Major coins traded higher Tuesday evening as the global cryptocurrency market cap rose 1.9% to $1.8 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 2.4% | -14.3% | $38,171.80 |

| Ethereum (CRYPTO: ETH) | 1.1% | -17.4% | $2,628.45 |

| Dogecoin (CRYPTO: DOGE) | 1.3% | -13.4% | $0.13 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Anchor Protocol (ANC) | +19% | $2.88 |

| Hedera (HBAR) | +13.8% | $0.23 |

| Arweave (AR) | +10% | $26.90 |

See Also: How To Buy Bitcoin (BTC)

Why Is It Moving? Cryptocurrencies moved higher alongside stock futures Monday evening. S&P Futures and Nasdaq Futures were seen trading 0.54% and 0.78% higher at 4,323.25 and 13,969.75, respectively, at press time.

Fear has not subsided in the cryptocurrency markets. The “Fear & Greed Index” by Alternative flashed “Extreme Fear;” the index was signaling “Neutral” last week.

Edward Moya, a senior market analyst with OANDA, attributed the gain in cryptocurrencies to “dip buying” and seller exhaustion

“Bitcoin was getting dangerously close to the low levels that were seen after it lost over half its value in January. Cryptos remain the ultimate risky asset and the escalation Russia-Ukraine will likely keep the volatility elevated with swings to 20% in either direction.”

Moya noted that both monetary tightening and current Russia-Ukraine geopolitical tensions are “getting closed to being priced in.”

“This Crypto winter has been brutal but it might end once we get past that first Fed rate hike.”

Cryptocurrency trader Justin Bennett tweeted that the apex coin needs to reclaim the $38,600 and $39,600 levels. He said that there’s a “good chance” that Tuesday marked the low for the next few weeks.

Still cautiously bullish $BTC while above $35k.

There’s even a good chance that Tuesday marked the low for the next few weeks. More on why I think so in tomorrow’s YouTube video.

But for now, #Bitcoin needs to reclaim $38,600 and $39,600. Those are the levels to watch.

