JasonDoiy/iStock Unreleased via Getty Images

PayPal Holdings (PYPL) faced downward pressure in 2021 as investors shifted away from the highly valued growth sector and toward value plays with greater upside potential. PayPal’s 4Q-21 earnings, released this week, and especially the company’s 2022 guidance, point to growing risks in the company’s business. The guidance for this year effectively killed PayPal’s investment case.

PayPal’s Guidance Displays The Risks Of Investing In High Multiple Stocks

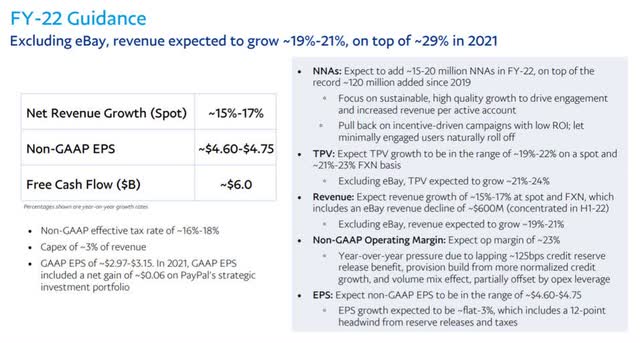

During the third quarter earnings call, PayPal CEO Dan Schulman stated that the online payments company expects 18% revenue growth in 2021, implying that full year net revenues will be between $25.3 billion and $25.4 billion. Few would have predicted that the forecast for 2022 would be even worse.

PayPal forecasted 15% to 17% net revenue growth this year, based on spot rates, this week. New accounts, which grew extremely quickly during the pandemic and aided PayPal’s net revenue growth, appear to be harder to come by. In 2022, total accounts are expected to grow by only 15 million to 20 million, implying that PayPal will end the year with a total customer count of 441 million to 446 million. Based on spot rates, PayPal’s net revenue growth rate for 1Q-22 is expected to be only 6%.

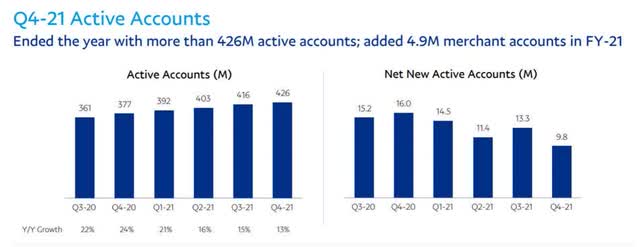

Net revenues, excluding eBay revenues, are expected to increase by 19% to 21%. Overall, the guidance is inadequate. Concerningly, PayPal has reported a significant QoQ decrease in account generation, which the company shows on a net basis. In 4Q-21, new customer accounts ((net)) increased by 9.8 million.

Despite this large number, the fourth quarter saw a QoQ decline in new accounts of 26%, indicating that the company faces greater challenges in attracting new customers to the PayPal payment system. PayPal added 16 million new accounts during the same time period last year.

Because net revenue growth is directly related to adoption rates, a slowdown in new account generation could pose a significant problem for PayPal in the future. What this means intuitively is that if account growth continues to decline, PayPal may be forced to lower its guidance again later this year.

Q4-21 Active Accounts (PayPal)

A Possible Remedy: The Amazon-Venmo Partnership

PayPal had 426 million customers and 34 million active merchant accounts at the end of the fourth quarter. PayPal and Amazon have agreed to form a partnership in 2021, with PayPal’s ‘Pay with Venmo’ service being used on Amazon’s shopping website. Venmo’s U.S. customers will be able to use its checkout service on Amazon as a result of the partnership. The partnership with Amazon, the country’s largest retailer, may help PayPal re-ignite customer account growth.

Cryptocurrencies: The Next Frontier For PayPal

One of the most undervalued growth opportunities for PayPal is the evolving market for cryptocurrencies.

Cryptocurrencies have grown in popularity in recent years, and infrastructure to support crypto-based payments for goods and services is being built. Bitcoin is the most valuable cryptocurrency in the market, with a total market capitalization of $723 billion, but new cryptocurrencies are constantly being introduced, and more businesses are willing to accept them as a form of payment.

PayPal could use its position as a leading digital payments company to offer customers the ability to buy, store, and sell cryptocurrencies in the market, similar to Robinhood. Cryptocurrencies present a significant opportunity for growth in the digital economy, and PayPal, which is already one of the world’s largest payment companies, could build an entirely new business on top of its existing payment infrastructure.

PayPal launched “Cash Back to Crypto” for Venmo Credit Cardholders last year, allowing customers to convert cash back into cryptocurrencies. The opportunity for PayPal to grow this “starter program” into a full-fledged crypto investment business is real, and it provides a way to counteract slowing business growth.

PayPal May Be Uninvestable For The Time Being

PayPal’s stock appeared to have found some support near the $160 level, but then PayPal released its revenue forecast for the year, causing the stock to crash.

PayPal’s stock price now includes significant uncertainty, and the stock may be uninvestable until the company and its investors have a clearer understanding of what PayPal will do to attract more customers and generate revenue growth.

Price And Risk Update

PayPal’s stock is still relatively risky in this market, and the stock may be overvalued. Non-GAAP earnings-per-share guidance for 2022 is $4.60-$4.75 per share, implying a P/E ratio of 27. This is a high P/E ratio to pay for a company whose payments business may slow significantly this year.

In terms of additional risks, PayPal is vulnerable to global supply chain shortages, which have resulted in empty shelves in U.S. retail stores, at least in some parts of the country. Online merchants and consumers rely on a reliable supply chain; otherwise, economic activity is disrupted. If the situation worsens in 2022, PayPal’s revenue guidance may be revised again.

My Conclusion

I was stopped out of PayPal yesterday, and I now believe I made a mistake in purchasing PayPal in the first place.

After considering the company’s shaky guidance for 2022, I’ve completely changed my mind about the company and have no qualms about admitting that I was completely wrong about PayPal.

High growth, high multiple stocks are currently on the rise, and the risks associated with PayPal have only increased this week. Furthermore, the stock may remain expensive given that PayPal’s ability to attract new accounts to its payment system may become more difficult in the future.