Federal Reserve Chair Jerome Powell is seen delivering remarks on a screen as a trader works on the trading floor at the New York Stock Exchange (NYSE) in Manhattan, New York City, U.S., December 15, 2021. REUTERS/Andrew Kelly/File Photo

Register now for FREE unlimited access to Reuters.com

Register

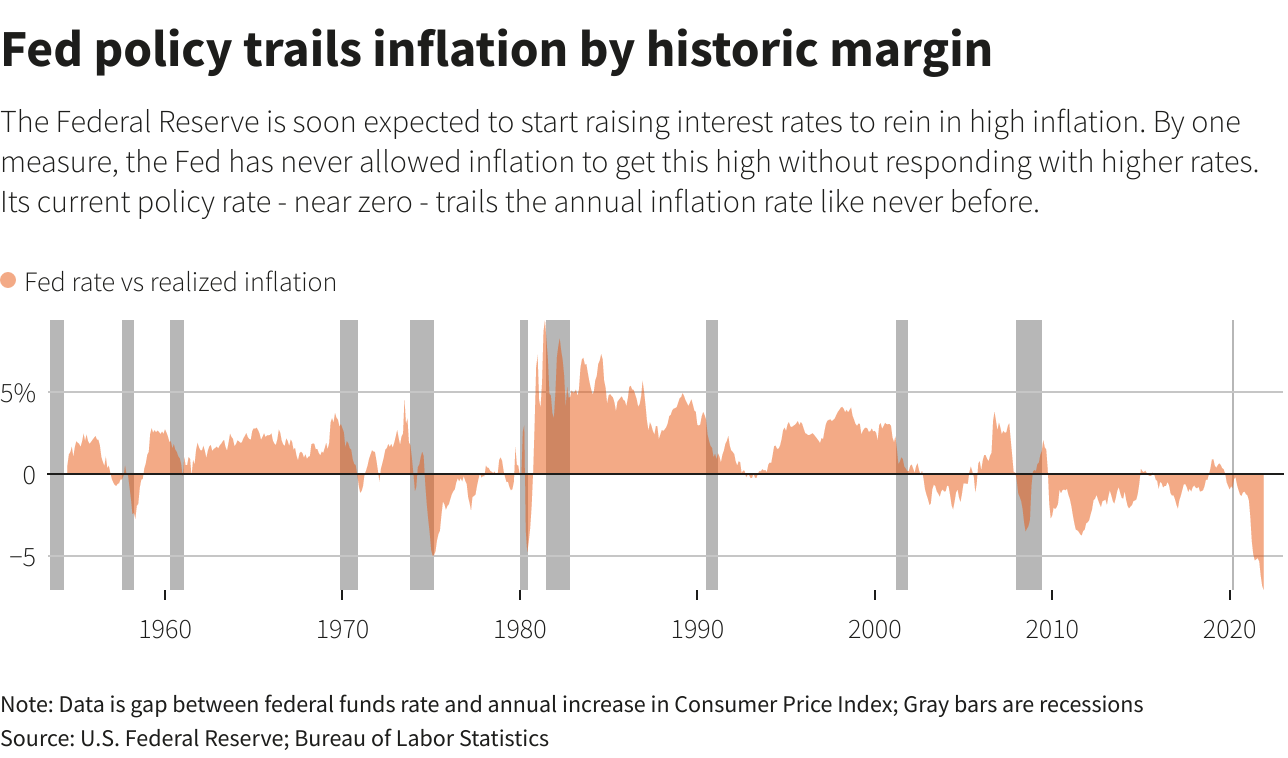

WASHINGTON, Jan 26 (Reuters) – The Federal Reserve is expected on Wednesday to signal plans to raise interest rates in March as it focuses on fighting inflation and sets aside, at least for now, economic risks posed by the ongoing coronavirus pandemic, a bout of market volatility, and Western fears of a Russian invasion of Ukraine.

The policy decision, due to be released at 2 p.m. EST (1900 GMT) after a two-day meeting, won’t commit the U.S. central bank to a particular course of action when its rate-setting committee meets again in seven weeks, and for now the benchmark overnight interest rate will remain unchanged at the near-zero level.

