After seven straight quarterly wins, the S&P 500 is about to log a 3% loss in the first quarter. The last losing quarter was a COVID-fueled 20% slump in March 2020,

But a 5% gain for March will make for the best month since October, and the index remains just 4% off its Jan. 4 highs.

It’s no mean feat for a market that was ready to cruise into a COVID-19 bounce, but instead got war, surging inflation and a Federal Reserve fired up to increase rates. Our call of the day, from a team at Goldman Sachs led by chief global strategist Peter Oppenheimer, warns this stock market’s best days are over for now.

While it’s perfectly understandable that investors may have missed this latest rally, Oppenheimer’s team sees “little upside in the short term” — the team’s end-2022 target is 4,700, just 2% above current levels.

“We continue to see this as a ‘fat and flat’ market environment — a wider trading range and lower returns than in the post financial crisis era. There remains risks of corrections in an environment in which equities continue to outperform bonds,” the team said.

In the near term, investors should watch second-quarter economic data and coming earnings for signs of trouble. Goldman economists see a 25% to 30% shot at recession in the U.S. over the next year, which could drive the S&P 500 to 3,600, or a drop of 22% from current levels.

As for where to invest now, Goldman brushes aside the growth versus value obsession and says focus on alpha — companies that can innovate, disrupt, enable and adapt. As well, look for companies that can deliver high and stable margins, instead of those with higher-revenue and record-high valuations that were chased in the last cycle.

Also important — building a wall around portfolios using broad diversification across assets, geographies and sectors, i.e. real estate and commodities. Hedging is also important, and with the VIX volatility index

VIX

below 20, S&P 500 puts — an option that offers the right to sell at a specific price by a specific date — are an attractive hedge. Defensive value and high-dividend yield stocks are another area they like.

Read: The latest Wall Street estimate for the metaverse is that it could be a $13 trillion market

Goldman also rattled off several reasons why stocks are holding up:

- Equities are still providing the best yield in town as real interest rates remain deep in negative territory. “As the yields no longer protect against inflation, and capital losses undermine their ‘risk free’ characteristics, we believe there is a growing desire to reduce bondholdings in favor of real assets,” said the strategist.

- As long as economies grow, revenues and dividends should as well, making equities a real asset.

- Private-sector balance sheets are strong thanks to pandemic-led savings. Banks balance sheets are strong and corporate ones are healthy.

- Relatively stable credit markets have kept systemic risks at bay, while debt servicing capacity is at its strongest in 30 years, which should keep dividends sustained, even if the economy weakens.

- Fiscal spending and capital expenditures are increasing, notably in China and Europe. The Russian invasion has dramatically changed attitudes on military spending and energy security goals.

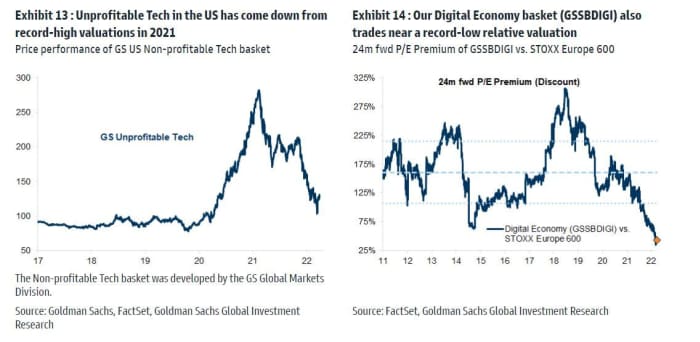

- Valuations are now below long-run averages. While the U.S. remains a relatively expensive market, the priciest bits, such as unprofitable tech, have derated sharply amid rising interest rate expectations.

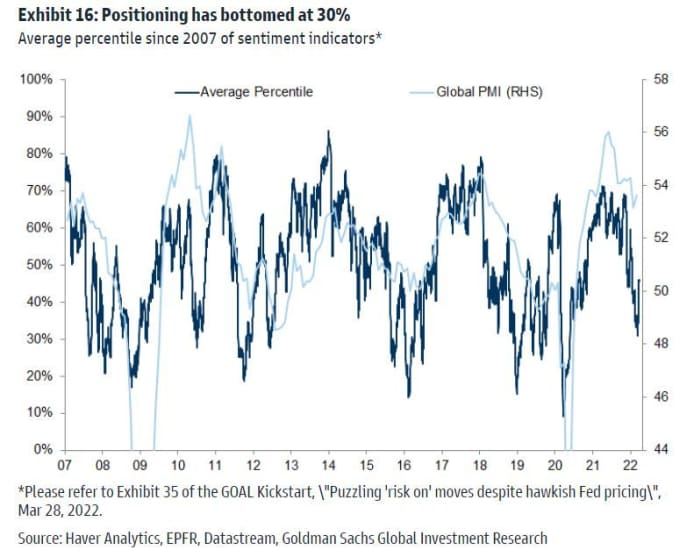

- An unwinding of bearish positioning, notably among fast money accounts — often run by speculators who use leverage to pay for securities — has also been a contributor to those gains. “Our aggregate measure of cross-asset positioning and sentiment has turned increasingly bearish YTD, bottoming at 30% 2 weeks ago, which tends to indicate an improved asymmetry for risky assets,” said Oppenheimer and the team.

Read: S&P 500 exits correction: Here’s what history says happens next to U.S. stock-market benchmark

The buzz

Oil prices

CL00

BRN00

are slumping on a report that President Joe Biden could announce as soon as Thursday the release of one million barrels of oil a day from the U.S. strategic petroleum reserve. Meanwhile, OPEC+, as expected left its existing oil output policy to lift output by 432,000 barrels per day from May unchanged.

Talks between Russia and Ukraine may continue via video on Friday. That’s as Ukrainian President Volodymyr Zelensky said the defense of his country is at a “turning point,” and he pleaded for more help from the U.S. and other allies.

Apple

AAPL

and Facebook parent Meta Platforms

FB

reportedly gave customer data to hackers posing as law-enforcement officials, Bloomberg reported, citing sources. Elsewhere, the newswire reported that Apple is testing memory chips from a Chinese company to power its iPhones.

Warren Buffett’s Berkshire Hathaway

BRK

BRK

has been flagged by a climate-watching investor advocate for a lack of transparency on emissions.

Ahead of Friday’s jobs report looming, weekly jobless claims rose by 14,000 to 202,000. Elsewhere, data consumer spending up just 0.2% in February, falling short of forecasts. The personal-consumption expenditures price index 6.4% on an annual basis and the U.S. savings rate climbed 6.3% in February, both up on the previous month. Still to come are Chicago purchasing managers index releases.

The Biden administration will now allow a new gender marker on passports, to promote transgender rights.

The markets

Nasdaq-100 futures

NQ00

are pointing to tech gains, while Dow

YM00

and S&P 500 futures

ES00

are mostly flat. Bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are dropping, gold

GC00

is under pressure and the dollar

DXY

is higher. Gasoline prices

RBJ22

are also tumbling.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

| GameStop | |

| AMC | AMC Entertainment |

| TSLA | Tesla |

| MULN | Mullen Automotive |

| NIO | NIO |

| HYMC | Hycroft Mining Holding |

| AAPL | Apple |

| TLRY | Tilray Brands |

| NVDA | Nvidia |

| SNDL | Sundial Growers |

Random reads

There is no good news for lovers of frozen pizza and packaged ramen.

Eye in the sky. NASA warns of disruptions from a solar flare through Friday.

And it’s World Cup here we come for the men’s U.S. soccer team:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.