The S&P 500 may be hitting all-time highs again fresh off of closing out a record-breaking year, but not every corner of the market was so fortunate.

Famed investor Cathie Wood and her Ark Invest had a poor showing last year, for example. Her ARKK innovation ETF, which holds stocks such as Zoom Video and Palantir, slid 24% in 2021.

Tom Lydon, CEO of ETF Trends, said don’t count out that beaten-down group of stocks this year. He said Ark Invest’s long-term outlook should be a focus for investors.

“I’m invested in Cathie Wood and will continue to be for the next 20 years. … You just have to ride it out. And if you’re diversified, you’re probably doing OK,” Lydon told CNBC’s “ETF Edge” on Monday.

The ARKK ETF may have lagged last year, but it has posted better returns over the longer term. For example, in the past three years, the ETF has risen 138% compared with the S&P 500’s 89% gain.

Like Lydon, Astoria Portfolio Advisors’ chief investment officer, John Davi, said the next big tech stock will likely be found in an Ark portfolio.

“At the end of the day, if you’re trying to find the next FAANG stock, she’s probably the most qualified out there. So, look, she had four or five great years, one bad year, so I think that’s OK,” Davi said during the same interview.

The rebound may not be immediate, though. Davi said a market shift to focus on earnings and profitability during the next interest rate cycle could disadvantage these kinds of high-growth, speculative stocks.

“When it comes to disruptive growth, bitcoin, you’ve got to size it appropriately in your portfolios. It’s got to be less than 5%. If it’s less than 5%, then you can ride out these waves,” Davi said.

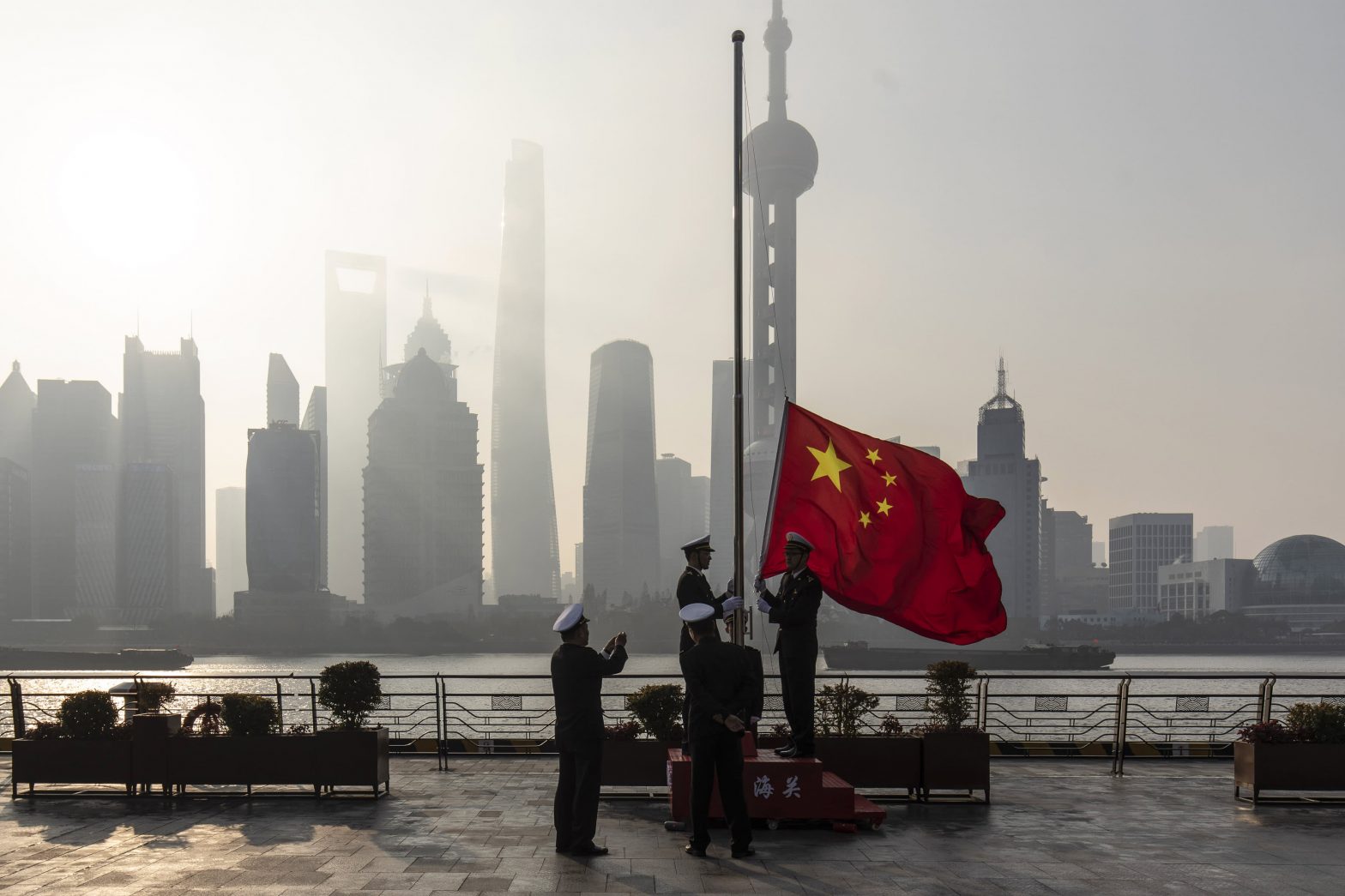

China Customs officers raise a Chinese flag during a rehearsal for a flag-raising ceremony along the Bund in front of buildings in the Lujiazui Financial District at sunrise in Shanghai, China, on Tuesday, Jan. 4, 2022.

Qilai Shen | Bloomberg | Getty Images

Chinese stocks, hobbled by regulatory pressures and uneven economic growth, also plummeted in 2021. The FXI China large-cap ETF fell 21% in its worst year since 2008. Lydon said this group should also be bought on that weakness.

“China’s not going away. China is going to continue to be a big part of the global infrastructure, and we are clearly intermingling with China on a daily basis. I think China is a buying opportunity. … When you intermingle China and online buying, it’s something that we’re going to be talking about for the next 10 years,” Lydon said.

The KWEB China internet ETF, which holds stocks such as Alibaba and Pinduoduo, has tanked 67% from a high set last February.

Davi agreed with Lydon that China could make a comeback if investors are willing to wait out the near-term turbulence.

“We’ve always told investors it’s a long-term play. So again, we size it appropriately in our portfolio. So, I think you’ve got to stick with China,” he said.

Sign up for our weekly newsletter that goes beyond the livestream, offering a closer look at the trends and figures shaping the ETF market.