Roblox Corp. shares plummeted Wednesday for their worst day since going public, as more “once-stuck inside kids” are going outside and making it harder for the social-gaming platform to make money.

Roblox

RBLX,

-26.51%

shares cratered Wednesday to close down 26.5% at $53.87, the stock’s worst one-day performance day since Roblox began trading as a public company last March.

The move followed Tuesday’s report of a fourth-quarter loss of 25 cents a share and bookings of $770.1 million, a far cry from the previous report, when shares soared 42% the day after the company reported strong results despite a three-day outage around Halloween.

In response to the report, at least three analysts decreased their price targets, and one reduced his rating on the stock to hold. Jefferies analyst Andrew Uerkwitz pointed to the most important culprit for the pullback in a note: “Once stuck-inside kids and teens are now spending weekdays off their devices and out in the real world.”

Read: 5 things to know about Roblox, the tween-centric gaming platform’s direct listing

And that isn’t very good news if you’re looking to make money off the “metaverse,” which Roblox succeeded at during the COVID-19 pandemic, but now could face more competition for young eyeballs.

“Like many content platforms, Roblox is seeing difficult compares and the impact of reopening,” Uerkwitz, who has a hold rating on the stock and a $70 price target, said.

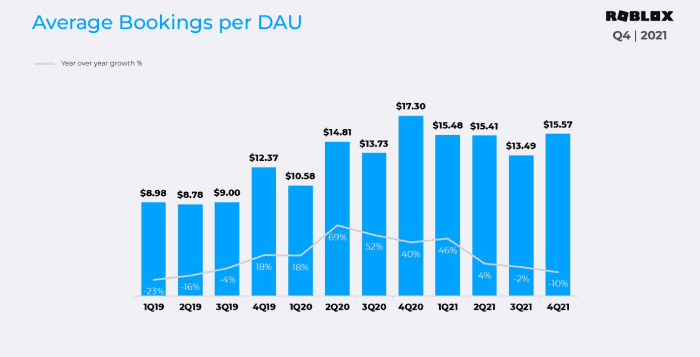

He pointed to ABPDAU, or average bookings per daily active user, falling year-over-year for a second straight quarter, and getting even worse in January even though average daily active users rose 33% to 49.5 million from the year ago quarter, and January’s rose 32% to 54.7 million from a year ago.

Roblox

For the fourth quarter, Roblox reported ABPDAU of $15.57, a 10% drop from a year ago, and in the third quarter, ABPDAU declined 2% to $13.49 from the previous year. Then, in January, ABPDAU was between $4.02 and $4.08, a drop of 22% to 23% from a year ago.

Also in the fourth quarter, hours of player engagement in the key U.S./Canada market declined 11% to 2.51 billion hours from a year ago.

“The big picture monetization metrics were disappointing,” Uerkwitz said. “The question: is monetization a canary or is engagement a sign of transitory issues.”

Full earnings coverage: Roblox bottom-line results, bookings fall short of Street expectations

Stifel analyst Drew Crum, who has a buy rating and a $110 target, said in a note that commentary suggested that bookings comparisons would not improve until well into the second quarter.

Crum said “the company indicated y/y bookings comps, ‘should improve starting in the May-June time frame,’ leaving us to ponder what this suggests for February-April.”

The company defines bookings as “revenue plus the change in deferred revenue during the period and other noncash adjustments.” The importance of bookings comes into play as the company sells virtual currency on its site that may be considered deferred revenue.

Half of the 12 analysts who cover and rate Roblox consider the stock a buy, according to FactSet, while 3 rate it a hold and 1 calls it a sell. The average price target as of Wednesday morning was $102.92.