A man wearing a protective mask, amid the coronavirus disease (COVID-19) outbreak, walks past an electronic board displaying various countries’ stock indexes including Russian Trading System (RTS) Index which is empty, outside a brokerage in Tokyo, Japan, March 10, 2022. REUTERS/Kim Kyung-Hoon

Register now for FREE unlimited access to Reuters.com

LONDON/TOKYO, March 17 (Reuters) – Europe’s stock markets consolidated strong gains made in Asia on Thursday, after China signalled more support for its spluttering economy and the Federal Reserve had pressed ahead with the first U.S. interest rate rise in more than three years.

Traders remained gripped by the devastating war in Ukraine, but with hopes of possible a peace deal faint but alive they were also watching to see if the Bank of England raises UK interest rates again later too. read more

The EuroSTOXX 600 (.STOXX) was 0.1% lower after an initial rise. Earlier 3.5% leaps by both the Nikkei in Tokyo (.N225) and emerging market stocks (.MSCIEF) meant MSCI’s main world index (.MIWD00000PUS) was still up and more than 6% higher in the last three days, albeit after a torrid start to the year.

Register now for FREE unlimited access to Reuters.com

Sanctions-ravaged Russia’s ongoing shelling of Ukraine meant commodity markets continued to gyrate wildly with oil prices back over the symbolic $100 level again. The Kremlin lashed out at U.S. President Joe Biden labelling Russian President Vladimir Putin a war criminal, but said it was putting “colossal energy” into peace talks. read more

Metals markets faced more drama after nickel trading had to be halted again on London Metal Exchange again on Wednesday.

“The reaction both this morning and overnight validates that the markets think the Fed is in line or ahead of the curve and doing the right thing,” by hiking interest rates, Chief Investment Officer of Close Brothers Asset Management, Robert Alster, said.

He added it would also be the “right thing” for the Bank of England to raise its rates later for a third meeting running, back to its pre-pandemic level of 0.75%.

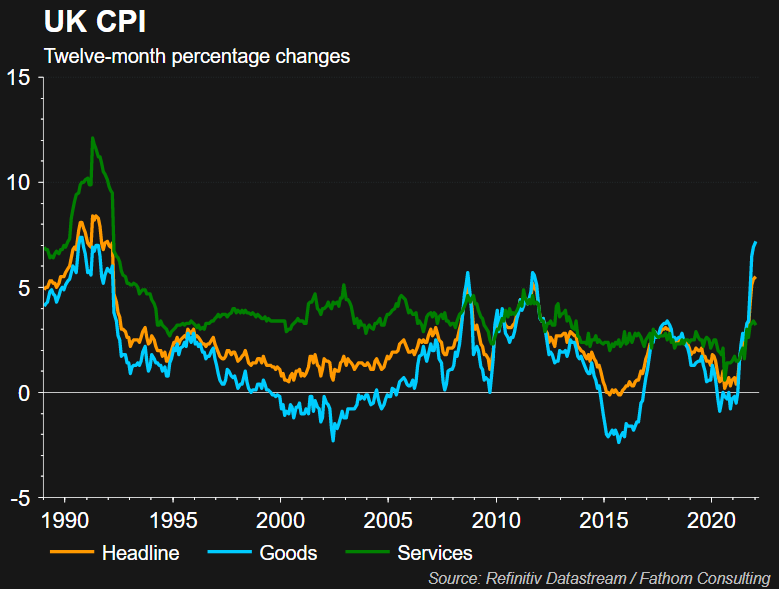

The BoE last month predicted inflation will peak at around 7.25% in April – almost four times its 2% target – but that forecast has been overtaken by seismic shifts in European energy markets following Russia’s invasion of Ukraine.

“The crunch point is that we are all expecting inflation to start coming down after Easter,” Alster added. “But if that doesn’t happen then we all probably need to have a reset.”

The stock market gains had followed a 2.2% surge on Wall Street’s S&P 500 (.SPX) overnight.

Bond markets meanwhile were beginning to settle after Treasury yields had spiked to nearly three-year highs following the Fed’s signal that it also planned to hike rate at every meeting for the remainder of this year to aggressively curb inflation. read more

Ten-year Treasuries were last at 2.12% while Germany’s benchmark 10-year Bund yield slipped back 2 basis points to 0.382% having started the day edging higher, extending the previous session’s gains to hit 0.408%, its highest since November 2018 DE10YT=RR.

The more upbeat sentiment in recent days means there are “fewer excuses for central banks to delay policy tightening,” ING rates strategists said in a note to clients.

ASIA RISES

The dollar, though, remained on the back foot in the FX markets. The dollar index , which tracks it against six other major currencies, was slightly weaker at 98.476 after also dropping 0.5% on Wednesday.

Where the dollar showed some strength was against Japan’s currency, standing at 118.82 yen , not too far from the more than six year high of 119.13 reached overnight amid a widening monetary policy gap.

The Bank of Japan is widely seen keeping its vast stimulus programme in place on Friday as the economy there continues to sputter. read more

Meanwhile, concerns about a sharp slowdown in China, which is battling a spreading COVID-19 outbreak with ultra-restrictive measures, were assuaged after its Vice Premier Liu He on Wednesday has signalled more stimulus was on the way.

Hong Kong’s Hang Seng index had surged more than 5% overnight, adding to a 9% leap on Wednesday. Beaten down sectors including tech and real estate soared, with Country Garden Services Holdings (6098.HK) and Country Garden Holdings (2007.HK) climbing about 28% and 26%, respectively.

Online giant Alibaba (9988.HK) leapt 9%, China’s blue chips (.CSI300) gained 2.3%, extending the previous day’s 4.3% rebound while Japan also saw outsized gains, with the Nikkei (.N225) vaulting 3.5% and touching a two-week peak.

Register now for FREE unlimited access to Reuters.com

Reporting by Marc Jones; Editing by Toby Chopra

Our Standards: The Thomson Reuters Trust Principles.