Advanced Micro Devices, Inc. AMD reported record first-quarter revenue and non-GAAP net income that comfortably beat estimates.

The chipmaker’s results reflected across-the-board strength, led by higher Ryzen and EPYC processor sales and solid semi-custom revenue. The company raised its full-year revenue guidance, citing strong contributions from Xilinx and server and semi-custom segments.

AMD’s Key Q1 Metrics: AMD reported first-quarter non-GAAP earnings per share of $1.13, exceeding the 91-cent consensus estimate. This compares to the year-ago quarter’s 52 cents and the December quarter’s 92 cents per share.

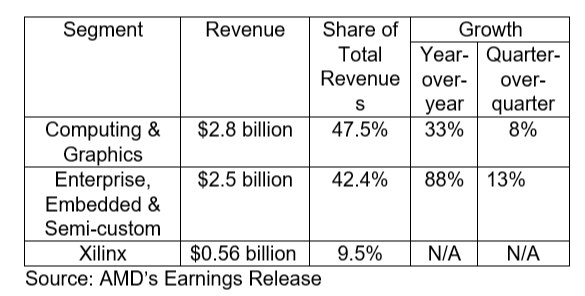

Revenues came in at a record $5.89 billion, representing a 71% year-over-year growth and 22% sequential increase. AMD’s topline exceeded the consensus estimate of $5.52 billion and the company’s guidance of $5 billion, plus or minus $100 million.

Excluding the contribution from Xilinx, revenue was at $5.33 billion. The company completed the Xilinx acquisition in mid-February.

Rival Intel Corporation INTC last week reported a 7% year-over-year revenue decline, but managed to expectations both on the top and bottom line.

AMD’s GAAP gross margin contracted from 50% in the fourth quarter of 2021 to 48%, with the company blaming the decline on the amortization of intangible assets and acquisition-related costs. Non-GAAP gross margin, however, expanded 660 basis points year-over-year and by 240 basis points quarter-over-quarter to 53%.

Excluding Xilinx, the non-GAAP gross margin was at 51%.

“The first quarter marked a significant inflection point in our journey to scale and transform AMD as we delivered record revenue and closed our strategic acquisition of Xilinx,” said AMD Chair and CEO Lisa Su.

AMD generated cash from operations of $995 million and free cash flow of $924 million, both representing records.

AMD’s Segmental Performance: The Santa Clara, California-based chipmaker reported record revenue for its two business segments, namely Computing & Graphics and Enterprise, Embedded and Semi-Custom.

AMD attributed the strength in Computing & Graphics segment to strong Ryzen and Radeon processor sales. GPU average selling price increased year-over-year due to high-end Radeon processor sales, while sequentially, it fell due to a lower mix of data center GPU revenue. Operating income from the segment stood at a record $723 million.

Higher EPYC server processor sales, semi-custom and embedded product sales lifted the Enterprise, Embedded and Semi-Custom segment revenue. The segment generated operating income of $881 million.

Related Link: Why This Analyst Recommends AMD And These 3 Chip Stocks As His Favorite Semiconductor Plays

Forward Outlook: AMD guided to second-quarter revenue of $6.5 billion, plus or minus $200 million. The consensus estimates call for second-quarter earnings of 99 cents per share on revenues of $6.38 billion.

AMD lifted its full-year revenue guidance from $21.5 billion to $26.3 billion, ahead of the consensus of $25.15 billion. The company expects non-GAAP gross margin to improve to 54%.

Intel issued a soft guidance for the second quarter, citing inventory challenges in the wake of China lockdowns and inflation.

Earnings Call Focal Points: When Su and her executive team host the earnings call, AMD investors may want to find out about how supply chain constraints will impact the company’s businesses going forward.

Rosenblatt Securities analyst Hans Mosesmann expects the company to provide insights into PC and data center demand and intra-quarter revenue contribution from the recent Xilinx acquisition.

AMD Stock Take: AMD shares are down about 38% in the year-to-period, markedly underperforming the Invesco QQQ Trust QQQ. The latter, considered a proxy for blue-chip tech performance, has fallen a more modest 20% during the same period.

The stock has recently bounced off a support around $84. On the upside the stock has resistance around $99.40. To make a meaningful move above that the stock has go past the psychological resistance of $100.

Average analysts’ price target for AMD shares, according to TipRanks, is $145.23, suggesting over 60% upside potential.

AMD shares were rising 4.22% to $94.98, according to BenzingaPro data. The stock closed the regular session 1.44% higher at $91.13.