U.S. stocks are moving higher, as investors continue to chew over the outcome of the Federal Reserve policy meeting on Wednesday.

Some saw rather hazy guidance from Chairman Jerome Powell, who said he was “of a mind” to hike interest rates in March, but made no commitment. Then he also hinted at a rate hike at each coming meeting, if needed. Clear as mud?

Here’s one problem, according to Northman Trader’s Sven Henrich: “The Fed having been wrong and being behind the curve, yet afraid to upset markets further with decisive and quick action, is making things worse as it prolongs the damage from inflation becoming more entrenched. It’s like waiting for cancer to metastasize.”

Uncredited

So for now, maybe investors should just count on choppy markets in the foreseeable future.

What kind of market selloff would it take to get alarm bells ringing at the Fed? Try another 20% or so, says our call of the day from Greg Jensen, a co-chief investment officer alongside Ray Dalio and Bob Prince at Bridgewater Associates.

“Some decline in asset prices is not a bad thing from the Fed’s perspective, so they’re going to let it happen,” Jensen told Bloomberg in an interview that published Thursday. “At these levels, it would take a much bigger move to get the ‘Fed put’ into the money. They’re a long way from that.”

Jensen estimates a 15% to 20% drop would get the Fed’s attention, and that it depends on how fast that happens, as he noted recent declines have been “healthy” as they’ve taken out bubbles in cryptocurrencies and elsewhere.

The S&P 500

SPX,

+1.21%

is off just over 9% from its record close of 4796.56 hit Jan. 3, 2022. A drop of 10% puts it in correction territory.

For now, lots of analysts and investor have written off a so-called “Fed put” option on the view that Powell and Co. are boxed in by soaring inflation and have no choice but to tighten up monetary policy. A figurative put option would see the central bank stepping in with monetary easing in the case of a bear market that threatened instability in the financial system.

Many have lobbed criticism at central banks for getting investors and markets hooked on cheap money over the years. They have warned that an adjustment will be hard, especially for the new investors that have come into the market since the start of the pandemic.

Jensen said the recent rout hitting stocks and bonds has been caused by a “liquidity hole,” with “excess liquidity” that had shored up risk assets now being pulled by central bankers, and too few buyers to fill the gap.

He warned that the shape of the economy now means a Fed rescue isn’t likely, as opposed to 2018, when inflation was far lower and companies were pouring on buybacks and raising wages. “We’re at a turning point now and things will be much different.”

Jensen also sees the 10-year Treasury yield hitting 3.5% or 4% before all the excess bonds can be soaked up, and predicts a stagflation type environment, which means investors need more commodities, international equities and Treasury breakevens, and can’t depend on that traditional 60/40 portfolio.

The buzz

Fresh data shows U.S. GDP grew an annual 6.9% in the fourth quarter, but durable goods dropped 0.9% in December. Initial jobless claims fell 30,000 to 260,000. Pending-home sales are still to come.

McDonald’s

MCD,

+0.20%

shares are down after the fast-food giant’s earnings and revenue fell short, and MasterCard

MA,

+3.65%

stock fell even amid forecast-beating results. Comcast

CMCSA,

+2.25%

is climbing after earnings topped forecasts with theme parks and studios bounce back. Results from Apple

AAPL,

+1.99%

(see preview), Western Digital

WDC,

+0.97%

and Visa

V,

+2.09%

are due after the close.

Read: 8 tech stocks poised to bounce after Nasdaq plunge, according to AI platform

Late Wednesday, Tesla

TSLA,

-6.51%

reported profit and sales that beat Wall Street expectations, but CEO Elon Musk spoke of supply-chain problems that he see as continuing this year. Shares are slipping.

Opinion: Why isn’t profit enough for Elon Musk?

Also reporting late, Intel stock

INTC,

-5.47%

is under pressure after disappointing earnings guidance from the chip maker. Disk-drive maker Seagate

STX,

+11.84%

is up after an upbeat financial outlook.

