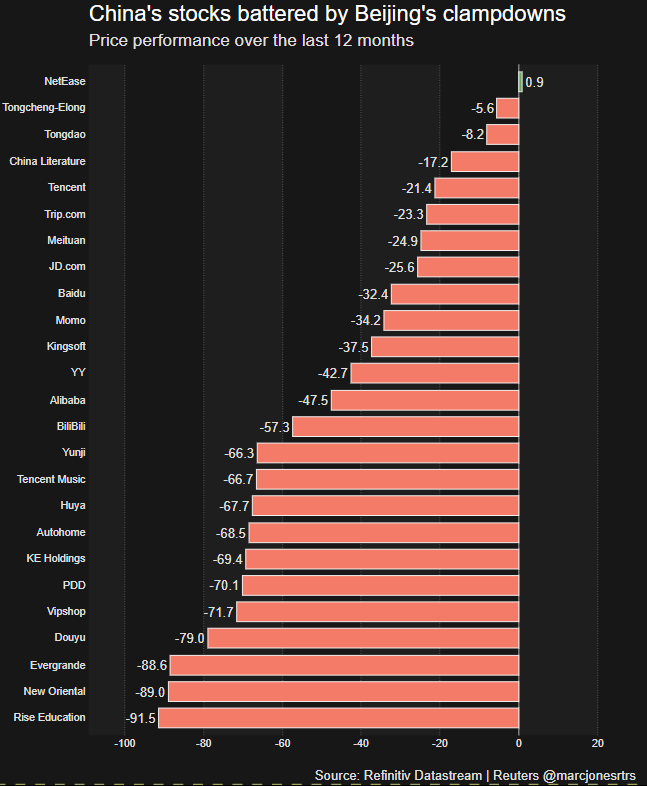

Jan 5 (Reuters) – Emerging market stocks broke a four-day winning streak on Wednesday as regulatory fines hit heavyweights Tencent and Alibaba, dragging tech stocks, while worries about inflation and tighter U.S. monetary policy also weighed.

China’s tech sector (.CSIINT) slipped 2.8%, dragging the broader blue-chip index (.CSI300) down 1.0%. Hong Kong’s main index (.HIS) closed down 1.6% in its worst session in more than two weeks.

Alibaba (9988.HK), Tencent (0700.HK) and Bilibili (9626.HK) dropped between 2.1% and 10.6% after the country’s top market regulator fined them for failing to properly report about a dozen deals – the latest act in Beijing’s crackdown on several industries that began last year. read more

Register now for FREE unlimited access to Reuters.com

Register

With e-commcerce firm Meituan (3690.HK) also sinking 11.2%, MSCI’s China-heavy index of emerging stocks (.MSCIEF) fell 0.9%, further away from three-week highs.

Stocks in Russia (.IMOEX), South Africa (.JTOPI) and Poland (.WIG) all fell between 0.1% and 0.3%, tracking weak Asian sentiment.

In Kazakhstan, violent protests over fuel price hikes saw its government resign – serving as a warning to other emerging markets policy makers trying to square the circle between tackling high inflation and resulting burdens on the population. read more .

Kazakhstan’s dollar-denominated sovereign bonds suffered sharp falls with the 2045 issue dropping around 3 cents to the dollar and many back to levels last seen in 2020, Tradeweb data showed.

Turkey is now prioritising a “sincere” fight against high inflation, Finance Minister Nureddin Nebati said on Wednesday. Inflation there rose to 36% in December after a series of interest rate cuts sought by President Tayyip Erdogan. read more

Turkey’s lira was last up 0.1% at 13.4 per dollar after having fallen up to 1.6% earlier in the session.

“We think that (Turkey’s) headline inflation will likely move towards 45% in the next couple of months and might increase further towards 48% or so in 2Q,” said Credit Suisse analyst Berna Bayazitoglu.

But the ongoing lira volatility leaves the margin of error wide, Bayazitoglu said, adding that recently announced increases in electricity and natural gas prices and minimum wage add to the inflationary pressures.

Most other emerging markets currencies made guarded moves against the dollar as investors priced in policy tightening in the United States, slating in the first of three rate hikes signalled, for May.

This sent U.S Treasury yields and the dollar higher overnight. On Wednesday, the dollar index (.DXY) held steady.

China’s yuan and South Africa’s rand were flat, while Russia’s rouble hit its lowest in more than five weeks.

Embattled China Evergrande Group (3333.HK) lost another 0.6% after it sought delay to onshore bond payment due on Saturday, which would be its first domestic bond payment miss. A bondholder meeting is scheduled for Jan. 7-10.

Bad loan company China Huarong (2799.HK) plunged 50% to a record low, on resuming trade following a nine-month hiatus. read more

For a GRAPHIC on emerging market FX performance in 2021, see http://tmsnrt.rs/2egbfVh

For a GRAPHIC on MSCI emerging index performance in 2021, see https://tmsnrt.rs/2OusNdX

For TOP NEWS across emerging markets

For CENTRAL EUROPE market report, see

For TURKISH market report, see

For RUSSIAN market report, see

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Susan Mathew in Bengaluru;

Editing by Tomasz Janowski

Our Standards: The Thomson Reuters Trust Principles.