Virgin Galactic

Space tourism company Virgin Galactic released its financial results for the fourth quarter of 2021, and the full year, on Tuesday afternoon. As usual, for a company that has yet to begin commercial service of its space plane, the results were grim.

During the final quarter of 2021, Virgin Galactic reported revenue of $141,000 and a net loss of $80 million. The cumulative results were even more sobering. According to the publicly traded company’s consolidated statements, Virgin Galactic has now lost $1 billion during the last two years.

Company officials sought to put a positive spin on these financial results.

“We remain on track and on schedule to complete our enhancement program and launch commercial service later this year,” said Michael Colglazier, chief executive officer of Virgin Galactic, in a statement accompanying the financial results. “We achieved many important milestones in 2021 that laid an essential foundation towards becoming a scaled, commercial operation.”

In particular, the company touted its recent opening of sales to the general public. Anyone can now purchase a ride to suborbital space for $450,000. The company expects to have signed up a total of 1,000 customers by the end of this year.

However, in recent years the issue has not so much been demand—from public interest in Virgin Galactic and Blue Origin it seems there are clearly thousands of people, if not more, willing to pay hundreds of thousands of dollars to go briefly into space—but, rather, capacity. In other words, Virgin Galactic may have 1,000 customers, but can it actually fly a significant fraction of them any time soon?

The company’s VSS Unity spacecraft first flew above 80 km in December 2018, with two pilots aboard. In the more than three years since that time, the space plane had repeated that feat a total of three more times. This is a flight cadence of a little more than one mission a year.

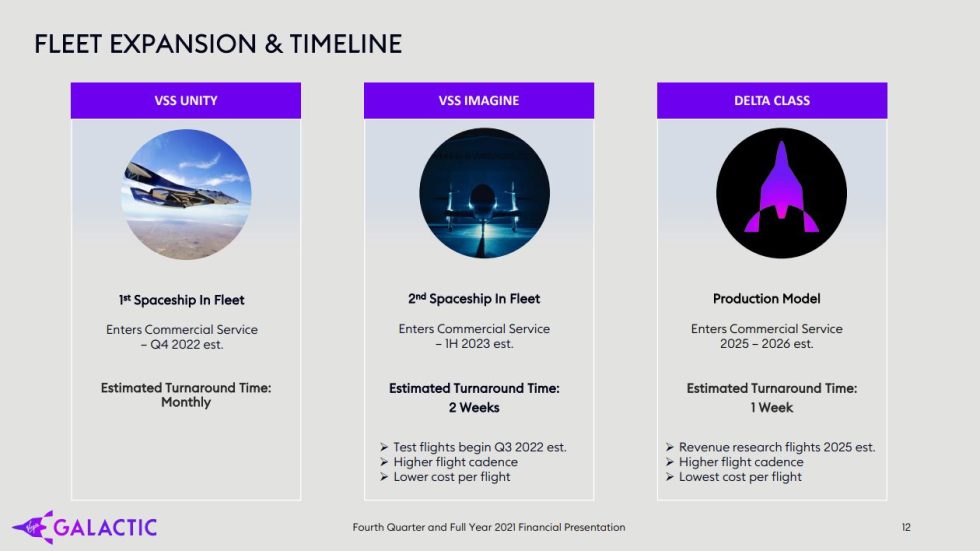

Virgin Galactic says it is still in the test phase of the program and that it anticipates beginning commercial operations late this year. After that time, VSS Unity will start monthly flights, Colglazier said during a conference call with financial analysts Tuesday. A second spaceship, VSS Imagine, will enter commercial service during the first half of 2023, Colglazier said. It will fly research payloads initially but eventually reach a flight cadence of one mission every two weeks.

So assuming the company is correct, at their best possible output, VSS Unity and VSS Imagine will be flying three missions a month. This also assumes that the White Knight Two carrier aircraft is capable of such a flight rate, which sources have said seems unlikely. The large quad-jet aircraft with a twin fuselage requires a lot of maintenance between flights.

Virgin Galactic

However, even at three flights a month, Virgin Galactic would certainly lose a significant amount of money. Going off of its most recent financial statement, Virgin Galactic’s expenses are about $80 million a quarter. At $450,000 a seat—making the naive assumption of pure profit off of every customer, on every full flight—the company would require 30 full flights a quarter, or 10 flights a month, just to break even.

Virgin Galactic has a plan for this, Colglazier said. It is designing and developing a “delta” class of spaceships that will have lower flight costs and be able to fly one mission a week. This new generation of space planes should enter commercial service in 2025 or 2026, Colglazier said, allowing Virgin Galactic to become cash-flow positive in 2026.

While theoretically possible, this seems like a stretch. Almost every spaceflight project in history has proven difficult to scale up operations, either because of technical challenges, production line issues, accidents, or all of the above. To go from one or two spaceflights a year to 10 is hard. To go from 10 to 100 annually is really hard, because it has never been done before.

Careful observers of Virgin Galactic’s projections into the future about flight rates and profits will also know to be somewhat wary. For example, back in 2019 when it was going public via a special purpose acquisition company, under a chart titled “Strong Profitability Highlights Strength of Business Model,” Virgin Galactic told investors it planned to become profitable by 2021.