(Bloomberg) — Taiwan Semiconductor Manufacturing Co. raised its growth projections and unveiled record spending plans for 2022, signaling that the voracious demand for chips that has fueled a months-long supply chain squeeze will persist for years.

Most Read from Bloomberg

Apple Inc.’s most important chipmaker is now projecting average sales growth of 15% to 20% annually — as much as double its previous expectation. The company foresees sales of $16.6 billion to $17.2 billion in the first quarter alone, at least 5% ahead of estimates. It intends to spend $40 billion to $44 billion expanding and upgrading capacity in 2022.

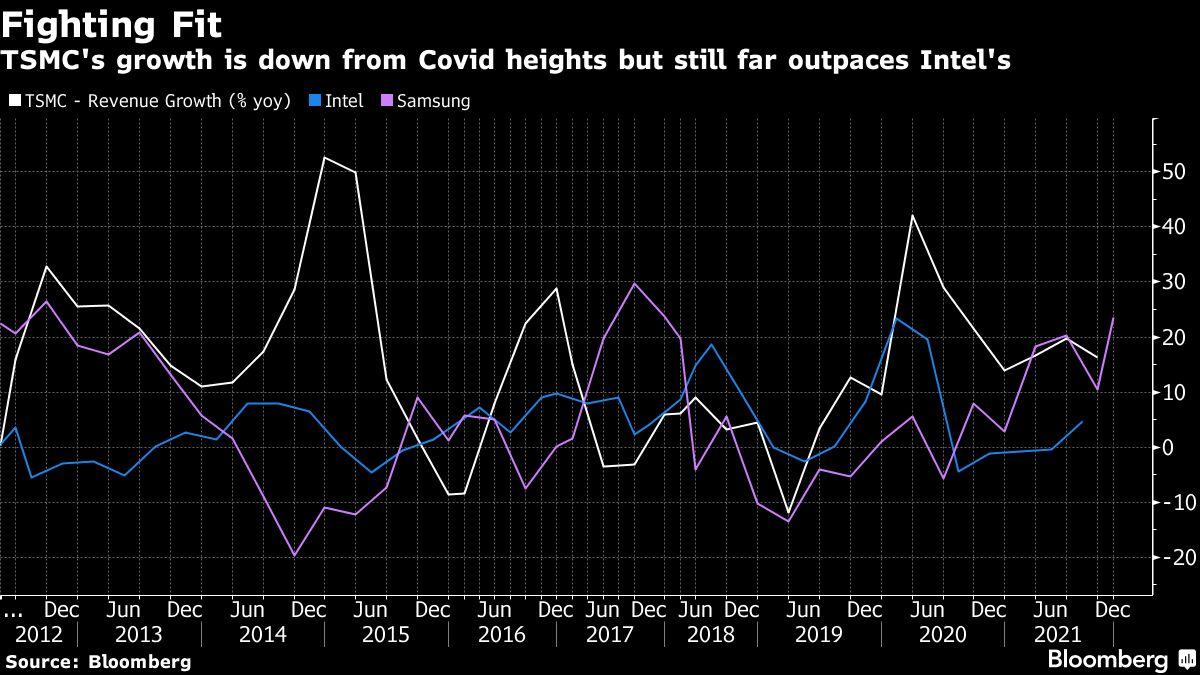

Those numbers affirm TSMC’s pole position in the market during an unprecedented chip shortage triggered by the pandemic, a deficit that’s walloped the production of cars, mobile phones and game consoles. Asia’s most valuable corporation intends to continue spending heavily to maintain its technological lead over Intel Corp. to Samsung Electronics Co., safeguarding its market share as the growing number of connected devices like cars drive datacenters and high-end computing.

With the crunch showing no signs of abating, TSMC has been running at near-full capacity over the past year and is now investing heavily in new fabs from its home island to Japan and the U.S. TSMC’s 2022 spending target is up at least $10 billion from last year and at least 43% higher than the $25 billion to $28 billion that Intel has set aside this year to regain its once-dominant position in the industry.

Read Tim Culpan’s column on TSMC’s capex

Delivery times for chips increased by six days to about 25.8 weeks in December compared with November, according to research by Susquehanna Financial Group. That lag marks the longest wait time since the firm began tracking the data in 2017. Chip-equipment maker ASML NV jumped as much as 3% Thursday.

The squeeze has been most notable in industries including automaking, wiping out an estimated $200 billion in sales for carmakers such as Volkswagen AG and General Motors Co. last year. Even Apple, TSMC’s top customer, hasn’t been spared: the iPhone maker said it lost $6 billion in sales due to component shortages in the three months ended in September, while losses stemming from product constraints will exceed $6 billion in the holiday quarter.

That endemic shortage has been a boon to chipmakers. On Thursday, the Taiwanese company reported a better-than-expected 16% jump in December-quarter net income to a record NT$166.2 billion ($6 billion). It set a long-term target of at least 53% for gross margins. Sales in the quarter reached NT$438.2 billion, also a record, based on previously released monthly revenue numbers.

What Bloomberg Intelligence Says:

TSMC’s capex plan for 2022 of up to $44 billion looks set to enable it to capture high growth in leading and specialty technology nodes and support its percentage sales-growth target of 15-20% CAGR. Its net cash position of $12 billion, coupled with consistent operating cash flow, appear likely to support its sizable capacity-expansion plan while maintaining its dividend payout. The company has the capacity to take on more debt without hurting its financial metrics significantly.

– Cecilia Chan and Dan Wang, analysts

Click here for research

TSMC needed to boost capital expenditure plans, because they need to expand capacity to fully capitalize on the boom. The company had originally set aside a total $100 billion to grow output over the three years to 2023, and announced plans for a new plant in Japan and Arizona. It’s also in discussions about manufacturing in Europe, though those discussions are more preliminary.

To secure supplies, more customers are now paying upfront, compared with just one or two before. TSMC took $6.7 billion of pre-payments in 2021, executives said.

“The semiconductor industry growth will continue to be fueled by the structural mega trends of 5G and high-performance computing,” Chairman Mark Liu told analysts on a conference call Thursday.

Click here for a blog summarizing TSMC’s post-earnings conference call.

(Updates with market performance in fifth paragraph)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.