Advanced Micro Devices (AMD) – Get Advanced Micro Devices, Inc. Report is ripping higher on Monday, following some of the late-day buying that gave it a big boost on Friday.

For what it’s worth, Nvidia (NVDA) – Get NVIDIA Corporation Report is also ripping higher in the session, while tech stocks in general are trading pretty well.

However, AMD is now due to report earnings on Tuesday after the close. The report will be closely watched by growth investors, as well as those that focus on Nvidia and other semiconductor stocks.

AMD stock roared to life a few months ago and bombarded its way to new all-time highs in November.

While not many investors are all that surprised that AMD — and Nvidia for that matter — soared higher at the time, it came at a time where many growth stocks were under intense selling pressure.

Now with both stocks down about 39.5% at the recent low, it has investors looking to get long.

Now we’re wondering if AMD stock bounced too early.

Trading AMD Stock

On Friday, AMD stock opened at $101.55, dropped down to $99.35 and…

Stop right there.

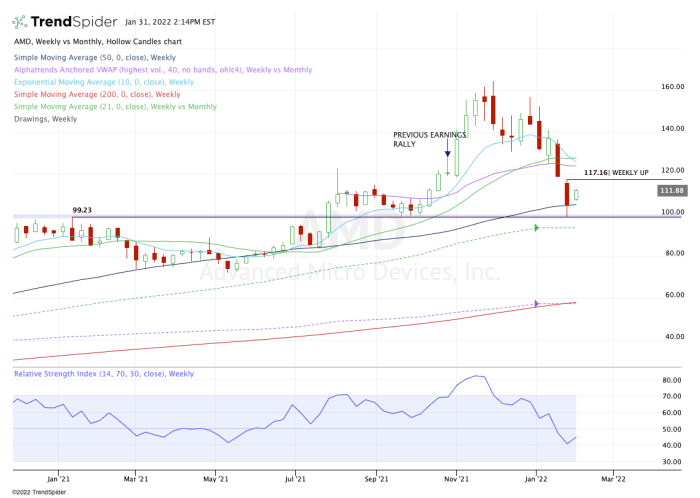

The stock’s drop down to $99-and-change was the buy zone. This area was resistance in the fourth quarter of 2020 and in January 2021, and was the breakout level in the third quarter of 2022.

Later, this zone was support in September and October. In other words, every bull should have had $100 written down and circled with alerts on their trading platform set.

Especially when shares were down about 40% and with the 200-day and 50-week moving averages so close.

With such a strong bounce underway, we have to wonder if the stock is using up too much energy ahead of earnings — depending on how it trades tomorrow, of course.

On the downside, you know the level to watch: $99 to $100 and last week’s low.

A retest of this zone could set up AMD stock for another bounce to the upside. A break of this area and failure to reclaim it puts the 21-month moving average in play.

If the stock continues to rally after earnings, look for a weekly-up attempt near $117.15. If shares can clear this level, it puts the declining 10-week moving average in play, followed by the 21-week moving average and the weekly VWAP measure.

AMD is a very good company with solid growth and consistent demand from investors. The broader market’s price action has had a negative impact on the stock, but earnings will tell the story.

If we get a bullish reaction to earnings, let’s see how strong the bounce is.