The sun sets behind an oil pump outside Saint-Fiacre, near Paris, France September 17, 2019. REUTERS/Christian Hartmann/File Photo

Register now for FREE unlimited access to Reuters.com

Register

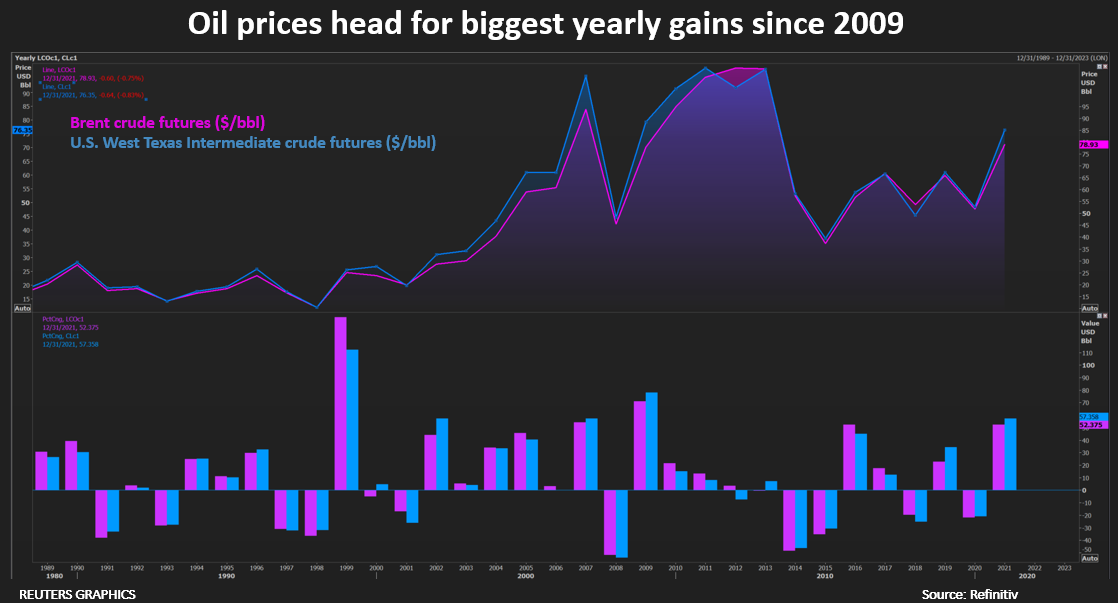

NEW YORK, Dec 31 (Reuters) – Oil prices fell on Friday but were set to post their biggest annual gains since at least 2016, spurred by the global economic recovery from the COVID-19 pandemic slump and producer restraint, even as infections reached record highs worldwide.

Brent crude futures fell 70 cents, or 0.9%, to $78.85 a barrel at 10:16 a.m. EST (1516 GMT), while U.S. West Texas Intermediate (WTI) crude futures dropped 84 cents, or 1.09%, to $76.15 a barrel.

Brent is on track to end the year up about 52%, its biggest gain since 2016, while WTI is heading for a 57% gain, the strongest performance for the benchmark contract since 2009, when prices soared more than 70%.

Register now for FREE unlimited access to Reuters.com

Register

Both contracts touched their 2021 peak in October, with Brent at $86.70 a barrel, the highest since 2018, and WTI at $85.41 a barrel, the highest since 2014.

Global oil prices are expected to rise further next year as jet fuel demand catches up. read more

“We’ve had Delta and Omicron and all manner of lockdowns and travel restrictions, but demand for oil has remained relatively firm,” said Australian brokerage firm CommSec’s Chief Economist Craig James.

“You can attribute that to the effects of stimulus supporting demand and restrictions on supply.”

However, after rising for several straight days, oil prices stalled on Friday as COVID-19 cases soared to new pandemic highs across the globe, from Australia to the United States, stoked by the highly transmissible Omicron coronavirus variant.

U.S. health experts warned Americans to prepare for severe disruptions in coming weeks, with infection rates likely to worsen amid increased holiday travel, New Year celebrations and school reopenings following winter breaks. read more

A Reuters survey of 35 economists and analysts forecast Brent crude would average $73.57 a barrel in 2022, about 2% lower than the $75.33 consensus in November.

It is the first reduction in the 2022 price forecast since the August poll.

Easing production outages in Nigeria and Ecuador weighed on prices earlier this week. read more

With oil hovering near $80, the Organization of the Petroleum Exporting Countries, Russia and allies – together called OPEC+ – will probably stick to their plan to add 400,000 barrels per day of supply in February when they meet on Jan. 4, four sources said. read more

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Sonali Paul, Florence Tan and Ahmad Ghaddar; Editing by David Evans, Jan Harvey and Grant McCool

Our Standards: The Thomson Reuters Trust Principles.