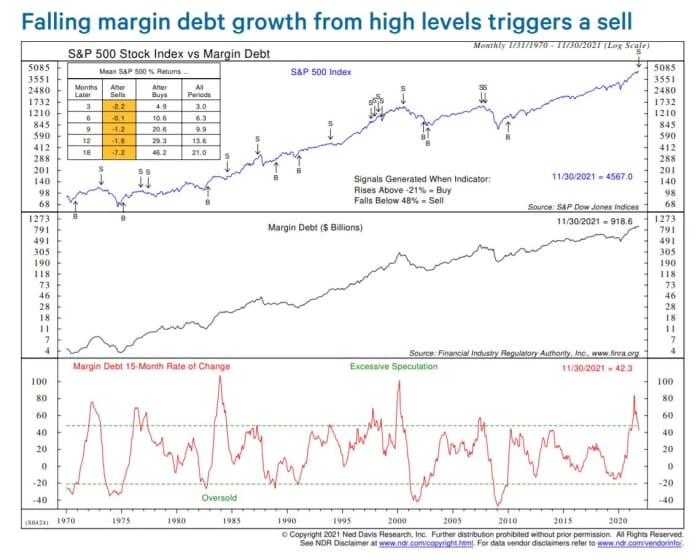

They don’t ring a bell at the top, the expression goes, but here’s an indicator that topped in 2000 and 2007.

It has to do with margin debt. According to Ned Davis, senior investment strategist at Ned Davis Research, falling margin debt growth, from high levels, triggers a sell warning. When the 15-month rate of change in margin debt falls below 48%, the market was lower three to 18 months later, on average.

Another warning sign is that price-to-earnings ratios on what the firm calls institutional grade stocks are stretched.

Yet Davis can’t quite bring himself to fully cloak himself in pessimism. Short-term sentiment is still negative, he points out, which usually is a good sign for markets.

“I would note however, that following any rally, a break of the December low is often a warning sign. So we will be watching the year-end rally closely,” he says. The S&P 500 touched its lowest level for the 12th month on Dec. 3, when it reached 4,495.12.

The chart

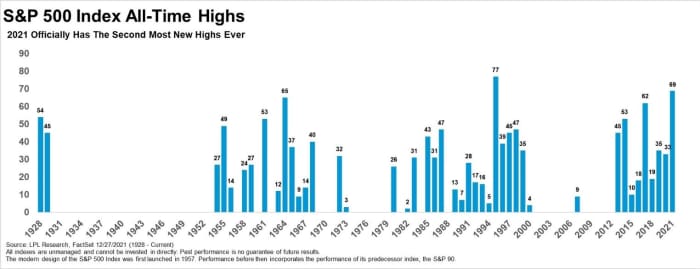

It’s already out of date, but this chart showing all-time highs for the S&P 500

SPX

was picked by Ryan Detrick, chief market strategist of LPL Financial, as the chart of the year. The benchmark U.S. index has registered 70 record highs, the highest number since 1995. “At the end of the day, the fact that 2021 had the second-most all-time highs ever probably tells the story better than nearly any other,” he said.

The buzz

U.S. President Joe Biden and Russian President Vladimir Putin are due to have a call at 3:30 p.m. Eastern, according to the White House schedule, to discuss tensions in Ukraine.

Johnson & Johnson

JNJ

said its vaccine, as a booster shot, was 85% effective in preventing hospitalization in South Africa as omicron became the dominant coronavirus variant.

Outdoor mask wearing will be compulsory in Paris, as England prepares hospitals for an omicron wave. The daily average of U.S. coronavirus cases topped 300,000, a record, with hospitalizations at a two-month high.

Initial jobless claims fell 8,000 to 198,000 in the week ending Dec. 25. Chicago PMI data is due shortly after the open.

Samsung Biologics

KR:207940

denied a report it was in talks to buy Biogen

BIIB,

which sent the biotech stock 7% lower in premarket action after a 9% surge on Wednesday.

Didi Global

DIDI

said revenue fell 11% from the prior quarter, as its operating loss widened.

Credit Suisse

CS

found a second breach of COVID-19 rules by its chairman, Reuters reported, citing sources.

Ghislaine Maxwell was convicted on five of six charges in the Jeffrey Epstein sex abuse case.

The market

U.S. stock futures

ES00

NQ00

were a touch higher. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 1.54%.

Top tickers

Here are the top tickers on MarketWatch, as of 6 a.m. Eastern.

Random reads

After two decades in space, the International Space Station is due to shut down. Here’s what comes next.

Meet the kids named after Harry Potter characters.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.