Scott Barbour/Getty Images News

Following Shell’s (NYSE:SHEL) acquisition of BG in 2016, the world’s largest LNG supplier has hosted an annual LNG outlook day. Monday, Management shared their view on the current market, and outlook through 2040, making the case for LNG as a transition fuel while the world attempts to move towards net-zero emissions.

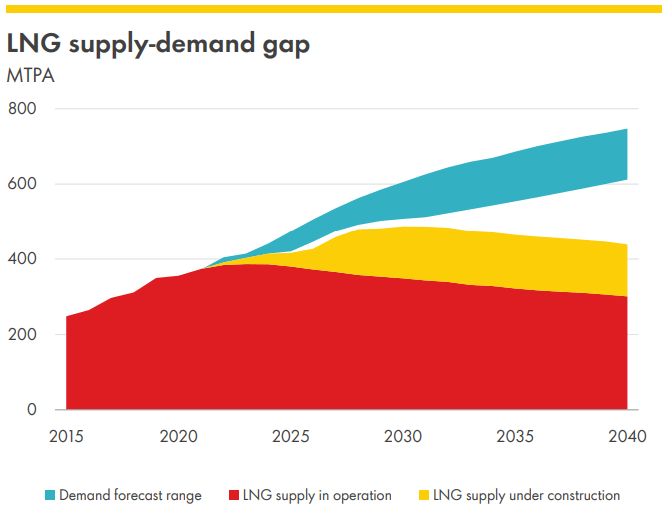

At the heart of Shell’s bullish view on LNG, is their call for demand to nearly doubles by 2040. The ~380mtpa market in 2021 is expected to grow to ~700mtpa over the next two decades. Meanwhile Shell identifies less than ~500mtpa of supply in the forecast period, driving an historic deficit market by the middle of this decade:

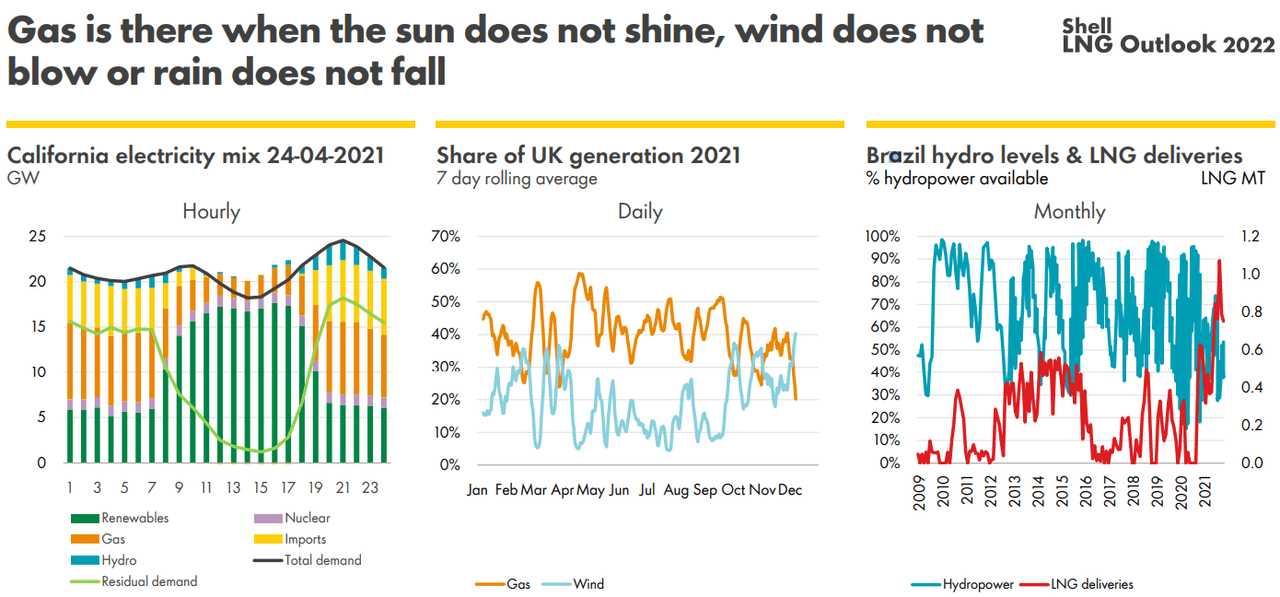

On the demand side, Shell flags growing absolute energy demand, falling pipe gas supply in Europe and Asia, and coal-to-gas substitution as the secular trends driving demand higher. Although Management also makes the case for gas as a necessary compliment to renewables in the power sector:

Importantly, the demand side of the gas equation is unlikely to be a smooth ramp from ~400mtpa to ~700mtpa, as evidenced by Chinese imports in 2021. At the end of 2020, forecasting specialists Poten, Wood Mac, China GAC, IHS, and GasTank estimated Chinese LNG demand would grow by 4mtpa in 2021 (~6%). Despite record Chinese coal production, LNG demand grew by 12mtpa (~18%). With hard-to-forecast, policy-led decarbonization efforts largely absent in 2021, market forecasters under-estimated demand from the world’s largest consumer by ~300%.

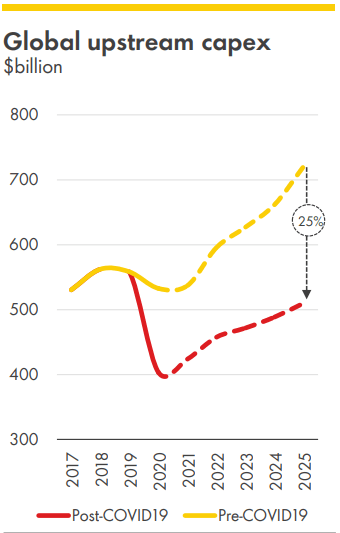

The supply side of the LNG equation is similarly bullish, in Shell’s view. The world added ~30mtpa to supplies annually between 2017 and 2019. If all goes to plan, the world will add 12mtpa on average between 2020 and 2025. LNG supply growth through 2025 is heavily dependent on growth from the US and Canada, where recent pipeline-related policy decisions further risk delays and cancellations (NYSE:LNG) (NYSE:TELL). But setting policy aside, there’s simply less capital being invested following the pandemic:

Chevron (NYSE:CVX) has effectively sworn off new mega-projects while pivoting to short-cycle production in the Permian. Exxon (NYSE:XOM) has yet to FID LNG expansion in Papua New Guinea following nearly a decade of negotiation delays. Total (NYSE:TTE) cancelled plans to build a plant in Mozambique following FID, as the security situation became unmanageable.

Shell has long pointed towards the secular trends of primary energy demand growth and decarbonization driving LNG demand higher. In 2021, the fragility of the global energy system put a spotlight on the flexible, low-carbon fuel, as LNG prices reached record levels. With cracks in the supply narrative beginning to show, Shell sees a continued tight market and high prices for years to come.