undefined undefined/iStock via Getty Images

Pessimism is pervasive across the equity market and traders are telling BofA Securities that a further 8% drop in the S&P 500 (SP500) (NYSEARCA:SPY) is a bullish scenario.

“Heard on the Street: ‘3600 is the new bull case,'” strategist Michael Hartnett said in his weekly Flow Show note Friday.

U.S. GDP was $24.4T in Q1 and the global equity market cap collapse since the Nov 2021 peak has been $23.4T.

The “stock market basically dropped by 1 US economy in 6 months,” Hartnett said.

But equity flows are not at capitulation levels and his stance is still “sell-any-rips.”

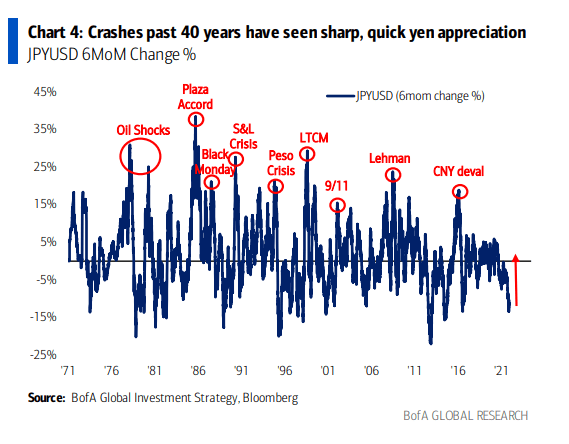

Investors should also watch the yen (FXY) as pretty much every stock market crash in the last 40 years has seen “sharp, quick yen appreciation.”

Of the “19 US equity bear markets past 140 year (the) average price decline = 37.3% & average duration 289 days,” he noted.

If that were to be repeated, today’s bear market ends on Oct. 19 2022 with the S&P at 3,000 and the Nasdaq (COMP.IND) (QQQ) at 10,000. The yen and the Swiss franc are hedges for this.

The bearish unanticipated cyclical risks are:

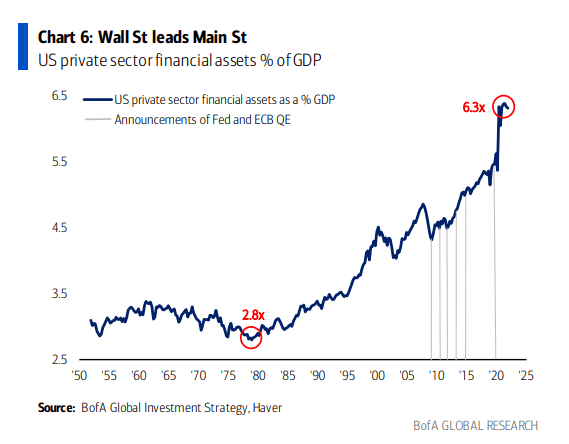

Wall Street assets being 6.3x U.S. GDP. As “seen in 2020 the quickest route to a deep recession is via a Wall St crash (and vice-versa).”

Housing and labor markets are “only just at inflection points.” The U.S. home purchase index is falling. Retail layoffs could sting as retail has accounted for 12% of all job gains over the past two years and leisure and hospitality has accounted for 33%.

Inflation “hinders Fed reaction function, polarization hinders fiscal policy reaction function in a crisis, recession.”

“Banks (are) arguably safest part of financial system yet (BKX) index trades below highs of ’07, ’18, pre-COVID ’19. A break below 100 would scream recession and/or credit event (and) tighter lending standards in coming quarters.”

The “leveraged loan market (is) cracking, systemic risk from bond/stock/real estate deleveraging in risk parity (RPAR), private equity (PSP) high, PE exposure to syndicated loans high, sovereign wealth funds, credit events in speculative tech, shadow banking, US consumer buy now, pay later models, European credit/banks/housing, Emerging Markets, zombie corporations, and so on … and the Fed has not yet begun QT.”

Goldman Sachs recently issued its playbook for a recession.