A sign outside JP Morgan Chase & Co. offices is seen in New York City, U.S., March 29, 2021. REUTERS/Brendan McDermid

Register now for FREE unlimited access to Reuters.com

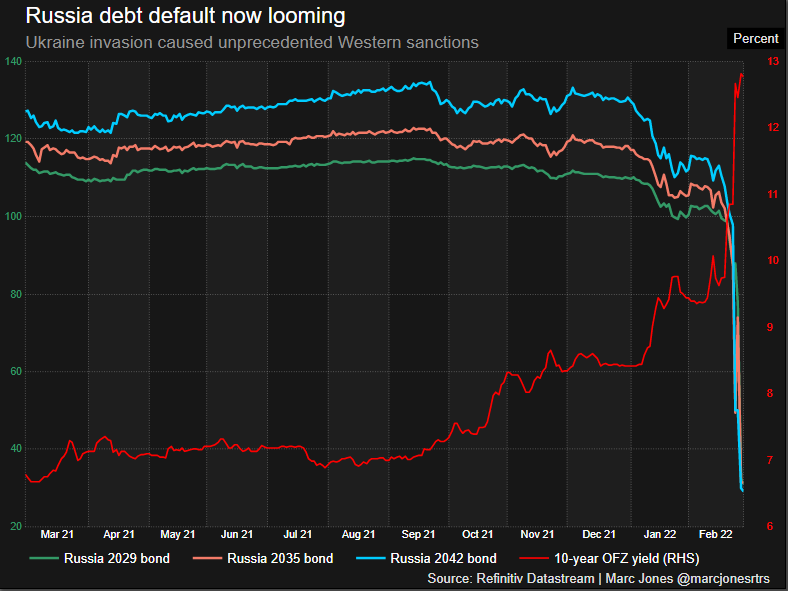

LONDON, March 2 (Reuters) – Sanctions imposed on Russia have significantly increased the chance of the country defaulting on its dollar- and other international market government debt, analysts at JPMorgan and elsewhere warned on Wednesday.

Russia has over $700 million worth of government bond payments due this month. While in theory it has ample reserves to cover debt, in practice a freeze on some assets and other measures could affect its ability to make payments. read more

“The sanctioning of Russian government entities by the United States, counter-measures within Russia to restrict foreign payments, and disruptions of payment chains present high hurdles for Russia to make a bond payment abroad,” JPMorgan said in a note to clients.

Register now for FREE unlimited access to Reuters.com

“Sanctions … have significantly increased the likelihood of a Russia government hard currency bond default.”

The central bank and the finance ministry did not reply to a Reuters request for comment on the possibility of defaults.

The first crunch date, JP Morgan analysts said, is March 16 when two bond coupon payments are due, although like much of Russia’s debt these have 30-day “grace periods” built into them, which would push back any formal moment of default to April 15.

Russia has just under $40 billion worth of international market or “hard currency” debt as it is known. While it is a small amount for an economy of Russia’s importance, any missed payment will trigger a chain of events.

Major credit rating agencies like S&P Global, Moody’s and Fitch, which all had investment grade scores for Russia until last week, would downgrade it en masse.

JPMorgan estimated that some $6 billion worth of Credit Default Swaps (CDS) that bondholders have bought as insurance policies would also need to payout, although the process could be complicated in the case of further debt sanctions.

The default concerns follow a warning from the Institute of International Finance (IIF) this week, which flagged how roughly half of Russia’s $640 billion of foreign exchange reserves had effectively been frozen by international sanctions. read more

Capital Economics also warned on Wednesday of the growing default risks. It said it would primarily hit international investors – foreigners held $20 billion of Russia’s dollar- and rouble-denominated government debt at the end of last year, according to Russia’s central bank – though it also would further scar Moscow’s reputation in international markets.

“The likelihood that the government and companies are unable or unwilling to make external debt repayments has risen significantly,” Jackson said.

Register now for FREE unlimited access to Reuters.com

Reporting by Marc Jones Editing by Karin Strohecker and Mark Potter

Our Standards: The Thomson Reuters Trust Principles.