Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., January 26, 2022. REUTERS/Brendan McDermid

Register now for FREE unlimited access to Reuters.com

Register

WASHINGTON, Feb 3 (Reuters) – Global stocks stumbled as the European Central Bank and the Bank of England soured investor sentiment around inflation on Thursday, while a downbeat status update from the firm formerly known as Facebook further exacerbated traders.

Europe’s main bourses were down as the BoE delivered its widely expected second UK interest rate hike in three months, which helped buoy sterling and lift the Euro.

Meanwhile, the pan-European STOXX 600 index (.STOXX) lost 1.34% and MSCI’s gauge of stocks across the globe (.MIWD00000PUS) shed 0.91%, in response to a seemingly worldwide surge in inflation, analysts said. read more

Register now for FREE unlimited access to Reuters.com

Register

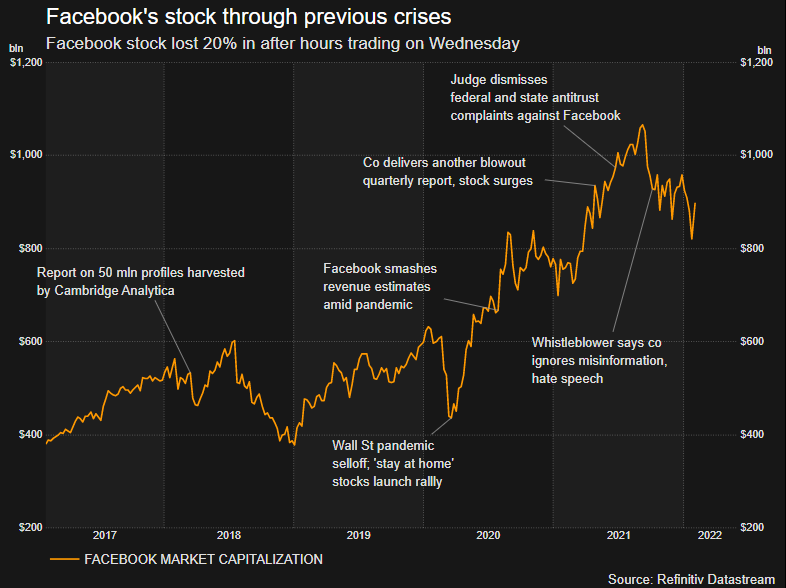

On Wall Street, investors digested the shock of a 20% plunge in Facebook owner Meta’s shares (FB.O) announced late the day prior. read more

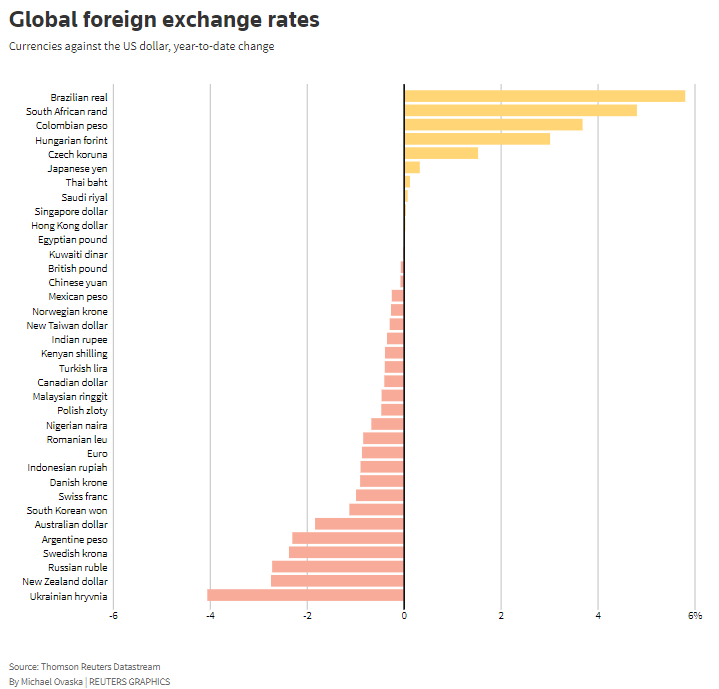

In the currency market, the defensive mood sunk the dollar after an earlier step to regain its footing. Inflation pressures were weighing on bonds as the European Central Bank kept policy unchanged as expected on Thursday.

Making only the smallest change to its statement, the ECB removed a clause stipulating that its next policy move could be in “either direction”.

U.S. stocks stumbled lower, especially for the tech-dominated Nasdaq after Facebook, Instagram and WhatsApp firm Meta’s (FB.O) disappointing earnings and outlook vaporized $200 billion of its market value in after-hours trading on Wednesday. read more

The Dow Jones Industrial Average (.DJI) fell 0.73%, the S&P 500 (.SPX) lost 1.22% and the Nasdaq Composite (.IXIC) dropped 1.83%.

Other social media companies were also expected to fall hard when trading resumes, including Twitter (TWTR.N), Pinterest (PINS.N) and Spotify (SPOT.N), which also gave a disappointing update and has been beset by a COVID-19 vaccination misinformation dispute. read more

“There’s a big impact from the results of Meta, it’s like a real earthquake,” said Mikael Jacoby, Head of Continental European Sales Trading at Oddo Securities in Paris.

“We had good results here for European tech…I’m quite surprised by the resilience of the market here. I would say I’m not positive for markets moving forward: this is the last quarter when earnings will enjoy such a favorable comparison year-on-year, rates are going up and there’s a major geopolitical risk”.

DATA DISTORTION

U.S. worker productivity rebounded more than expected in the fourth quarter, curbing labor cost growth, but the coronavirus pandemic has distorted the data and prevented a clear trend.

The Labor Department said on Thursday that nonfarm productivity, which measures hourly output per worker, increased at a 6.6% annualized rate last quarter. Data for the third quarter was revised up to show productivity declining at a 5.0% rate instead of the previously reported 5.2% pace. read more

In emerging markets, pressure was building on Turkey’s lira again after inflation there came in at nearly 50%. Russia’s rouble also dropped as tensions over Ukraine were fanned by the movement of 3,000 U.S. troops to eastern Europe.

Gold prices eased on Thursday as the U.S. dollar and Treasury yields strengthened a day after dismal U.S. private payrolls data sent bullion prices to one-week highs.

The dollar index fell 0.535%, with the euro up 0.88% to $1.1403.

The yield on 10-year Treasury notes was up 6.8 basis points to 1.834%. The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was up 4.2 basis points at 1.198%.

Oil prices fell on Thursday amid profit-taking, but remained underpinned by tight supply as OPEC+ producers stuck to planned moderate output increases.

U.S. crude recently fell 0.59% to $87.74 per barrel and Brent was at $89.02, down 0.5% on the day.

“This morning’s dip might be a result of the shockingly low U.S. ADP employment print last night, but we believe the supply squeeze may drive oil prices higher through this year,” said Howie Lee, economist at OCBC in Singapore.

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Julie Ponthus, Marc Jones and Ahmad Ghaddar in London

Editing by Ed Osmond, John Stonestreet and Mark Heinrich

Our Standards: The Thomson Reuters Trust Principles.