Double-digit inflation has already been raging in several European countries.

By Wolf Richter for WOLF STREET.

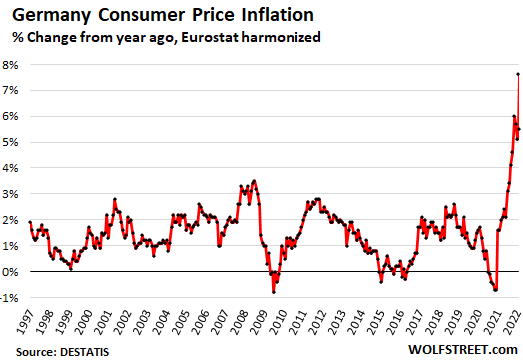

German consumer price inflation started spiking in January 2021, over a year before Russia’s invasion of Ukraine and already hit 6.0% in November 2021. And energy costs had been spiking for a year as well.

And in March, consumer price inflation spiked by 7.6% compared to March 2021, according to the preliminary estimates by the German statistical agency Destatis, based on the Eurostat harmonized method. Russia’s invasion of Ukraine added fuel to the fire that had started raging a year ago.

The Eurozone is one of the places where a crazed central bank inflicts negative policy interest rates, and thereby negative bond yields, and increasingly negative interest on bank deposits, on the economy and households. The ECB left its negative interest rate policy (NIRP) unchanged at its last meeting, with its deposit interest rate still at -0.5%, and it is still buying bonds.

The ECB’s policies are incomprehensibly reckless in light of inflation that started exploding in January 2021.

But rate hikes – way too timid, way too late – are now seen later in 2022. And the ECB has already drastically cut its bond buying program and will taper it further.

Month-to-month, Germany’s consumer price inflation spiked by a horrendous 2.5% (30% annualized!). Both inflation figures, the year-over-year 7.6% and the month-to-month 2.5%, blew away the already sky-high expectations that economists had dared to harbor.

Based on the German method for calculating inflation, consumer prices spiked by 7.3% from a year ago, the highest since 1981, according to Destatis.

The agency cited energy costs (+39.5% year-over-year), and “delivery bottlenecks” that caused prices of goods overall to spike by 12.3%. Food prices jumped by 6.2%.

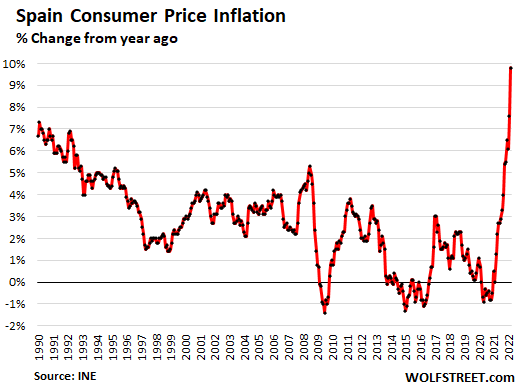

In Spain, consumer price inflation spiked by 3.0% in March from February (36% annualized!), and by 9.8% year-over-year, the highest since May 1985, according to preliminary estimates of Spain’s statistical agency INE today.

But this spike took off in March 2021 and by December 2021 already hit 6.5%, the highest since 1990. The war in Ukraine that caused further surges of the already spiking energy costs made it even worse:

For February, three European countries had already reported double-digit year-over-year inflation: the Czech Republic (10.0%), Estonia (11.6%), and Lithuania (14.0%), with Belgium not far behind (9.5%). March is going to look a lot worse.

The central bank of the Czech Republic, which is not in the Eurozone and can still determine its own monetary policies, has already hiked its policy rate four times, from 0.5% in July last year to 3.5% at its most recent meeting in February.

And for some much-needed inflation humor: In Turkey, which is not in the EU, Erdogan has embarked on the wholesale destruction of the lira by firing recalcitrant central bank heads and replacing them with rate cutters, and they cut its policy rate by 5 percentage points to 14%. And inflation has now exploded to 54%, up from 16% a year ago.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()