A woman walks past an Apple logo in front of an Apple store in Saint-Herblain near Nantes, France, September 16, 2021. REUTERS/Stephane Mahe

Register now for FREE unlimited access to Reuters.com

Register

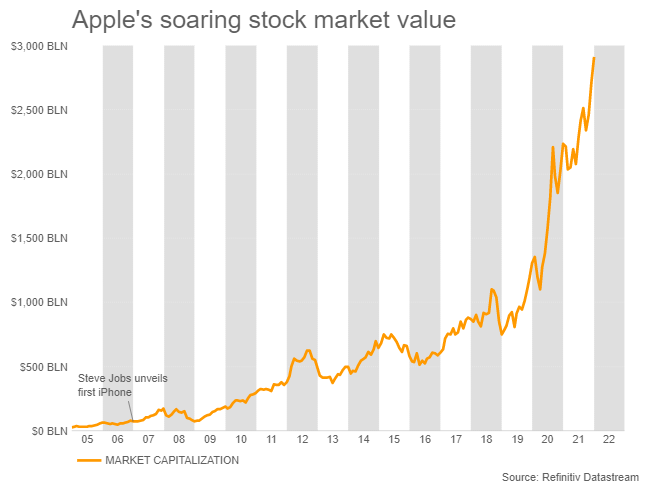

Jan 3 (Reuters) – Apple Inc (AAPL.O) on Monday became the first company with a $3 trillion stock market value, lifted by investor confidence that the iPhone maker will keep launching best-selling products as it explores new markets such as automated cars and virtual reality.

On the first day of trading in 2022, the Silicon Valley company’s shares hit an intraday record high of $182.88, putting Apple’s market value just above $3 trillion. The stock ended the session up 2.5% at $182.01, with Apple’s market capitalization at $2.99 trillion.

The world’s most valuable company reached the milestone as investors bet that consumers will continue to shell out top dollar for iPhones, MacBooks and services such as Apple TV and Apple Music. read more

Register now for FREE unlimited access to Reuters.com

Register

“It’s a fantastic accomplishment and certainly worthy to be celebrated,” said Jake Dollarhide, chief executive officer of Longbow Asset Management in Tulsa, Oklahoma. “It just shows you how far Apple has come, and how dominant it is seen as in the majority of investors’ eyes.”

Apple shared the $2 trillion market value club with Microsoft Corp (MSFT.O), which is now worth about $2.5 trillion. Alphabet (GOOGL.O), Amazon.com Inc and Tesla (TSLA.O) have market values above $1 trillion.

“The market is rewarding companies that have strong fundamentals and balance sheets, and the companies that are hitting these sort of huge market caps have proven they are strong businesses and not speculation,” said Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

The rapid embrace of technologies such as 5G, virtual reality and artificial intelligence has also helped these stocks become market darlings as investors moved towards cash-rich companies and away from businesses that have been more sensitive to economic growth.

In China, one of Apple’s biggest markets, it continued to lead the smartphone market for the second straight month, beating rivals such as Vivo and Xiaomi, recent data from CounterPoint Research showed.

With Tesla now the world’s most valuable automaker as Wall Street bets heavily on electric cars, many investors expect Apple to launch its own vehicle within the next few years.

“The icing on the cake, which may turn out to be the cake, is the potential for an EV car,” Rhys Williams, chief strategist at Spouting Rock Asset Management said.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Nivedita Balu in Bengaluru, Additional reporting by Eva Mathews and Chavi Mehta in Bengaluru, by Noel Randewich in Oakland, California, and by David Randall in New York; Editing by Maju Samuel, Arun Koyyur, Nick Zieminski and Cynthia Osterman

Our Standards: The Thomson Reuters Trust Principles.