solarseven/iStock via Getty Images

Cathie Wood, CEO of ARK Invest, expressed her concerns over the global economy on Tuesday, contending that worrisome data out of China and Europe could point to the early stages of a downturn. The popular fund manager stated in her latest monthly market webinar: “We think we could be in a global recession.”

Wood highlighted concerns around the metrics coming out of China and Europe, arguing that sentiment indicators out of Germany have been “quite concerning.”

Ahead of Wednesday’s CPI print, Wood also shared her thoughts around the state of inflation, saying that some progress has been made. “We’re seeing commodity prices starting to top out at the very least,” she said.

She added: “We’re seeing other inflation indicators, new and used car prices are falling. Used car prices falling quite dramatically over the past three months… So that’s improving.”

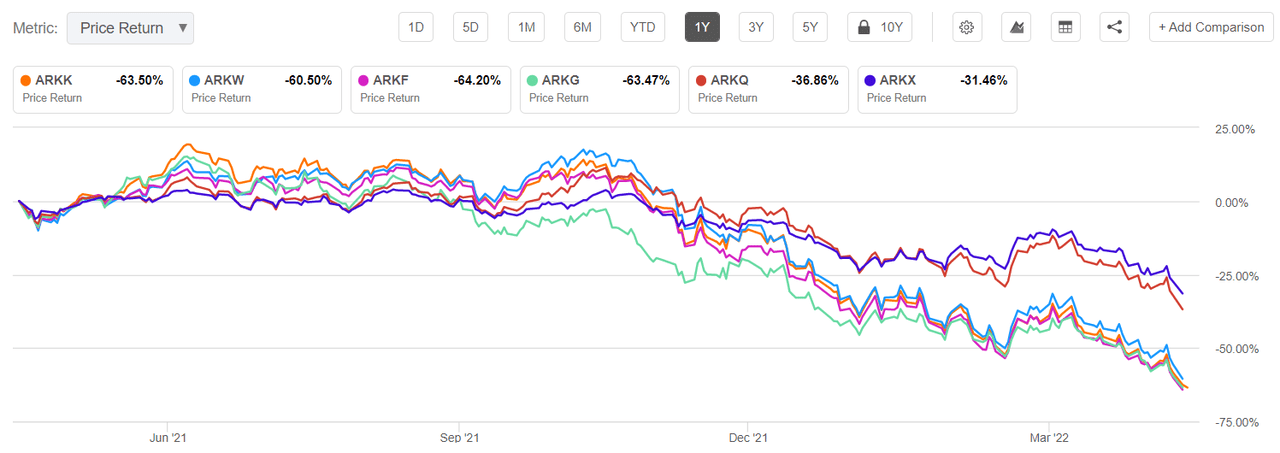

Wood’s commentary comes as her suite of innovation- and growth-focused funds have suffered massive declines in recent months, as concerns about interest rates, inflation, geopolitical tensions and the state of the economy have put pressure on stocks.

Year-to-date price action on all six of ARK’s actively managed ETFs: (NYSEARCA:ARKK) -58.2%, (NYSEARCA:ARKW) -56.5%, (ARKF) -58.5%, (BATS:ARKG) -51.7%, (BATS:ARKQ) -35.6%, and (ARKX) -27.2%.

Wood’s flagship ARK Innovation ETF is down nearly 60% YTD, almost four times that of the benchmark SPDR S&P 500 Trust ETF (SPY), which is down 15.4% in 2022. However, while significantly underperforming SPY, ARKK has also accumulated $1.35B in investor flows YTD, outdoing SPY, which has watched $26.67B exit the door.

Moreover, see a longer one-year period chart of how all six exchange traded funds fared against each other.