WASHINGTON/LONDON, Feb 10 (Reuters) – Major global stock indexes fell on Thursday under pressure from crucial U.S. inflation data, falling technology shares and rising benchmark bond yields.

U.S. consumer prices rose solidly in January, leading to the biggest annual increase in inflation in 40 years, which could fuel financial market speculation for a 50 basis points interest rate hike from the Federal Reserve next month. read more

Wall Street retreated. The Dow Jones Industrial Average (.DJI) fell 1.47% to end at 35,241.59 points, while the S&P 500 (.SPX) lost 1.81% to 4,504.06. The Nasdaq Composite (.IXIC) dropped 2.1% to 14,185.64. It was the seventh time in 2022 that the Nasdaq lost more than 2% in a session.

Register now for FREE unlimited access to Reuters.com

Register

The S&P 500 is now down about 5% in 2022, and the Nasdaq is down about 9%.

Tech stocks (.SPLRCT), which boosted U.S. shares to steep gains earlier in the week, fell 2.75%.

The MSCI world equity index (.MIWD00000PUS) fell after clinging to gains throughout much of the session.

The pan-European STOXX 600 index (.STOXX) closed down 0.2% as rising bond yields. The heavyweight technology sector (.SX8P) fell more than 1%, with losses in France’s Atos (ATOS.PA) a drag.

Meanwhile, the FTSE 100 (.FTSE) rose 0.38% and the German DAX (.GDAXI) edged up 0.05%.

“While inflation continued to overshoot the Fed’s target in January, fundamental drivers of inflation are starting to improve,” said Bill Adams, chief economist for Comerica Bank. “Remember, a big part of the surge in prices was from shortages, and the economy is making big strides to reduce shortages.”

A pullback in government bond yields in recent days and a tech-fueled rebound had supported the broader stock market rally this week. But most markets remain down sharply for the year – the tech-dominated Nasdaq 100 by 8% – after a January in which investors panicked about the impact of higher rates and less cheap money on highly valued shares.

The Fed is broadly expected to begin raising rates at its March meeting.

Federal funds rate futures have increased the chances of a half percentage-point tightening by the Federal Reserve at next month’s meeting following the U.S. consumer prices report. read more

In Asia, Chinese blue chips (.CSI300) lost 0.26% as investors took profits and worries about U.S. sanctions continued to weigh on sentiment. read more

Japan’s blue-chip Nikkei (.N225) closed 0.42% higher.

Long-term bond yields had been continuing Wednesday’s retreat when U.S. inflation data sent them whipsawing. The yield on the benchmark 10-year U.S. Treasury note topped 2% for the first time since August 2019.

Germany’s benchmark 10-year yield soared to its highest since December 2018.

Bond yields have been climbing as investors anticipate the Fed will begin to tighten monetary policy as well as expectations the U.S. central bank will begin to wind down its balance sheet.

Money markets are expecting a first rate hike by the European Central Bank as soon as June after ECB President Christine Lagarde signaled last week for the first time that a rate hike in 2022 could be a possibility to curb inflation. read more

In a reminder that many central banks remain concerned about rising rates, the Bank of Japan announced that it would buy an unlimited amount of 10-year government bonds at 0.25%. read more .

The 10-year government bond yield hit 0.23% on Thursday, the highest since 2016 and close to the implicit 0.25% cap the BOJ set around its target of 0%, before easing back.

The yen rose 0.51% against the dollar by 4:27 p.m. EST.

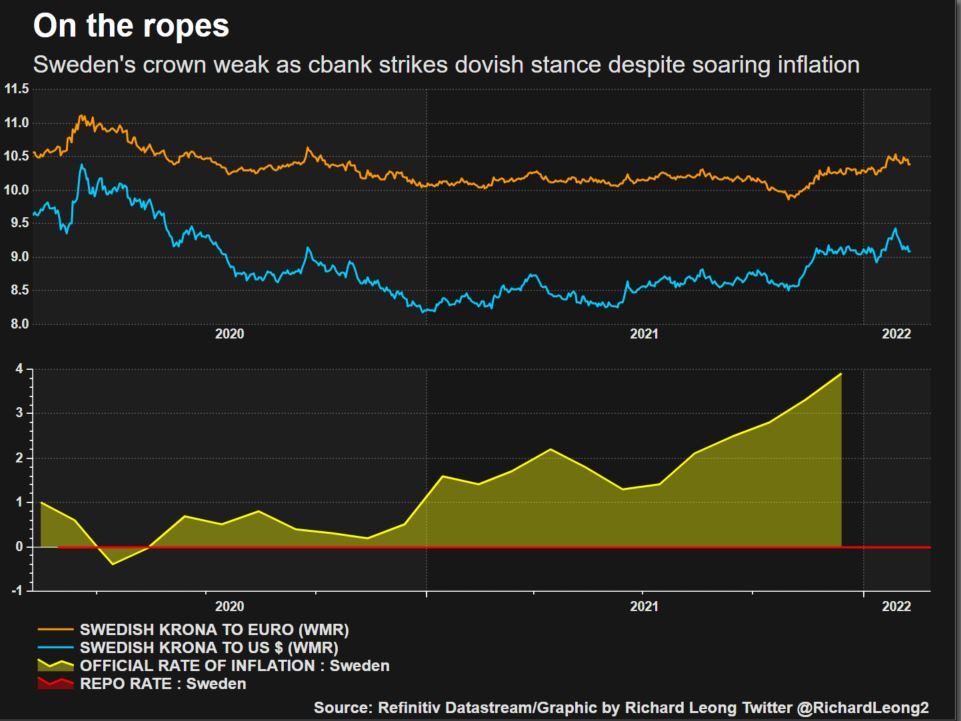

Sweden’s central bank kept its policy broadly unchanged, saying it was too early to withdraw support for the economy and that surging inflation was temporary.

The dollar whipsawed in choppy trade, and the euro retreated 0.14% .

Gold prices touched their highest level in two weeks, with a boost from earlier losses in the dollar, before retreating. Spot prices or -0.37 percent, to $1,825.69 an ounce. U.S. gold futures settled mostly unchanged at $1,837.40.

Elsewhere in commodities, Brent crude futures settled down 0.2% at $91.41 a barrel after rising more than 1%. U.S. crude , which rose more than $2 earlier in the day, settled up 0.3% at $89.88 a barrel.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Chris Prentice in Washington and Tommy Wilkes in New York; Editing by Will Dunham, Chizu Nomiyama, Nick Macfie and Sandra Maler

Our Standards: The Thomson Reuters Trust Principles.