. bond markets also will be open on Friday, the trading body that oversees fixed-income trading, The Securities Industry and Financial Markets Association recommends a 2 p.m. close for trading in bonds, such as the 10-year Treasury note

TMUBMUSD10Y,

1.510%

an hour earlier.

For its part, the U.S. stock market this year has seen its best start to a Santa Claus rally, usually defined as trading during the last five sessions of the year and the first two days of the new year, in a couple of decades.

Investors have essentially dismissed concerns about the economic impact of the omicron variant of COVID. The Dow Jones Industrial Average

DJIA,

-0.25%

and the S&P 500

SPX,

-0.30%

were on track for gains of about 5% or better in December and have risen by at least 1.5% on the week, while the Nasdaq Composite

COMP,

-0.16%

was looking at a gain of about 2% on the month and 1% on the week, as of Thursday afternoon.

Sign up for our MarketWatch Newsletters here.