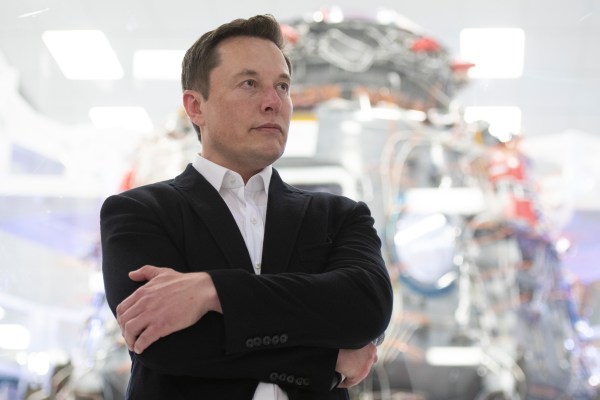

Elon Musk isn’t about to catch a hoped-for break from the SEC any time soon. Sources for The Wall Street Journal claim the SEC is investigating whether Musk and his brother Kimbal violated insider trading regulations with recent share sales. Officials are concerned Elon might have told Kimbal he planned to ask Twitter followers about selling Tesla stock, leading the brother to sell 88,500 shares just a day before the November 6th tweet. If so, the company chief might have broken rules barring employees from trading on undisclosed information.

Kimbal Musk has frequently traded Tesla stock at regular intervals under a plan. He didn’t on November 5th, according to an SEC filing.

We’ve asked the SEC for comment. Tesla isn’t available for comment as it disbanded its communications team sometime in 2020. Musk clearly isn’t on friendly terms with the Commission, however, as he said a day earlier that he “will finish” a fight he believed the SEC started.

If the report is accurate, the investigation will add more tension to a years-long feud. It began in 2018, when the SEC took action against Musk over tweets about taking the company private. While Musk agreed to a settlement that included approval requirements for any financially relevant social media posts, that wasn’t the end of the fight between the two. The SEC has been looking into Musk’s tweets over the past few years over concerns production-related tweets weren’t approved, and just days ago subpoenaed Tesla for information on the EV maker’s processes for honoring the 2018 settlement.

Musk has publicly sparred with the SEC at the same time. This year, he accused the regulator of conducting a “harassment campaign” that unfairly singled him out and excluded the court from monitoring. The SEC denied the accusations. Whatever the truth behind those claims, it’s safe to presume Musk won’t welcome any new investigation with open arms.

Editor’s note: This article originally appeared on Engadget.