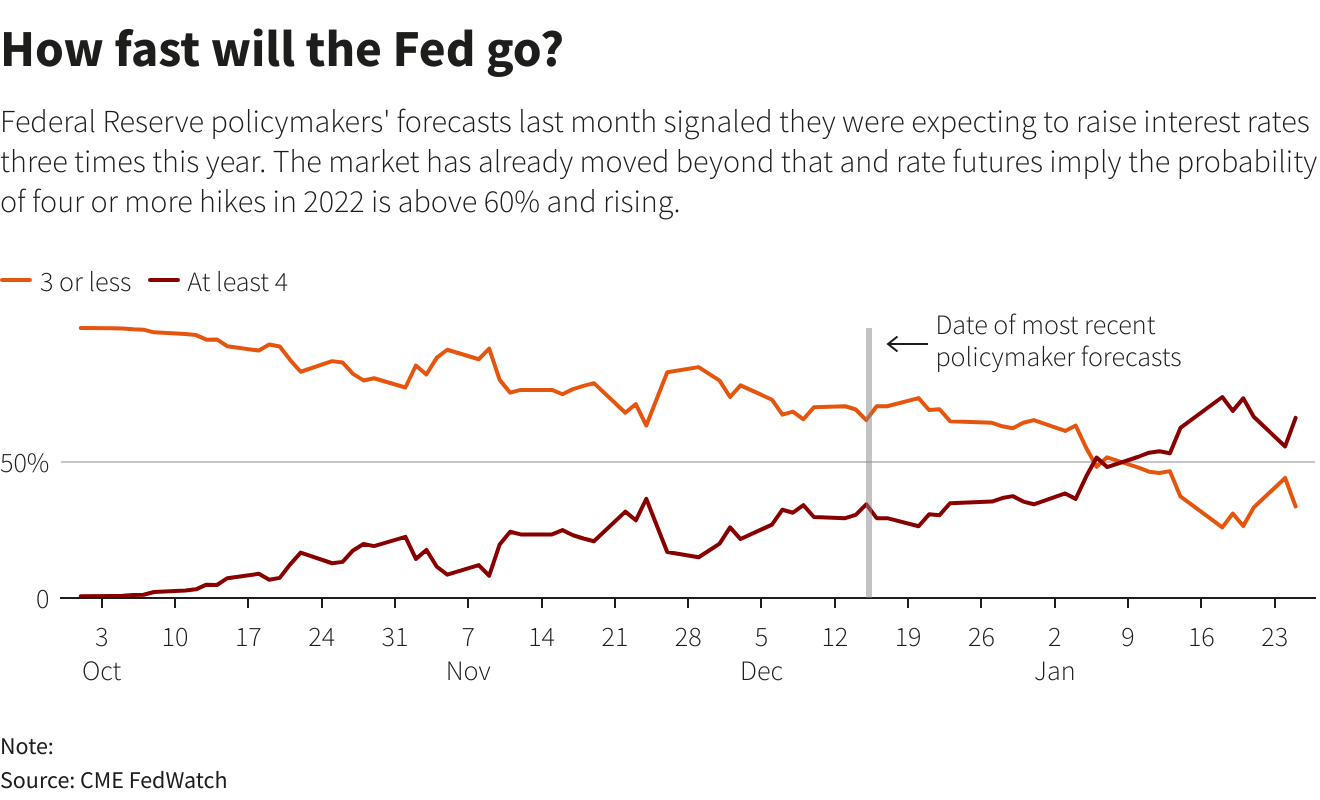

But absent a marked shock to the economy, that will likely change in March when the Fed is expected to approve the first of what may be several quarter-percentage-point interest rate hikes this year.

Register now for FREE unlimited access to Reuters.com

Register

This week’s meeting, analysts say, can be used to telegraph what’s coming both on rates and an eventual decision to reduce the Fed’s massive holdings of government bonds as a second lever to raise the cost of credit to firms and households and, in theory, slow the pace of price increases.

With U.S. inflation “very high” and the unemployment rate now just 3.9%, Fed Chair Jerome Powell and his colleagues “will talk up the economy without sounding apocalyptic on inflation and prepare the ground for a March liftoff” of interest rates, Cornerstone Macro economist Roberto Perli wrote in a note ahead of the decision. They are likely to continue debating how and when to reduce the central bank’s massive holdings of Treasury bonds and mortgage-backed securities as a further way to tighten monetary policy, but not announce a decision today.

Powell is due to begin a news conference half an hour after the release of the statement. Fed officials will not provide updated economic and interest rate projections on Wednesday, so it will be up to Powell to elaborate on how the central bank’s views align with investors who are expecting a more vigorous fight against inflation, and who have sold off U.S. stocks and begun raising long-term interest rates this month as a result.

TRANSITORY NO MORE

Trading on Wall Street this week has been notably volatile, with intraday swings in the S&P 500 (.SPX) index of as much as 4%. The index is down about 8% so far this year.

Markets were more settled on Wednesday ahead of the Fed’s policy release, with major U.S. stock indexes up solidly and yields on U.S. government bonds lower in early trading.

But the turbulence, and particularly the rise in market interest rates for things like home mortgages, was a reminder of the fine line the Fed and Powell are walking as they try to engineer a decline of inflation that also keeps the economic recovery underway.

In his news conference Powell “won’t sound nervous about inflation remaining high for a long time,” Perli wrote, but will still leave open the possibility of raising rates faster than anticipated, or even by more than the usual quarter-percentage-point increment, “as insurance against inflation tail risks, which are obviously substantial.”

