Toyota Motor Corp. grabbed the U.S. sales crown from General Motors Co., swiping an honor that the Detroit automaker has held since Herbert Hoover was president.

If GM’s explanation is to be believed — that its 43% fourth-quarter sales decline and 13% tumble for the year stemmed from a semiconductor shortage — then last year’s sales race was really a supply-chain pageant. Whoever could best cajole stretched chip producers for more product came out a winner.

Navigating the squeeze has been a nightmare for the auto industry, and especially for U.S. carmakers. While GM’s sales fell for the year, Toyota, Honda Motor Co. and Nissan Motor Co. posted gains.

Toyota may not be No. 1 — the spot GM had occupied beginning in 1931 — for long.

“We see it as not sustainable,” Jack Hollis, Toyota’s senior vice president of automotive operations, said without elaborating Tuesday at a briefing for reporters.

GM agreed. Steve Carlisle, the carmaker’s president for North America, said the company will increase sales this year. Most major automakers reported fourth-quarter U.S. sales Tuesday. Ford Motor Co. is expected to release its figures Wednesday.

“Our dealers and our engineering, supply chain, manufacturing and brand teams moved mountains to satisfy as many customers as possible in 2021” Carlisle said in a statement. “In 2022, we plan to take advantage of the strong economy and anticipated improved semiconductor supplies to grow our sales and share.”

To retake its leadership position, GM will have to return to something closer to the 2.5 million vehicles the company delivered in 2020. It’s certainly possible. In 2019, before the COVID-19 pandemic and semiconductor shortage hit, GM sold about 2.9 million vehicles.

Market share is vital to GM’s long-range target of doubling revenue to $280 billion. That will require keeping buyers of gasoline-burning cars and trucks and stealing new ones who want electric vehicles.

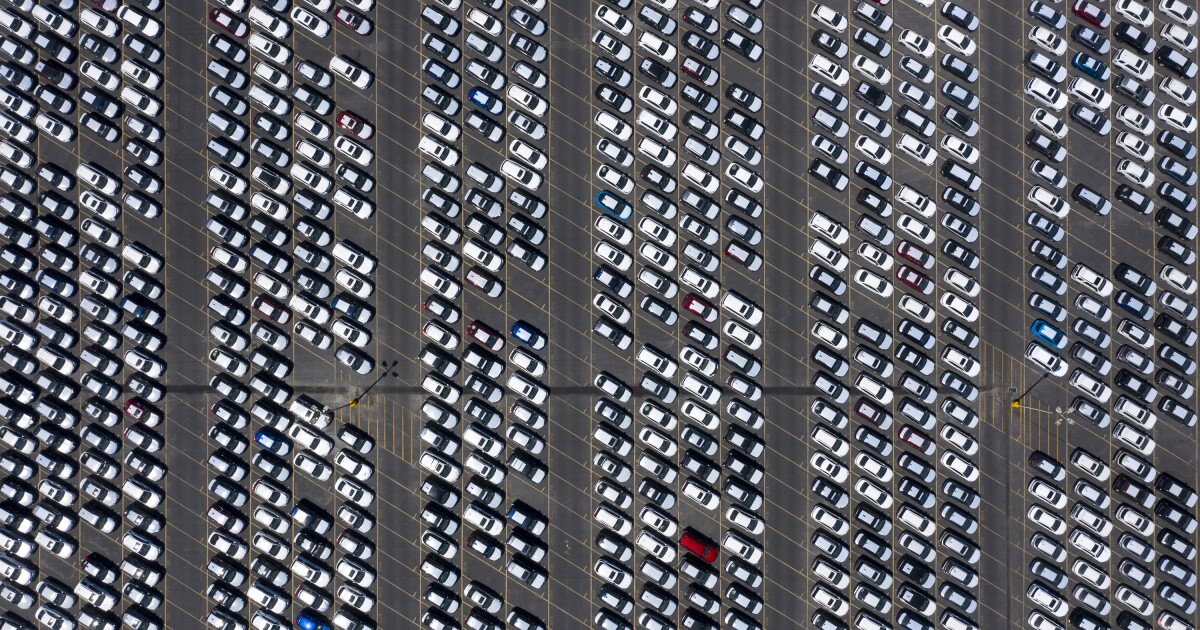

And as production recovers, GM may not want every sale it can get. Domestic automakers typically keep 80 days’ worth of vehicles on dealer lots, while Japanese automakers keep as few as 50 days’ worth available. A thinner inventory allows for better pricing and fatter profit.

