Weekend news

Chinese state oil and gas company Sinopec has pulled a US$500mn investment from Russia

was to be for a new gas chemical plant in Russia

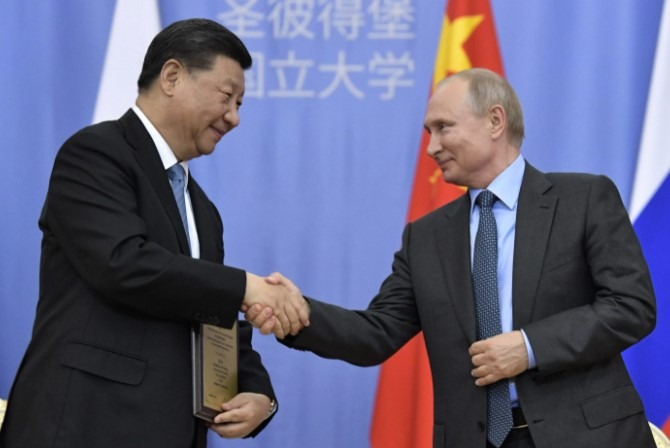

China has been a supporter of Russia’s invasion but the prospect of economic damage appears to be triggering a change of view. Firms such as Sinopec will abide by Chinese Communist Party foreign policy. Sinopec execs will have received instructions from the CCP on this. Of all the ‘turning points’ touted in Russia’s war on Ukraine the withdrawal of support from China will be a significant one.

—

Sinopec is Asia’s biggest oil refiner

eur Read this Term

ADVERTISEMENT – CONTINUE READING BELOW