The White House is bracing for another bad report Wednesday on inflation — but now expects it to slow down by the end of the year, administration officials tell Axios.

Why it matters: The Biden administration had been labeling price hikes as “transitory.” By publicly warning the Consumer Price Index December reading shows inflation will linger through 2022, officials are trying to temper public expectations and minimize the bad-news blow.

- They also want to put U.S. inflation, which economists forecast will be 7% for the year in the report, into the context of surging global prices.

- Eurozone inflation increased to an all-time high of 5% in December.

- “We expect the print to be firm, as we have seen in the past few months,” Michael Pyle, the chief economic adviser to Vice President Kamala Harris, told Axios. “But we expect the trend lines, as we roll into 2022, to turn towards deceleration.”

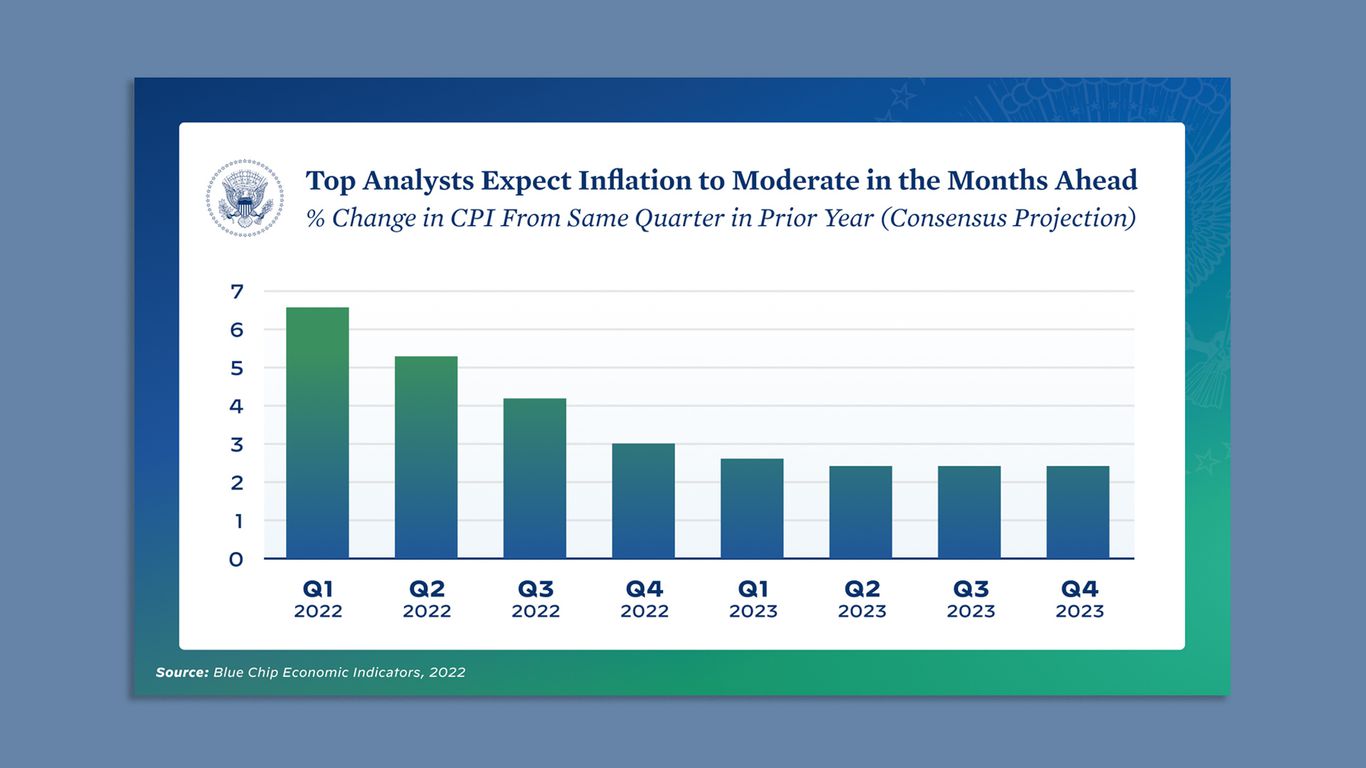

Between the lines: The White House’s goal is to focus attention on the trajectory of inflation, rather than a single percentage.

- However, even based on those projections, voters would head to the polls for the midterm elections with inflation hitting above 4% for most of the year.

The intrigue: The White House also is careful not to predict that Wednesday’s CPI figure will be the peak number.

- And officials are relying on public forecasts by outside economists to make their broader inflation points.

- But they will have to make their own forecast when they release the president’s budget, likely in March.

The big picture: Republicans have seized upon rising prices as evidence Biden’s economic policies — including his $1.9 trillion coronavirus relief package enacted last March — have done more harm than good.

- As inflation began to emerge this spring, Biden officials insisted it would be temporary. Treasury Secretary Janet Yellen predicted in June it could reach 3% in 2021 — a prediction that now seems widely off base.

- The administration’s view of price increases was largely shared by the Federal Reserve for most of last year, until Fed Chair Jay Powell shifted in December. He warned that “inflation may be more persistent.”

- The Fed is now telegraphing interest rate hikes as early as March.

Go deeper: Biden has tried to shift the blame for inflation onto corporations, focusing on consolidation in some industries, like meatpackers, and pointing out record corporate profits.

- But the approach has bothered some senior officials at the Treasury Department.

- They question whether the broad increase in prices can be attributed to recent corporate behavior, according to Washington Post.