Netflix

NFLX,

+8.62%

is surging after billionaire Bill Ackman said his hedge fund bought more than 3.1 million shares.

Facebook

FB,

+2.07%

is reportedly looking to exit its stablecoin venture.

Shares of Block

SQ,

-0.54%,

which runs small-business payments service Square, are down on a report Apple plans to allow such payments on iPhones without any extra hardware.

Rocker Neil Young’s music is no longer on Spotify

SPOT,

+0.73%,

which pulled it at the singer’s request amid a spat over what he sees as COVID misinformation being spread by podcaster Joe Rogan.

Kyiv Mayor Vitali Klitschko said he was left “speechless” by a German offer of 5,000 helmets for his country, that’s facing down thousands of Russia troops along its borders.

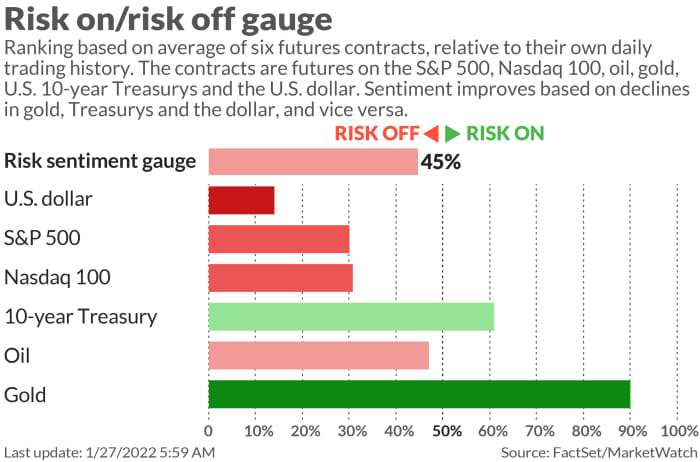

The markets

Uncredited

Wall Street stocks

DJIA,

+1.40%

COMP,

+0.81%

are higher post data, shedding early-Thursday declines that triggered sharp losses in Asia — the Nikkei

NIK,

-3.11%

and Kospi

180721,

-3.50%

dropped 3% each. The two-year Treasury yield

TMUBMUSD02Y,

1.183%

is surging to fresh 52-week highs, hovering at 1.17%. Oil prices

CL00,

-0.14%

BRN00,

-0.16%

are hovering at 7-year highs. Gold

GC00,

-1.96%

is under pressure, along with Bitcoin

BTCUSD,

+0.52%

and other cryptocurrencies.

The chart

The selloff in growth stocks over recent weeks may be reaching an end, says Mark Newton, head of technical strategy at Fundstrat, who provides this chart.

Optima/Fundstrat

“The chart of IShares Small-cap Growth ETF

IJT,

-0.24%

vs iShares Small-cap Value ETF

IJS,

-0.16%

shows that this ratio is right down near key trend line support to buy. Large-cap and midcap ETF’s look similar in that these ratios have become either oversold, or lie near key intermediate-term trends that argue for an upcoming bounce. Thus, I expect growth to outperform value and should bottom out and lead higher in the month of February into March,” he said in a note to clients.

Top tickers

Here are the most active stock market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security |

|

TSLA, -6.51% |

Tesla |

|

GME, -7.75% |

GameStop |

|

AMC, -5.71% |

AMC Entertainment |

|

NIO, -3.55% |

NIO |

|

AAPL, +1.99% |

Apple |

|

NVDA, -1.37% |

Nvidia |

|

MSFT, +2.95% |

Microsoft |

|

XELA, -11.50% |

Exela Technologies |

|

BABA, +0.38% |

Alibaba |

|

NFLX, +8.62% |

Netflix |

Random reads

Scientists spot “spooky, spinning” pulsating object in the Milky Way

Debris from one of Elon Musk’s SpaceX rockets will crash into the moon in March, says this astronomist.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.