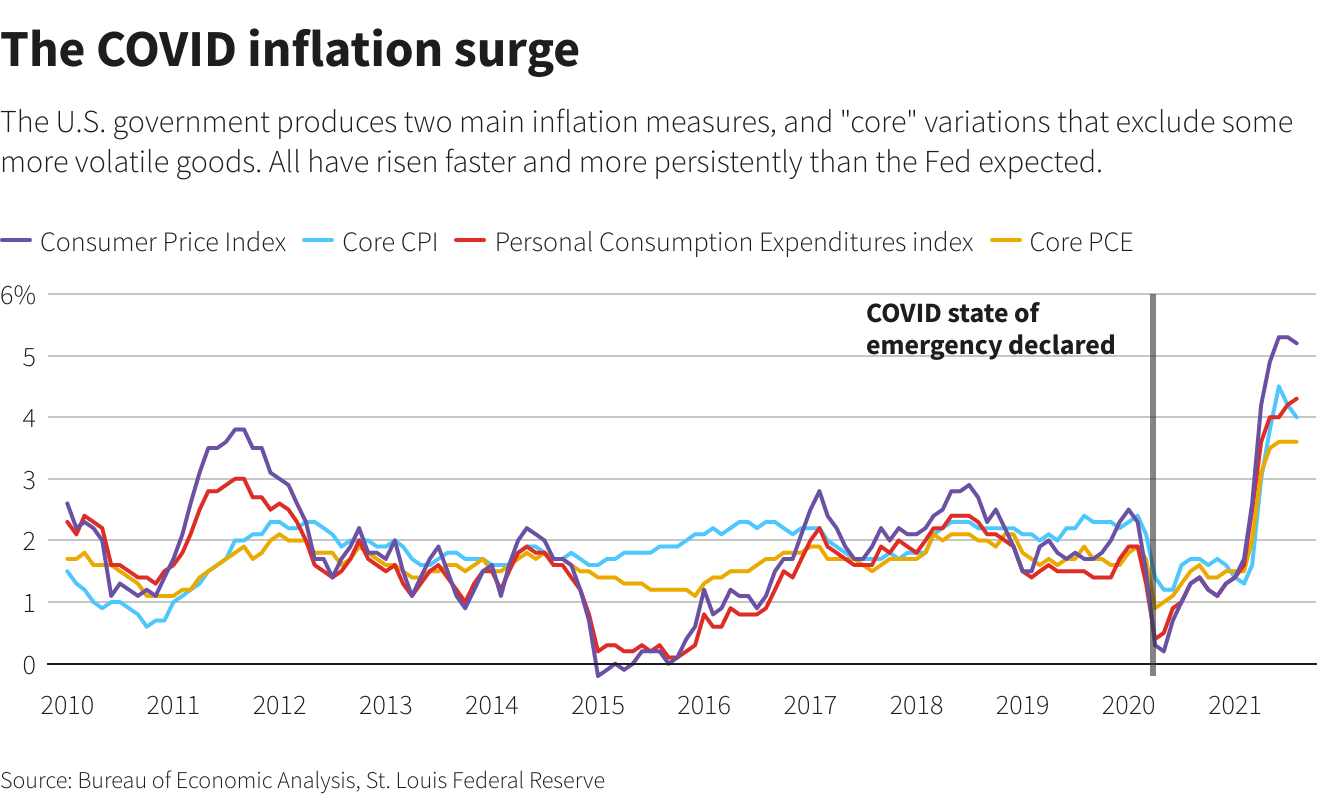

Those risks have become steadily more pronounced over the last five months. Powell in August used a high-profile speech to outline why he thought high inflation would be “transitory,” but since then economic data have shown otherwise.

With consumer inflation rising at 7% annually, the fastest pace since the early 1980s, the issue has been flagged by the White House as a key economic and, for President Joe Biden’s Democratic Party, political risk.

New data released later this week will likely show that the resurgent pandemic both reduced the pace of economic growth at the end of 2021, and kept the inflation measures watched most closely by the Fed rising at well above its 2% target.

There’s little respite in sight. If anything, international developments hold a risk of worse to come. China’s strict coronavirus lockdown policies mean global supply chains may be slower to return to normal, and a military conflict between Russia and Ukraine could add to inflation as well.

“The consequences for the energy market … likely would be a further increase in prices of oil and natural gas, and therefore of energy costs more broadly for many countries in the world,” Gita Gopinath, the first deputy managing director of the International Monetary Fund, said on Tuesday after the IMF lowered its 2022 economic growth forecasts for the U.S., Chinese and global economies.

“So in terms of headline inflation numbers, it certainly could keep headline inflation much more elevated for longer,” she said.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Howard Schneider

Editing by Paul Simao

Our Standards: The Thomson Reuters Trust Principles.