After Russia-Ukraine worries tipped the S&P 500

SPX

into correction territory on Tuesday, investors are rightly asking what’s next?

In the wait for more developments, some grim-looking charts are floating around, like this one from Stuck in the Middle blogger @Mr Blonde _macro who shows the S&P 500 tracking the action from 2018. If that holds, the index could be headed for a bounce — then down we go.

Uncredited

“The pattern suggests some relief before anxiety builds into the mid-March FOMC meeting,” says the blogger. (h/t The Market Ear). Of course, it also shows another bounce to come.

As for that correction, history tells us equities tend to eventually rebound from those downturns, with recoveries a year later even in the case of a bear market. Evidence is piling up for that big pullback, says our call of the day from the founder & CEO of BullAndBearProfits.com, Jon Wolfenbarger.

After warning us in October, the newsletter editor who spent 22 years as an equity analyst at Allianz Global Investors, is now even more convinced. Among his evidence is this laundry list of assets he says now trading below their 250-day moving averages, viewed as a bearish signal by some:

- Global Stocks

- Dow Jones Industrial Average

- Dow Jones Transportation Average

- S&P 500

- NASDAQ 100

- US small-cap stocks

- US Value Line Geometric Stock Index

- International Developed Market Stocks

- International Emerging Market Stocks

- International small-cap stocks

- US REITs

- International REITs

- Silver

- US Government Bonds

Record-high stock valuations are also a worry, and the fact that big bear markets usually begin before recessions and sometimes interest rate increases begin, like in the ‘stagflationary’ late 1960s, 1970s and five times in Japan over the past 30 years, he said, in emailed comments summing up his newsletter thoughts.

Slowing global economic growth and money-supply, which could stall even further amid Fed tightening are also on his worry list.

As for his core advice, he’s doubling down on a call to buy inverse ETFS that rise when stocks are falling, as he notes the 2007 to 2009 S&P pullback swept up stocks, real estate, commodities and defensives.

“For example, the ProShares Short S&P 500 ETF

SH,

which is designed to move in the opposite direction as the S&P 500 on a daily basis, rose 89%. Similarly, the ProShares Short QQQ ETF

PSQ

rose 96%,” he said. Others designed to move at twice the rate — the ProShares UltraShort S&P 500

SDS

and QQQ

QID

ETFs — surged 184% and 210%, respectively, he said.

Uncredited

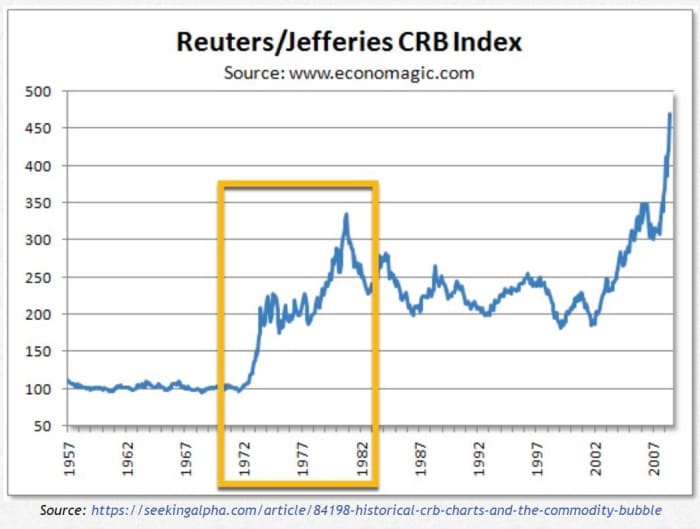

Commodities, meanwhile, could be in a sweet spot in case of 1970s stagflation, which a Russia-Ukraine crisis could exacerbate. Wolfenbarger looked at what happened to the asset class during the Disco days, also noting its attractiveness on a historical basis, versus stocks and growth:

Uncredited

Investors new to geopolitical tensions we’ve been seeing lately, should study that 1970s stagflation period, which was not kind to stock and bond investors, he said.

“Investors can make lots of money in that environment, but it will likely be in ways they have haven’t seen in over 40 years. Namely, investing in ETFs for commodities like energy, agriculture and metals, as well as buying inverse ETFs to profit from bear markets in both stocks and bonds,” said Wolfenbarger.

The buzz

It looks like any summits for Thursday, between U.S. and Russian presidents and foreign ministers as more sanctions trickle out from the West, while Ukraine officials are sounding more concerned with its national security head calling for a nationwide state of emergency.

Opinion: Reddit’s retail investors are bullish on Russia’s invasion of Ukraine

Stock of home DIY group Lowe’s

LOW

are rising on strong results. TJX

TJX

stock is sinking as results fell short. After the close, Ebay

EBAY,

Hertz

HTZ,

Herbalife

HLF,

Sleep Number

SNBR

and Five9

FIVN

will report.

Activision Blizzard shares

ATVI

shook off reports of a delay to next year’s version of the “Call of Duty” videogame.

The markets

Uncredited

Stocks

SPX

COMP

are rising, with oil

CL00

BRN00

slipping and bonds

BX:TMUBMUSD10Y

and gold

GC00

losing some of their haven luster. Asian stocks were higher overall, and European equities

XX:SXXP

The New Zealand dollar

USDNZD

is climbing after the country’s central bank hiked interest rates for the third time since late last year.

Read: U.S. drivers brace for the highest gas prices in 9 years as oil approaches $100 a barrel

The chart

Our chart comes from Pepperstone’s head of research, Chris Weston, who sees gold in the palladium hills.

Pepperstone

He argues the key component for catalytic converters and fuel cells is a “momentum play through $2,400 [an ounce], where a break could see this bull trend for 2500+.” It’s a clear Russia play — 50% of the world’s palladium is produced in that country.

With Russia’s push into separatist regions and sanctions priced in, risk could roll over again in case of a deeper push into Ukraine. Still, “energy remains the elephant in the room (for markets), and any belief that Russian production and supply will be impacted will likely cause a new leg up – nat gas, Brent, wheat, palladium – they are all on the radar,” he said.

Read: Russia’s move into Ukraine is boosting commodity prices — here’s what’s at stake

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time.

Random reads

A 9,000 year-old perfectly intact shrine has been found in the Jordanian desert

Get ready for a “tighter and more electric” Oscars ceremony

Pricey meteorite fragments are on offer on offer at a Christie’s auction, along with a doghouse that survived a hit from one.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.