Tesla’s stock (TSLA) has surged 7% today to rise back to over $1 trillion in market valuation. The reason behind the surge appeared to be Elon Musk saying that he is done selling the stock, but the CEO actually corrected his statement.

Ever since Musk announced that he will sell 10% of his stake in Tesla, the company’s stock has been suffering. Earlier this week, it lost the incredible gains it made following the announcement that Hertz would be buying 100,000 Model 3 vehicles, which pushed Tesla’s stock to over $1 trillion for the first time.

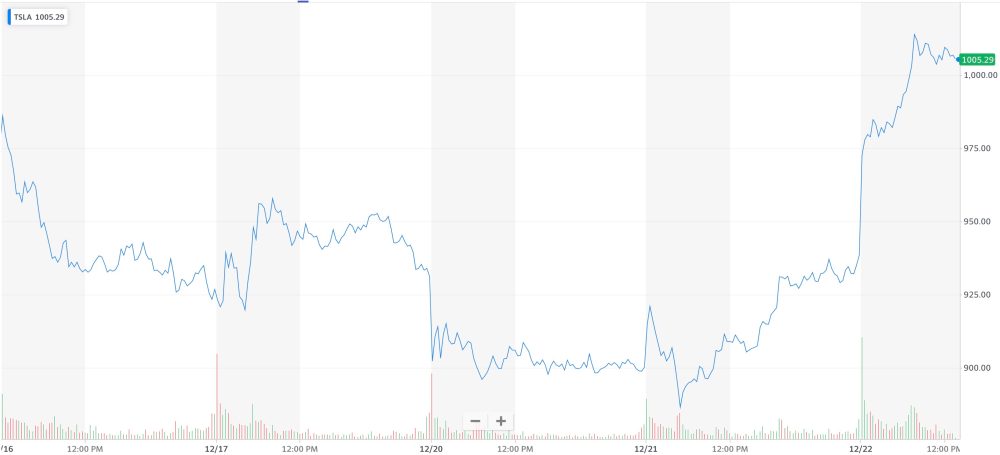

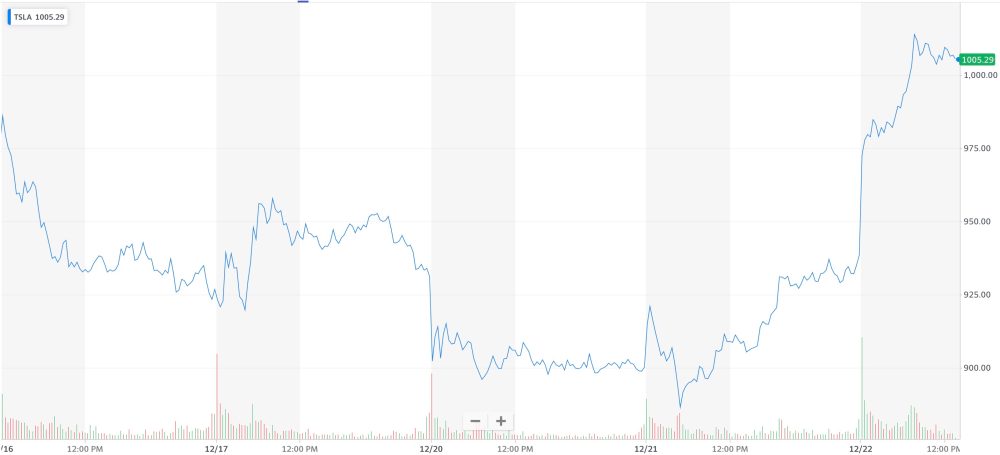

But, it has had a reversal yesterday and today. Tesla’s stock surged by 7%, which is wild for a company that valuable. The stock has now settled past $1,000 a share, which gives it back a market capitalization of over $1 trillion:

Today’s surge happened on a slow news day, and the main new information that contributed to the price increase appears to be Musk saying that he believes he sold enough shares to satisfy his statement that he would sell 10% of his Tesla stocks.

As we previously reported today, it does seem that he didn’t quite sell 10% of his stake based on the number of stocks he owned in Tesla when he made the announcement. But Musk did sell over 13 million Tesla shares over the last month, which put direct pressure on the stock on top of the bad signal of the CEO selling shares, even if it was mainly to pay taxes.

Now Musk said on Twitter this afternoon that he still has a few tranches of stock options to exercise:

“When the 10b preprogrammed sales complete. There are still a few tranches left, but almost done.”

In Tesla’s last filing, the company disclosed that Musk still has 2,637,455 stock options to exercise as part of the plan set in September. However, it sounds like Musk won’t be selling any additional shares other than what was part of his compensation plan.

Tesla’s stock is now recovering with its valuation back to over $1 trillion amid a lot of talk about automaker and EV startup valuations. Rivian also went public recently, and it currently holds a valuation of $85 billion – making it one of the most valuable automakers in the world despite only having delivered a few vehicles.

FTC: We use income earning auto affiliate links. More.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.