— Justin Bennett (@JustinBennettFX) February 22, 2022

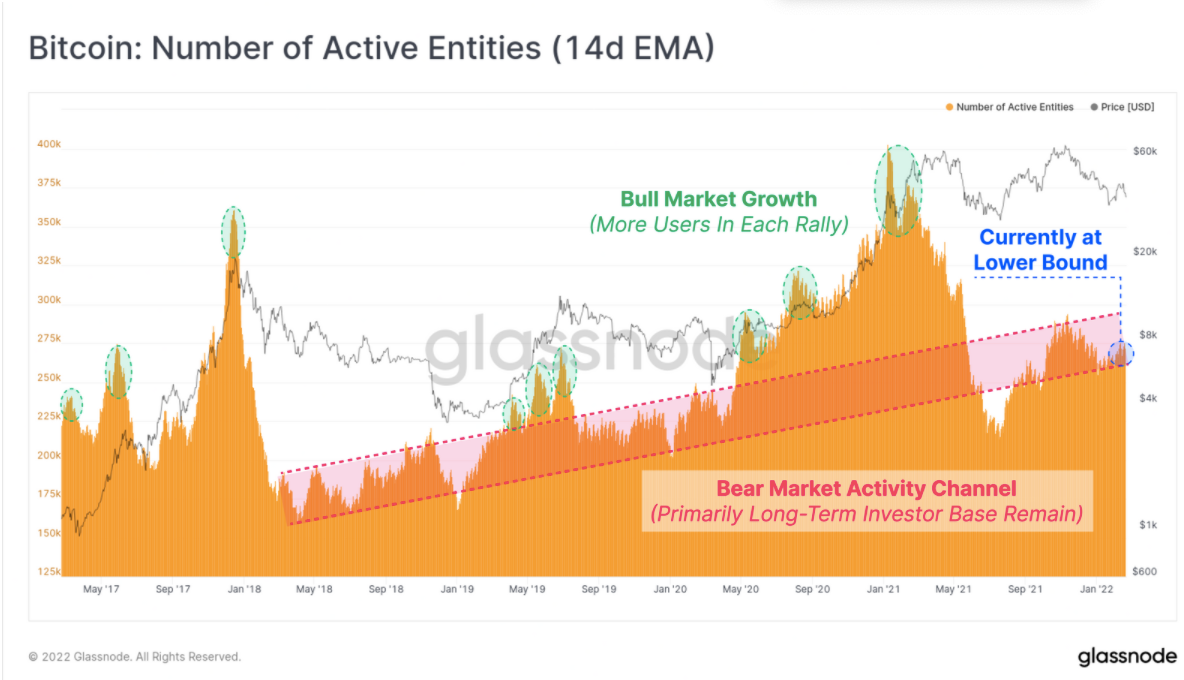

On-chain analytics firm Glassnode noted in a newsletter that a hallmark of bear markets is a lack of on-chain activity. The company said this week’s Bitcoin on-chain activity is “languishing at the lower-bound of the bear market channel, which can hardly be interpreted as a signal of increased interest and demand for the asset.”

Bitcoin — Number Of Active Entities, Source Glassnode

Bitcoin — Number Of Active Entities, Source Glassnode

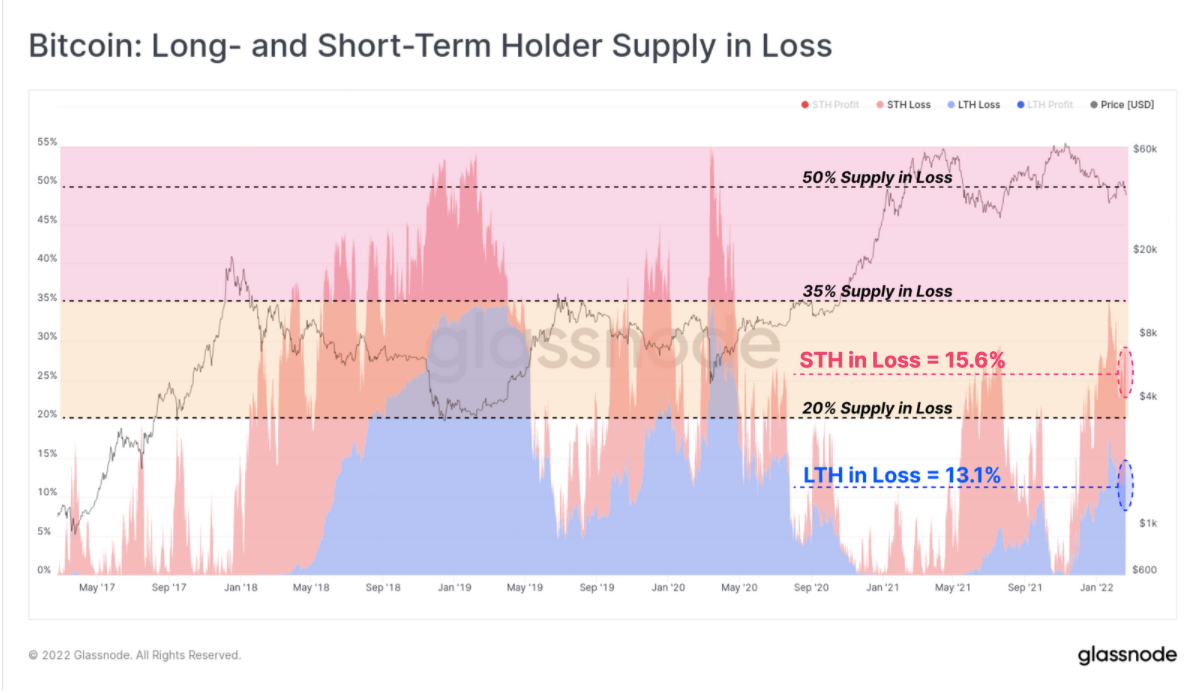

Glassnode said that the total magnitude of coin supply held in an unrealized loss is now higher than it was during May-July 2021 time frame but only half as severe as the 2018 bear market and the March 2020 flush-out.

Currently, 28.7% of Sovereign Supply or 4.70 million BTC (approx. $178.9 Billion) is “underwater,” according to Glassnode, which “poses headwinds” for bulls to establish a strong market recovery.

Bitcoin — Long and Short Term Holder Supply In Loss — Source Glassnode

Bitcoin — Long and Short Term Holder Supply In Loss — Source Glassnode