ZargonDesign/E+ via Getty Images

In its chronicling of shocks to the U.S. economy and market, BofA says the inflation shock is worsening, the rates shock is just beginning and the recession shock is on its way.

“Inflation causes recessions” and inflation is out of control, strategist Michael Hartnett and team wrote Friday in their weekly “Flow Show” note.

The S&P 500 (SP500) (NYSEARCA:SPY) will drop below 4,000 this year, while the 30-year Treasury yield (NYSEARCA:TBT) (TLT) will rise above 4% in 2023, Hartnett said.

They also predict the ISM manufacturing index to fall below 50, while EPS growth turns negative by the end of the year and crypto outperforms bonds.

Price action is “very recessionary,” Hartnett added, noting the homebuilders (XHB) (NAIL) are down 30%, chips (SOXX) (SMH) are down 23%, small caps (IWM) are down 20%, retail (XRT) (ONLN) is down 20% and private equity (PSP) (PEX) is down 19%.

Client feedback: “recession now soooo consensus,” “no-one wants to get cocky ahead of 50bps & QT” and “oil says war shock over.”

WTI (CL1:COM) (USO) and Brent (CO1:COM) (BNO) are now at prices seen before the invasion of Ukraine.

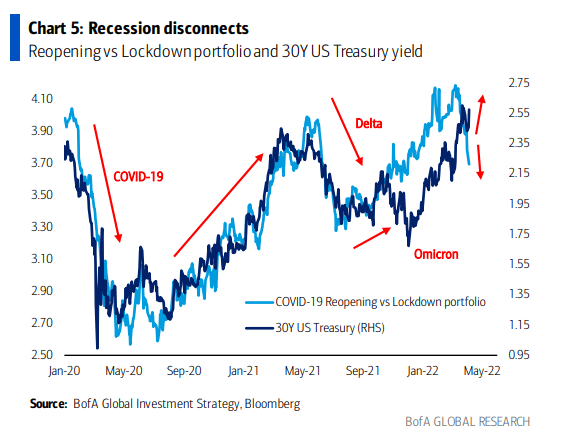

Disconnects you can expect to see in a recession are yields up and banks (KBE) down, yields up and reopening stocks down, utilities (XLU) up and transports (XTN) (IYT) down and steepening yield curve before the recession begins, he said.

Deutsche Bank said this week its base case is now for a recession in late 2023.