Facebook parent Meta Platforms was probably the least loved megacap tech stock before its slide over its weak first-quarter outlook, but its sheer size meant it was a widely owned holding — according to FactSet, 1,560 funds that have filed 13-F reports for the period ending Dec. 31 held the stock.

The £1 billion ($1.4 billion) LF Blue Whale Growth Fund was one of them — but it says it got out in time, having owned the stock since its inception in 2017. Stephen Yiu, the lead manager of Blue Whale, says the spending on the metaverse led the fund to sell what was a top-10 holding as recently as October. Meta’s

FB

stock has collapsed by 34% this year.

Unlike Apple

AAPL

and Google

GOOG,

Meta Platforms doesn’t have an operating system on which to build a metaverse, and even if it is successful, it could take five years for the investment to pay off. Meanwhile, the core Facebook is being hit by the iOS advertising change and competition from TikTok. What first attracted the fund to Meta Platforms in the first place was its attractive valuation on free cash-flow yield, but that discount to Google’s parent Alphabet is now being eroded.

Yiu isn’t dismissive of the metaverse but he says there are better alternatives, such as graphics chip maker Nvidia

NVDA.

“We would rather have Nvidia, which is doing quite well outside of the metaverse, and if the metaverse is going to come, it’s going to take a good chunk of that,” he says.

The fund also sold out of PayPal Holdings

PYPL

before its slide on its cautious outlook and its scrapping of its 2025 user goal of 750 million. Yiu is concerned over its longer-term strategy. He notes the company doesn’t have a clear succession plan on who would succeed 64-year-old CEO Dan Schulman, who has led the company since the spinoff from eBay, and he called the company’s interest in buying Pinterest

PINS

a distraction. Its move into crypto, ‘buy now, pay later,’ and likely stock-market trading aren’t going to be game-changers but just moves to keep users on the platform, Yiu says, as it fights off competition from Apple Pay, Google Pay and others. “Over the last three to six months, a lot of value has been destroyed,” he says.

So what to buy instead? The fund turned to a financial, the brokerage Charles Schwab

SCHW,

as a beneficiary from rising interest rates. Yiu says the fund doesn’t invest in any bank because it can never know what’s on its balance sheet. Since over 50% of revenue is derived from the interest on cash balances on account, Schwab benefits from a rising interest-rate environment, and its successful takeover of TD Ameritrade also is a benefit.

More broadly, Yiu says it’s a difficult environment and one where you have to be highly selective. He contrasts a company such as Peloton Interactive

PTON

— which he says might not exist in a year’s time if it isn’t taken over by Nike or Amazon, given the cash it’s burning — with companies such as Microsoft

MSFT

and Google. “At the moment, it’s quite chaotic in the market. They look at the headlines from Facebook, PayPal, Netflix and they say, ‘OK, anything that’s tech related, let’s get out.’”

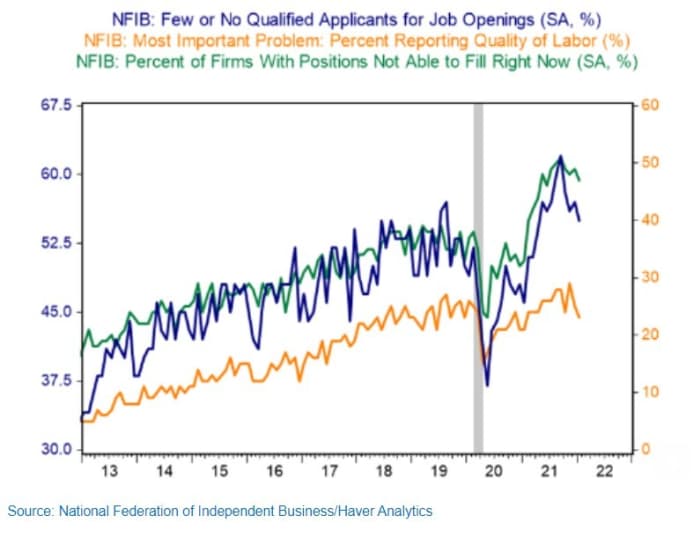

The chart

Taken from Tuesday’s release of the National Federation of Independent Business small-business report, this chart shows a turn in labor-market indicators including not having enough qualified applicants for job openings. Given the lagged relationship between job openings and wages, that could spell a slowing in pay growth to come. “Many consumers were sitting on a mountain of cash. Now many aren’t,” says Tom Porcelli, chief U.S. economist at RBC Capital Markets. “Wage gains have been incredibly strong. And now there seems to be some early signs it could start slowing. We think the Fed should tread carefully here.”

The buzz

Chipotle Mexican Grill

CMG

shares are due to rally, after the restaurant operator reported stronger-than-forecast fourth-quarter results and set plans to expand in smaller towns where it sees fatter profit margins.

NCR

NCR

is due to surge, as the point-of-sale software maker said it’s conducting a strategic review.

A cautious outlook pressured shares of ride-sharing company Lyft

LYFT.

Rival Uber Technologies

UBER

reports results after the close, as does media and entertainment giant Walt Disney

DIS.

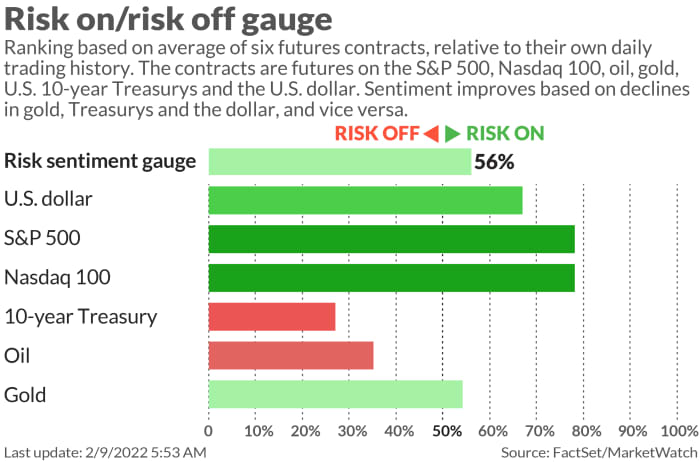

The market

U.S. stock futures

ES00

NQ00

pointed to a solid opening.

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

slipped to 1.93%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

Random reads

It’s worth checking out Christopher Walken describing the secrets of acting like Christopher Walken.

The woman in the husband-and-wife duo charged with laundering stolen bitcoin referred to herself as the “infamous crocodile of Wall Street” when she rapped.

But this crocodile, with a tire stuck around its neck, is finally freed after six years.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.