Consumers today are paying record prices, since automakers don’t need rebates and dealers don’t need to bargain heavily.

“The domestic producers will run at 50 to 60 days instead of 80 even if it means smaller market share,” said Bloomberg Intelligence analyst Kevin Tynan. “It may mean that they’re not the top volume automaker, but they will be much healthier from a financial perspective.”

For Toyota to stay in the lead, it would need a much bigger slice of the U.S. market than it’s had before. Toyota’s share inched up to 14.3% in 2020 from 14% in 2018. GM was 17.3%, little changed from the 17.1% it notched in 2018, according to Bloomberg Intelligence.

Overall, it was a tough year for the industry and ended on a sour note. Carmakers probably sold a seasonally adjusted annual rate of about 12.5 million new vehicles in December, down 23% from a year earlier, according to the average forecast of six market researchers surveyed by Bloomberg.

For the full year, U.S. auto sales probably came to 14.9 million vehicles, up 2.5% from the coronavirus-stricken days of 2020, according to Cox Automotive. Automakers typically sell more than 16 million vehicles a year.

The chip shortage forced GM to allocate supply to its most profitable vehicles. Fourth-quarter sales of the Chevy Silverado fell more than 30% and tumbled 21% for the GMC Sierra, but a spokesman said the company still sold more full-size pickups than anyone.

Sales climbed for the Chevy Tahoe and Suburban, the GMC Yukon and the Cadillac Escalade large sport utility vehicles — the company’s most profitable models.

Toyota’s strong 2021 performance was buoyed by sales of sedans such as the Corolla and Camry. The RAV4 remained the automaker’s top-selling vehicle, though its sales dropped 5% for the year. Sales of the Corolla and Camry rose 5% and 6.6%, respectively.

Nissan’s sales dropped 20% in the fourth quarter but rose 8.7% for the year. The Nissan Rogue and Kicks small SUVs were strong sellers.

Judy Wheeler, vice president of sales for Nissan, said the company has been working to allocate scant semiconductors to the vehicles that it needs most, but that’s not always possible. She compared the puzzle to lining up the colors on a Rubik’s Cube.

“Each month has gotten stronger,” she said. “Our next quarter will be better as far as production. We believe we’ll be back to normal production levels. It may not be the ideal mix, but production levels will be normal.”

Honda also boosted sales for the year despite a sharp drop at the end. December’s tally fell 23% but sales rose 8.9% for the year.

The CR-V compact crossover led deliveries, rising 8.3%. The Civic compact and Accord midsize sedans also did well, continuing the dominance of Asian brands in the segment. Among Honda’s biggest gainers: its Ridgeline pickup and Passport midsize SUV, both of which were redesigned to showcase more rugged looks.

Hyundai Motor Co.’s namesake brand was one of the big winners last year, logging a 19% increase. But the South Korean automaker also lost steam as the year wound down, with a 23% plunge in December sales contributing to a 15% decline in the fourth quarter.

U.S. retail sales were the company’s highest ever, buoyed by demand for the budget-friendly Venue subcompact crossover model, which starts at less than $20,000, as well as for the Kona subcompact SUV and Tucson compact SUV.

Hyundai had comparable inventory levels with Japanese competitors but availability fell late in the year.

“You get better at online retailing and get better at pre-selling your pipeline,” said Randy Parker, senior vice president of sales at Hyundai Motor America. “That’s exactly what we did, and that helped fuel our success in a very difficult year.”

— Bloomberg writer Keith Naughton contributed to this report.