LONDON, Jan 28 (Reuters) – European stocks fell heavily again on Friday as worries about a sudden halt to central bank stimulus and rising tensions between Western powers and Moscow drove one of the worst ever starts to a year for world stock markets.

Strong earnings from Apple provided some encouragement for battered tech and U.S. markets , but traders were struggling to draw a line under a global selloff that has now firmly taken root.

The pan-European STOXX 600 (.STOXX) tumbled 1.5% in morning trading, on course for its fourth straight weekly drop, while U.S. futures were pointing to more crimson screens on Wall Street later too. .

Register now for FREE unlimited access to Reuters.com

Register

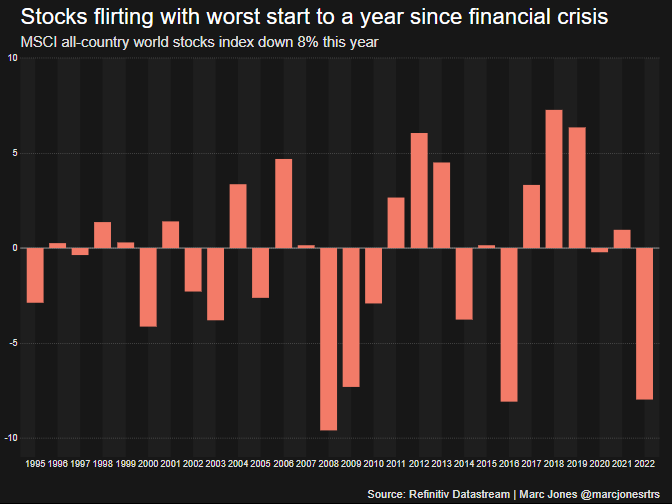

MSCI’s 50-country main world index (.MIWD00000PUS) is now down over 8.1% for the month, which will be its worst January since the 2008 global financial crisis year.

The dollar , meanwhile, is on track for its best week in seven months on bets that U.S. interest rates could now go up as many as five times this year. /FRX

“With the Federal Reserve sounding a lot more hawkish, it has shaken the markets,” said Jeremy Gatto, a multi-asset portfolio manager at Unigestion in Switzerland.

“Markets can live with rate hikes, but the main question remains around the balance sheet,” he added. Markets have been driven up by all the stimulus pumped in during the COVID-19 crisis, “so if it starts reducing liquidity, that changes the game”.

The Fed indicated this week that it is likely to raise rates in March, as widely expected, and reaffirmed plans to end its pandemic-era bond purchases that month before launching a significant reduction in its asset holdings.

The prospect of faster or larger U.S. interest rate hikes, and possible stimulus withdrawal, lifted the dollar to a 20-month high of $1.1119 per euro and to 115.50 yen – close to a high of year so far of 116.35 yen . /FRX

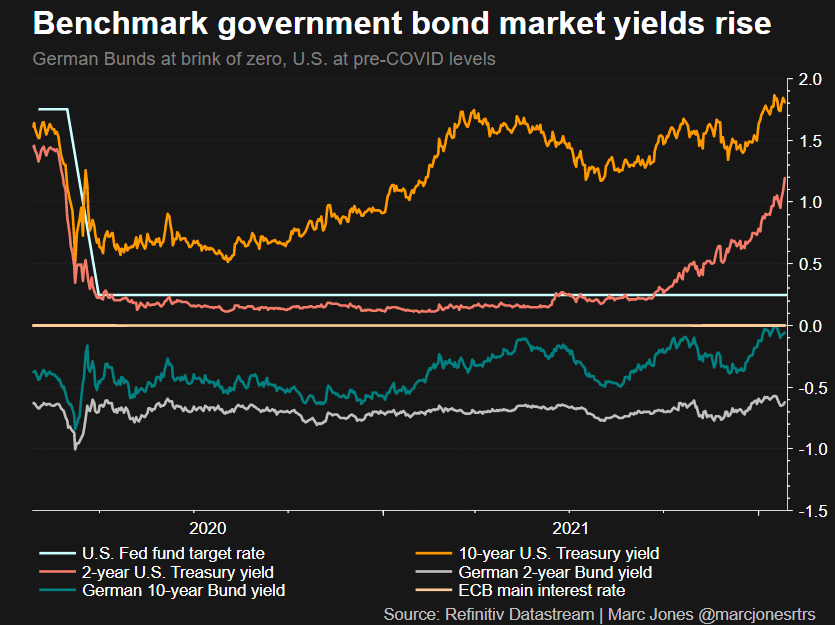

In the big government bond markets that drive global borrowing costs, benchmark 10-year U.S. Treasury yields rose to 1.84% compared with their U.S. close of 1.80% on Thursday. The two-year yield , which is even more sensitive to rate hike expectations, touched 1.22%, having started the year at roughly 0.75%.

European bond yields also rose further. Germany’s 10-year yield, the benchmark for the euro zone, was up over half a bp to -0.02% although still not quite able to break through the zero threshold.

Focus was also on Italy, where bond yields were back up around 4 bps after a late afternoon rally on Thursday while its parliament struggled to elect a new president.

OIL PRESSURE

Oil prices remained strong, set for their sixth weekly gain, amid concerns of tight supplies as major producers continue their policy of limited output increases amid rising fuel demand.

Brent crude futures climbed 57 cents, or 0.6%, to $89.91 a barrel, just shy of the $91.04 hit earlier in the week that was the highest level since October 2014.

A sixth week of gains will also mark the longest weekly winning streak for Brent since October last year, when Brent prices climbed for seven weeks while U.S. WTI gained for nine.

This year, prices have risen about 15% amid geopolitical tensions between Russia, the world’s second-largest oil producer and a key natural gas provider to Europe, and the West over Ukraine, as well as threats to the United Arab Emirates from Yemen’s Houthi movement that have raised concerns about energy supply. read more

“Where Brent crosses the $90 level, we see some selling from a sense of accomplishment, but investors start buying again when the prices fall a little as they remain cautious about possible supply disruptions due to rising geopolitical tensions,” said Tatsufumi Okoshi, senior economist at Nomura Securities.

“The market expects supply will stay tight as the OPEC+ is seen to keep the existing policy of gradual increase in production,” he said.

The market is focusing on a Feb. 2 meeting of the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, a group known as OPEC+. It is likely to stick with a planned rise in its oil output target for March, several sources in the group told Reuters. read more

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Rowena Edwards;

Editing by Andrew Cawthorne

Our Standards: The Thomson Reuters Trust Principles.