NEW YORK/LONDON, Jan 12 (Reuters) – World equity markets edged higher on Wednesday while U.S. Treasury yields dipped after the latest U.S. inflation data showed price pressures that were still within expectations, reinforcing bets the Federal Reserve will soon be raising interest rates.

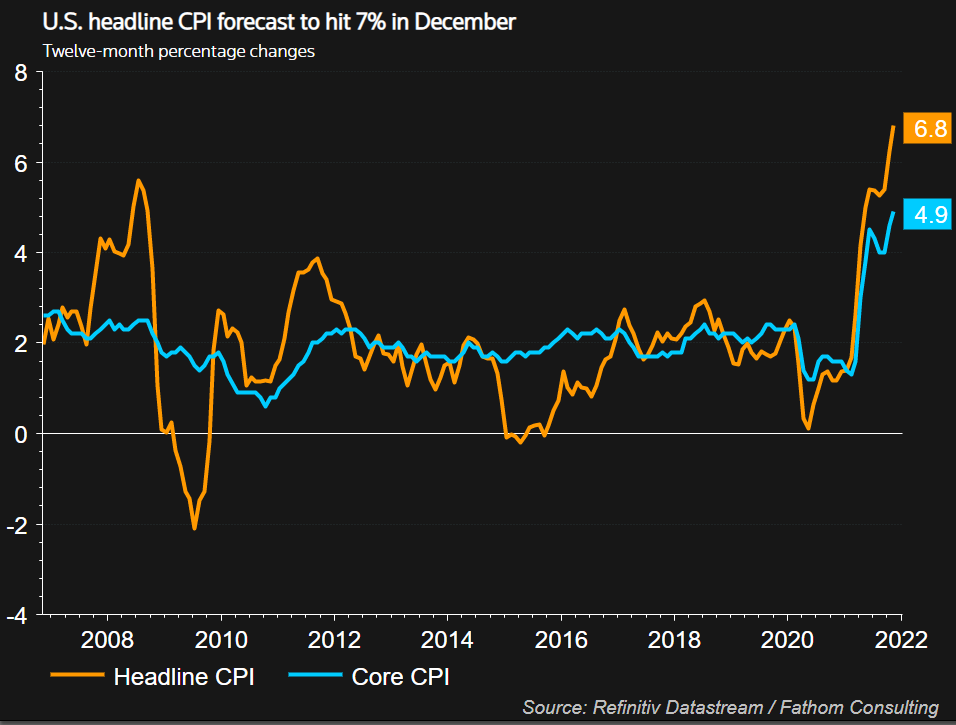

Data showed the U.S. consumer price index surging a whopping 7% in the 12 months through December, the biggest annual increase since June 1982, but in line with forecasts. read more

Investors appeared to be comforted by the fact that inflation was not worse than feared, and that the Federal Reserve was unlikely to be more aggressive than expected in hiking interest rates and tightening monetary policy .

Register now for FREE unlimited access to Reuters.com

Register

By late morning, the benchmark S&P 500 index (.SPX) gained 0.11%, the Nasdaq Composite (.IXIC) added 0.05%, and the Dow Jones Industrial Average (.DJI) inched up 0.02%.

London’s FTSE 100 was lifted by mining and oil giants following a global rally in risky assets and a slew of positive earnings updates, while European indexes gained, taking their cues from Wall Street overnight.

The pan-European STOXX 600 index (.STOXX) rose 0.66%, Britain’s FTSE 100 (.FTSE) climbed 0.74% to one-year highs, and MSCI’s gauge of stocks across the globe (.MIWD00000PUS) gained 0.69%.

That the U.S. inflation data was largely within forecasts weighed on Treasury yields, as investors bet that policy will not be tightened more than expected.

Benchmark 10-year Treasury yields edged down to 1.7357%, pulling back over seven basis points from an almost two-year high hit on Monday.

Though Fed fund futures are predicting nearly four rate hikes this year, a seismic change from a few months ago, longer-term rate expectations haven’t budged sharply.

U.S. interest rate pricing is peaking at 1.5% by the third quarter of 2024, far lower than previous U.S. rate tightening cycles.

“It seems to be a fait accompli that the Fed will hike interest rates quickly, even if inflation comes in a little below expectations,” Commerzbank analysts said in a client note.

“In a worst-case scenario, lift-off will not be in March, but in May or June.”

The dollar hit a new two-year low on the inflation report, with the dollar index falling 0.526% to 95.117. The struggling dollar lifted the euro up 0.5% to a near two-month high of $1.1421.

Still, in another sign of persistent inflationary pressure, oil prices hit two-month highs on Wednesday, lifted by tight supply and easing concerns over the spread of the Omicron coronavirus variant.

U.S. crude recently rose 1.48% to $82.42 per barrel and Brent was at $84.53, up 0.97% on the day.

“Omicron is yesterday’s story now”, said Luca Paolini, chief strategist at Pictet Asset Management.

“The market isn’t moving on Omicron but on earnings, Fed and economic data.”

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) soared 1.6% to a one-and-a-half month high, led by a 5% jump for tech stocks in Hong Kong (.HSTECH).

Japan’s Nikkei (.N225) rose 1.9%.

In China, a softer than expected reading on prices has drawn bets on policy easing. read more

Five-year Chinese government bond futures rose eight ticks to an 18-month high before trimming gains. Yuan gains were also capped.

Safe-haven gold was little changed at $1,822.24 while bitcoin rose 1.76% to $43,488.88..

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Tom Westbrook in Sydney and Saikat Chatterjee, Dhara Ranasinghe and Sujata Rao in London; editing by Bernadette Baum

Our Standards: The Thomson Reuters Trust Principles.